Trade was slower than the 2019 comparative for the first 4 months of 2020, impacted by some logistical difficulties due to COVID-19, but also against strong 2019 numbers for milk powders when prices were much lower. There are some timing factors that affected that – the peak of WMP trade was pushed earlier with the Chinese New Year timing this year, while the early 2019 run-out sale of SMP in the EU continued into March – meaning comparatives were strong.

The sustained strong retail sales, refilling foodservice outlets, government aid spending in the US and slower milk supply effects have hauled cheese and butter prices off the floor.

This feels like a false dawn. A deep recession is unfolding due to the huge losses in income due to business closures which will erode household spending in western markets and weaken developing world economies.

As the reality of recession takes hold, food spending in western economies will be impacted, reducing discretionary outlays, reducing the propensity to dine out and causing frugal spending in the grocery store.

The effect on ongoing cheese demand will be the most important driver of the impact on dairy markets, as the processor response to weaker demand will push more milk to powder driers in coming months. In the outlook, cheese EU and US demand remains flat in H2-2020 before improving in 2021.

The impact on cream demand without food service consumption will push up butter production and stocks. Demand from export markets, also with weak food service sectors for the rest of the year, will not help, despite prices being more attractive.

The milk supply response will be all important in this outlook with likely different trends across major producers.

Skim Milk Powder

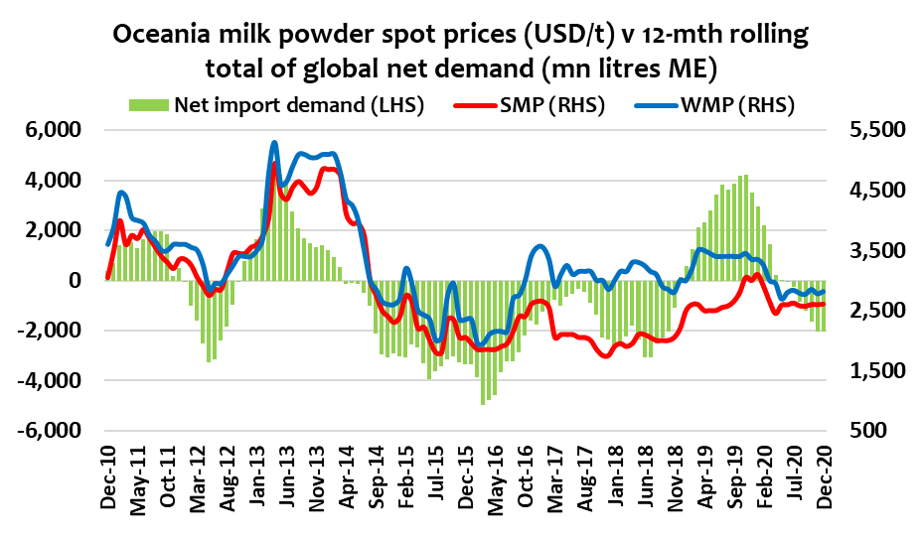

SMP and NFDM prices continued steady, recovering after the worst of the COVID-19 shocks, as cheese and butterfat markets also stabilised.

Whole Milk Powder

Spot values remained mixed through June; NZ values improved, while EU product was steady. However, EU product continues to trade at a premium. WMP trade shrank (with exports to China 16% lower) further in May, with export declines posted by NZ and Uruguay.

Cheese

Global cheese markets are likely to be impacted through 2020 by the disruption to food service sales, but not all of the impact will be negative. Attention is focused on the impacts on demand in major EU and US markets, affecting export prices, but also SMP/butter output.

Butter

Global butterfat prices have converged with improving EU wholesale prices, while Oceania markets have weakened with demand reflecting the slow reopening of food service channels in major markets and the damage to consumer spending as recession bites.

While grocery and other food retail demand remains buoyant, there is no prospect that this can make up for the loss of butterfat sales into food service outlets.

Whey

Whey product prices have inevitably been caught in the complex impacts of COVID-19 due to changes in cheese production, relative protein values and the demand for certain applications.