Normalised earnings for the first six months of the 2020 financial year are up +$272 mln on last year to $584 mln. Stable underlying earnings from the Ingredients business, improving gross margins in Foodservice have delivered as well as reducing our operating expenses.

This is the result of prioritising New Zealand milk and “staying focused on what we know we’re good at and what makes a difference to our farmer owners, unit holders, employees and communities” they said.

Their Foodservice business has delivered good results in the first half and they have grown our sales to bakeries and coffee and tea houses across Greater China and Asia.

The world is changing fast and we now need your support more than ever. Quality journalism is expensive and in these very troubled times our ad revenues are becoming very uncertain. We provide our coverage free to readers, and if you value that, we ask that you Become a Supporter. To do that, either click on the Red button below, or on the Black button at the top of this page. The level of your support is up to you. Thank you. (If you are already a Supporter, you’re a hero.)

Debt has been cut -22% after the sale of DFE Pharma and foodspring® with cash proceeds of $624 mln and with the improving performance debt is down bt -$1.6 bln compared to this time last year.

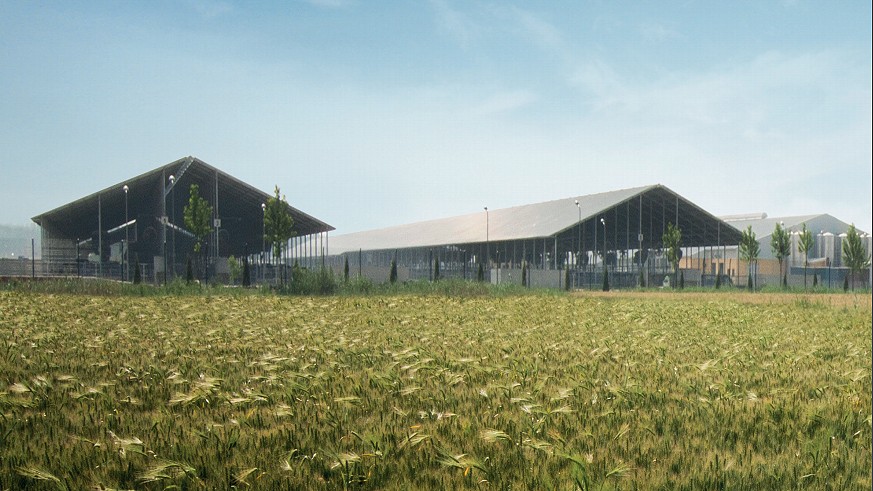

And they have revised down the valuation of China Farms and DPA Brazil by a total of -$134 mln. The book value of their China Farming joint venture has been cut by -$65 mln.

Operating costs went down by -$140 mln on the same period last year.

“While lifting our financial performance, we’ve also kept sustainability and communities at our heart. Some examples include:

But despite the strong earnings improvement, the Board has decided not to declare an interim dividend.

Chairman John Monaghan says “after considering the current uncertainty of the impact COVID-19 could have on earnings in the second half of the year, the Board has elected to not pay an interim dividend. At the end of the financial year the Board will reassess the Co-op’s financial position and review the decision to pay a dividend.”

The Co-op is still forecasting a Farmgate Milk Price range of $7.00-$7.60 per kgMS and forecast normalised earnings guidance of 15-25 cents per share. These are unchanged from earlier guidance

CEO Miles Hurrell said, “Our underlying earnings are tracking well at the half year, but there is no doubt that we have a number of risks that are outside our control in the second half – in particular, the potential impact of COVID-19 on global demand, geo-political risks in key markets such as Hong Kong and Chile, and ongoing dry weather conditions here in New Zealand which could impact collections and potentially input costs. As a result, we have held our forecast earnings range at 15-25 cents per share”

“As I said a few weeks ago, we have already contracted a high percentage of this year’s milk supply. But our teams know we have to keep our foot on the pedal and navigate very carefully through the challenges we’ll face in the second half.”