Sustained retail sales, refilling foodservice channels, the cushion of government aid and slow milk supply growth have combined to keep prices steady and firming in many cases. This has been aided by strong trade volumes as buyers took advantage of the dip in prices in Q2-2020.

While it feels like there is denial in dairy markets about the seriousness of the economic impact of COVID, experience to date shows the resilience of demand for dairy products. This will be tested in coming months with large 2nd wave infections reprising movement restrictions in many major economies.

While milk supplies will continue growing in H2-2020 – albeit slower than in the first half. The US cheddar market will weaken as block cheese supply improves with rising milk supply and additional capacity. Butterfat markets are exposed in all regions to weaker food service demand, which in the US and EU will force higher cream volumes into the butter churn.

The changes in mobility and shopping habits will continue to alter the composition of demand for dairy products and ingredients. A deep recession is unfolding as the effects of early stimulus measures wear off and governments brace for the impact of employment losses and business closures on household spending.

While developing world markets tend to respond to product prices rather than GDP changes, the uncertainty ahead will keep buyers cautious, and any outlook must consider risks of slower demand, as described herein.

While experience suggests a recession might help everyday cheese demand in the US, the outlook will see consumers trade down to cheaper grocery lines, reduce spending on high-value specialty cheeses, snacks and entertainment lines, and (where it is possible) avoid dining out.

Skim Milk Powder

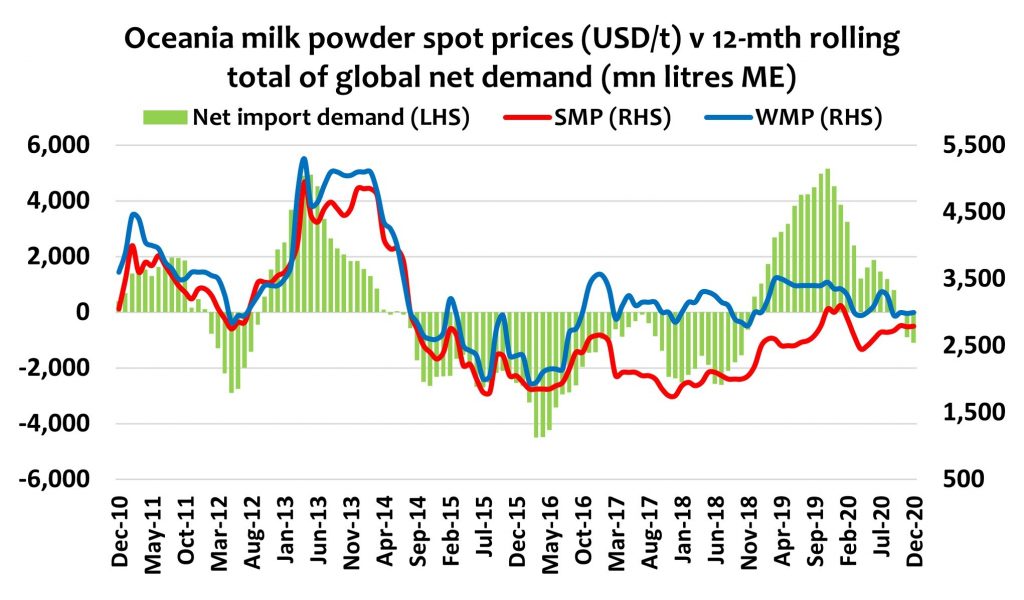

SMP and NFDM prices have continued to steadily build. The earlier fears of stock build did not eventuate – milk supply slowed, and cheese demand has been resilient with the swing to retail sales.

Whole Milk Powder

The WMP market has stabilised despite increased output from the EU and South America and the prospect of stronger peak milk production in New Zealand. Persistent demand from China (despite heavy internal stocks) and MENA have kept the market balanced.

Cheese

Cheese markets have – like butter – shown divergent trends but the stability of domestic demand in the EU and US has soaked up enough milk solids to keep the entire dairy complex in stable condition.

Butter

Global butterfat prices have diverged in recent months as different influences impact the fundamentals in each of the major producers.

Whey

Whey product prices remain under the complex influences of COVID-19 on milk supplies, cheese output, relative SMP prices and weak demand for high-concentrate products. The outlook for the commodity whey market in China remains positive with the ongoing rebuilding of their pig herd numbers.