Global trade rebounded strongly in June, with healthy rises across most major product categories as buyers took advantage of low prices in April and May. The trade in the month took overall trade for the first half of 2020 to just 0.7% behind the 2019 comparative, despite COVID-19 disruptions.

COVID-19 restrictions will continue to ease but “second wave” surges in infections will cause reversals of reopenings in many regions. This will ensure retail demand remains a stable platform alongside a slow and bumpy recovery in food service channels while business and tourism travel and events will be limited through much of 2021.

Milk production trends are varied. While the EU-27’s growth may slow a little and changing climate may stem Latin America’s surge, output in most other regions is improving – strongest in the US, while weather is still a lottery in NZ.

Domestic demand for cheese and butterfat – sustained by strong grocery sales – may be vulnerable to the impacts of recession on household food spending. Shoppers will probably trade down to cheaper products, do less entertaining and opt for low-cost eating out or takeout options. This may weaken overall demand and increase price sensitivity – but this hasn’t shown up just yet.

This risk of stock-build in butterfat remains a moderate risk but is dependent on the sustainability of cheese demand in Europe and the prospects for increased exports, while improved US cheese supplies will weaken prices.

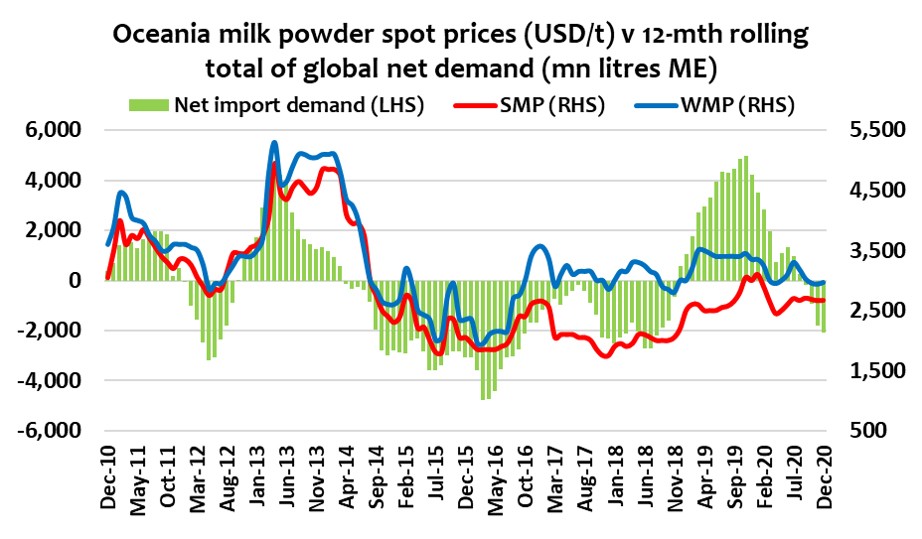

Oceania markets are mixed. While WMP fundamentals appear balanced, weak butterfat demand due to the impacts of food service closures is weighing on prices, while the durability of premiums over US and EU SMP will be tested.

Skim Milk Powder

Global SMP trade jumped 21% YOY in June, 43% of which came from SE Asia. The rolling annual total of SMP trade has recovered to within 2.6% of peak tonnage (achieved last September).

Whole Milk Powder

Global WMP trade rebounded 23% in June (with exports to Nth Africa making up half the gains in the month with the rolling annual total of WMP trade remaining 5.8% behind its peak 6 years earlier.

Cheese

Global cheese trade increased 14.4% YOY in June, with gains in most regions – strongest being UK, China and Mexico. Once the lure of low prices washed through the trade data, weak food service demand and uncertainty about the ongoing effects of COVID-19 will hang over cheese markets in coming months.

Butter

Global butterfat prices continue to converge, with Oceania values weakening further through August. EU butter prices improved, while US values softened through the month. Butterfat trade lifted 13.1% YOY in June in overall terms, this time aided by a 19% jump in butter trade, half of which came from MENA.

Whey

Whey powder prices continue to steady in the EU, while US prices have firmed in August after dipping in July. WPC prices for higher concentrated products remain weak with the lack of demand from the fitness market and weak growth in infant formula trade. The lack of demand for WPCs is pushing more whey solids into commodity powder production, as cheese output improves – especially in the US. Global trade in whey products lifted 8.5% YOY in August with strong trade into China.

By Dustin Boughton, Procurement Director, Maxum Foods – Your partner in dairy

Graph Reference: Fresh Agenda

For more information or interviews contact:

Dustin Boughton | Director, Procurement – Maxum Foods

Ph: +61 409 629 866

dustin@maxumfoods.com

Maxum Foods

Maxum Foods is one of Australia and New Zealand’s principal suppliers of dairy ingredients to the Human Health and Nutrition, as well as the Animal Nutrition industries. Maxum Foods specialises in supplying medium to large-scale food manufacturers with high-quality dairy ingredients such as milk powders, cheese and butter. Backed by top-level technical support and a huge dairy ingredient range, Maxum Foods have open global supply channels to source exactly what our customers need.