The re-opening of foodservice outlets has lifted short-term demand for cheese and boosted confidence that the worst is behind us. The strength of that recovery is now the primary focus – once populations are free to leave their homes and eat out, the reality of consumption is likely to leave a large gap in expectations.

The relaxation of COVID-19 restrictions will vary as Governments juggle the political choices between managing health system overload and economic fallout. This will ensure varied rates of recovery in food service sales while business and tourism travel will remain minor until late in 2020 (at the earliest). The ongoing impacts of lower household incomes will drive “trading down” behaviour and weak discretionary spending.

Slowing milk supply in Q2 will offset some of the slump in demand. Weather will continue to heavily influence milk output, but US government payments to farmers will support margins and may encourage a return to milk growth in Q3. Commercial actions to reduce surplus milk and product will cut milk output.

Weaker cheese demand may drive some change in post-peak product mix in the US and Europe, where flexibility exists.

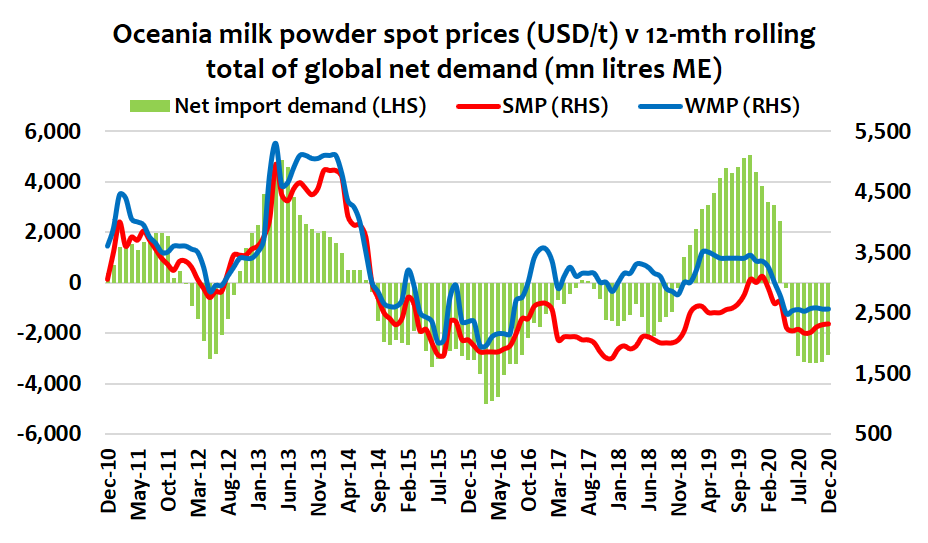

Commodity prices will be influenced by the risk of stock-build in SMP and butter, until there is meaningful rebuilding of cheese and butter demand in Europe and the US. Oceania prices will be impacted by the pressure on available product from the EU in Q3-2020.

The stimulation of stronger export demand in commodity ingredients at lower prices from developing Asian and MENA markets will be critical to the outlook. These regions are experiencing their own lockdowns, the flow-on from global recession and travel restrictions.

Skim Milk Powder

Spot and futures improved in May as US values gained, moving ahead of European prices. NZ values softened but continue to trade at a premium. GDT prices jumped significantly at the most recent event on heavy Chinese buying.

Whole Milk Powder

Spot values were mixed in May; European values were steady and premium to NZ product, which softened through the month. Limited inventory available for prompt shipment out of NZ, however weather is looking favourable for a good start to the new season.

Cheese

US prices jumped in May due to a short-term cheddar shortage with the combination of slowing milk supply, domestic retail demand and a rush to fill government purchases for food aid programs. This lift was the largest increase in 30 days ever on the exchange.

EU spot values recovered at a slower pace in May, while NZ spot values softened for the month.

Butter

Spot values were mixed in May. The EU market stabilised and began to improve as cream surpluses were avoided and retail demand for butter remained strong. Slowing milk supply due to dry weather in a number of major EU producers helped. NZ values softened but continues to trade at a premium.

Whey

EU spot prices were mixed in May and continued to trade below US prices, which firmed through May with better demand from China and SE Asia.

By Dustin Boughton, Procurement Director, Maxum Foods – Your partner in dairy