One of the prominent milk processors in the Northwest, Darigold, has made significant deductions from farmers’ milk checks.

In the world of dairy production, fluctuations in milk prices are all too common, yet when paired with sudden financial deductions, the impact can be overwhelming. Recently, dairy producers in the Northwest have been caught off guard by unexpected deductions from their processor, Darigold. This Seattle-based cooperative recently announced significant financial adjustments, leaving its member farmers grappling with uncertainty and seeking solutions.

Announcement and Implications

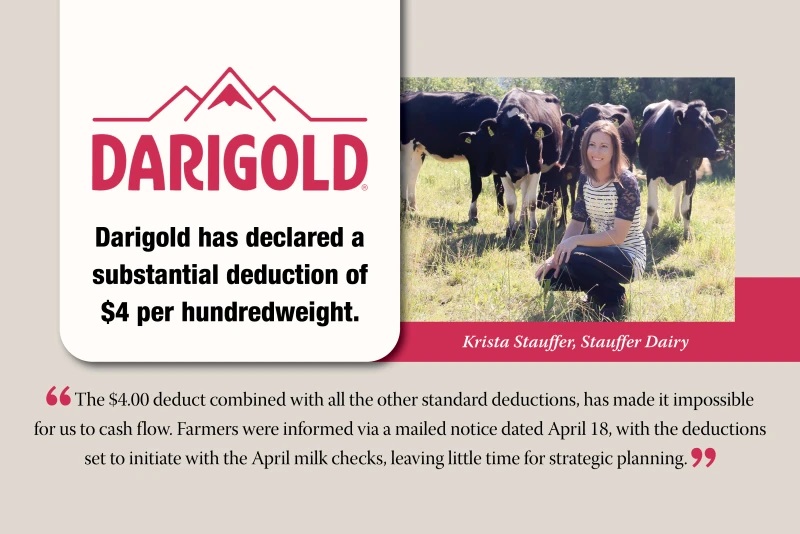

Darigold, with approximately 250 member farms distributed across Washington, Oregon, Idaho and Montana, has declared a substantial deduction of $4 per hundredweight. This cost will be felt by all its members throughout the remainder of the year. Of this deduction, $2.50 is specifically allocated for the construction of a new plant in Pasco, Wash., while the rest aims to offset operating losses. This announcement has spurred a wave of concern among farmers already striving to maintain their livelihoods.

Firsthand Impact on Farmers

For farmers like Krista Stauffer, whose family milks 100 cows and has been supplying milk to Darigold since 2009, these adjustments present a formidable challenge. With an initial deduction of $1.50/cwt., Stauffer shares financial viability was already marginal.

“The $4.00 deduct, combined with all the other standard deductions, has made it impossible for us to cash flow,” she says. “Farmers were informed via a mailed notice dated April 18, with the deductions set to initiate with the April milk checks, leaving little time for strategic planning.”

Stauffer underscores the significance of diversifying farm operations, a path her family has ventured down by establishing an on-farm creamery, although this endeavor faces its own set of obstacles due to restrictions on processing Class I products.

“We started building our on-farm creamery in the summer of 2024 with the intent of making products on the side while supplying the bulk of our milk to Darigold, like other farms are currently doing. We launched our first products in March 2025,” she shares.

Strained Relationships

Despite longstanding dedication and effort toward Darigold, many farmers feel frustrated. Stauffer recounts having been told, “If you want to do your own thing, just leave.”

“We have spent 16 years with this cooperative through the highs and lows. We have paid all the retains along the way and have quite a bit of equity sitting there — with the likelihood of being paid back slim to none. Maybe our kids will see it in the future.”

Fourth-generation dairy farmer Jason Sheehan runs J&K Dairy — a 3,000-cow dairy in eastern Wash., — and also ships to Darigold. He believes there is a bright future ahead for his operation.

“It’s going to be a rough road to get there for the next year or so,” he says. “We are hurting right now. When milk price is down, coupled with these deducts, it starts to sting.”

Sheehan shares this Darigold situation makes it difficult to cash flow and with high cow values right now, some producers are opting to sell out.

“Especially when you have an uncertain future,” he adds.

The issues facing Darigold are not isolated and represent a microcosm of broader challenges within the dairy industry in Washington State. Since 2009, over half of the state’s dairy farms have ceased operations.

Ben Laine, dairy analyst with Terrain, says one of the primary benefits of being part of a cooperative is access to collective processing assets. This advantage allows co-op members to balance supply internally, which is invaluable in maintaining stable operations and ensuring production remains consistent.

However, this very advantage can also pose significant challenges.

“When a co-op needs to make critical investments, whether it be in technology or infrastructure, the funding must come from the same pool of producers within the cooperative. This can sometimes create tension, particularly in years where margins are tight, and producers face financial difficulties,” he says.

Long-term Benefits vs. Immediate Hardships

For cooperatives, the decision to invest in processing plants like butter and powder facilities is no small feat. Long-term, these investments often prove worthwhile to help balance supply and enhance cooperative capabilities.

“Yet, it’s important to acknowledge the short-term hardships. Investment decisions can be incredibly challenging for farmers during tight years. When the farm level economy is strained, proposing additional contributions for expansions or upgrades can be met with understandable resistance from those within the cooperative,” Laine says. “At the same time, when you do need to make investments, it can be tough, because it does need to come out of that same pool of producers. It’s always a challenge.”

Sheehan believes Darigold’s short term hurdles will become long term benefits for their patrons.

“We’re going from 11 plants, and we built the 12th plant. Eventually you’ve got to get to a lower cost to keep up these plants. A lot of our plants have been high cost,” he says. “It’s like a dairy farmer who expands by buying smaller dairies. Eventually, at some point in time, you can’t run a bunch of double six parlors. You’ve got to consolidate and build a facility. That’s kind of what Darigold chose to do.”

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K