Prices firmed, albeit slightly, for the sixth time in a row at last weeks’ GlobalDairyTrade auction, but the price of most of Fonterra’s key “reference” products have improved dramatically so far this year.

Since the last sale of 2018 on December 19, whole milk powder prices – which have the greatest bearing on Fonterra’s milk price – have rallied by 13 per cent to US$3022 a tonne.

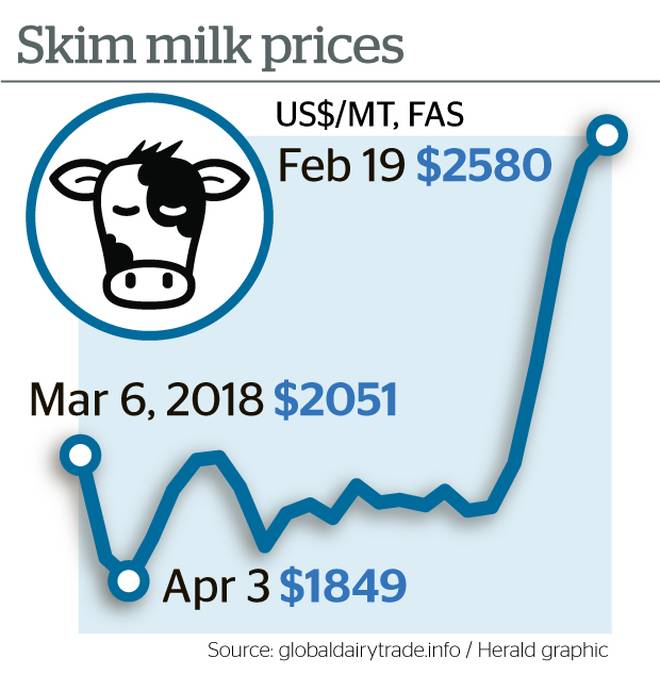

Another important reference product, skim milk powder, has shot up in price by 26.3 per cent to US$2580 tonne.

Butter prices have risen by 14.4 per cent to US$4495 a tonne and anhydrous milk fat by 13.9 per cent to US$5620 a tonne.

The “reference” products comprise around 70 per cent of Fonterra’s total New Zealand production.

Last December, Fonterra downgraded its farm gate milk price forecast to a range of $6.00 to $6.30 per kg of milksolids, from a previous forecast of $6.25-$6.50, because global supply had remained stronger than demand.

Since then demand has picked up, particularly from China, and prices for skim milk powder prices have rocketed thanks to big inroads being made into European Union intervention stocks, which have in the past acted as buffer against supply tightness.

At the same time, New Zealand production has continued to surge due to favourable weather throughout most of the country during the peak months of September, October and November.

In January, production shot up by 7.7 in terms of milk solids, against the same month a year earlier, according to Dairy Companies Association (DCANZ) data.

Season-to-date NZ milk production was up 5.6 per cent and production for the 12-months to January 2019 up 3.8 per cent, also on a milksolids basis.

However, the sudden onset of very dry conditions in parts of the country since start of the year will be talking the shine off the season , which ends on May 31.

“Already very hot weather has started to put the brakes on production over February,” ASB senior rural economist Nathan Penny said.

“In addition, despite strong recent production New Zealand’s dairy herd is actually smaller than in prior seasons,” he said.

Over 2019, Penny expects supply growth to slow to around 1 per cent.

“Growth at this level across the major exporters – the EU, New Zealand and the US – won’t be enough to keep up with annual global demand growth of about 2 per cent.”

Moreover, global dairy stocks are now much lower than in previous years, he said.

Penny said conditions for a new dairy price cycle have begun to emerge; global dairy supply is tightening, with little backstop in terms of stocks.

As a result, ASB said here was “upside risk” to its 2018/19 milk price forecast of $6.25/kg. In addition, the bank has turned heavily bullish for next season, with a forecast of $7.00/kg.

“The conditions for the start of a new cycle have begun to emerge,” Penny said.

“Essentially those conditions boil down to supply growth increasingly lagging behind demand growth, with little prospect of catch up in the short-term,” he said.

Westpac says that there is now “upside risk” to its forecast of $6.30/kg for the current season.

Likewise, ANZ rural economist Susan Kilsby said there was “upside risk” to the bank’s $6.10/kg forecast.

Kilsby expects a $6.90/kg milk price for the coming 2019/20 season, based on futures market pricing and expectations that supply in the key producing counties will not grow as fast as it has done in the past.

“The big unknown is on the demand side,” she said.

ASB’s Penny said his forecasts assumed that the Chinese household sector remained a bright spot in an otherwise weaker-performing economy.

Dairy NZ’s estimate of break-even for 2018/19 is $5.40 to $5.50/kg.