Uncertainty grows as we are only in the early stages of the pandemic which will continue to rapidly evolve over the coming months.

The impacts of lockdowns to control the spread of disease on employment in major business sectors will transform into staggered and uncoordinated measures to unwind restrictions and settle into a deep recession in major economies – the length and depth of which depends on many factors.

These profound changes will significantly impact the upstream supply chain, causing changes in product mix in response to major shifts in product demand – mainly due to weaker cheese demand – to avoid large production of mozzarella and processed cheese. The short surge in retail sales, as consumers shifted to eating at home, has eased.

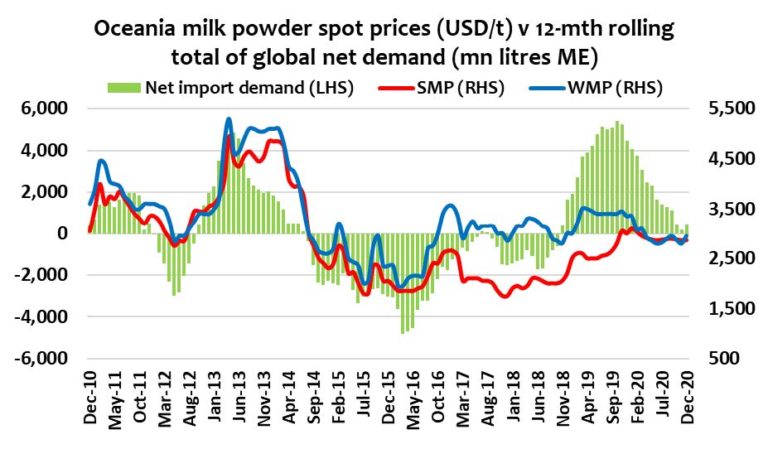

Commodity markets reflect those risks, influenced also by supply-side dynamics as milk output builds towards the seasonal peak in Europe and the US. Demand from importing developing regions remains robust, including a recovery in Chinese business and consumer activity, conditional on COVID-19 being held in check.

While the market crash has been sudden, milk price signals and supply side impacts will lag.

Commercial and policy measures may intervene to address surplus milk supplies and take excess product off the market – kicking the can down the road into a scenario that global markets have only just shaken off.

Skim Milk Powder

SMP prices have fallen with the expected rapid stock build – initially as a result of slowing of global trade with restrictions on freight and logistics. The risk has escalated with the expected increase in SMP and NFDM production as major producers avoid production of cheese exposed to food service markets which have been decimated by COVID-19 lockdowns.

Whole Milk Powder

European spot prices rose in March after softening in February as global markets continued to be disrupted by the spread of COVID-19. NZ values dropped under US$3,000/t mid-March and continued to slide through the month. NZ shipped prices rose, widening the gap to South American shipped values.

WMP prices cannot remain immune from falling protein and fat values. The weaker global economic outlook – especially with the uncertainty ahead for oil-producing countries – is likely to see further preference for FFMP, which may gain improve share in more traditional WMP markets.

Cheese

These profound changes will significantly impact the upstream supply chain, causing changes in product mix in response to major shifts in product demand – mainly due to weaker cheese demand – to avoid large production of mozzarella and processed cheese. The short surge in retail sales, as consumers shifted to eating at home, has eased.

Global cheese markets are likely to be heavily impacted by the sudden loss of sales into food service. The US industry is most-exposed with near 50% of cheese sales reliant upon food service outlets.

Global cheese trade had a long sustained run of growth from Q4-2018 into early 2020 and grew 7% in the 3 months to January.

Butter

Butterfat markets have weakened with the risks to demand for butter, AMF and cream from the shutting of food service channels in major markets.

Butter markets in the EU and Oceania were delicately poised prior to the impact of major lockdowns in March 2020. Prices had steadied in EU wholesale markets as demand improved and export markets (only about 10% of EU output) surged.

Whey

Commodity whey prices have been caught in the impacts of COVID-19 on the wider dairy complex, which continues to be weighed by the contraction of demand for commodity whey in the Chinese and other Asian animal feed markets.

US dry whey output increased 10% in the 6 months to January as producers scaled back WPC output and demand for dry whey improved, including some switching from milk protein use with steadily rising prices.

By Dustin Boughton, Procurement, Maxum Foods – Your partner in dairy

Graph Reference: Fresh Agenda