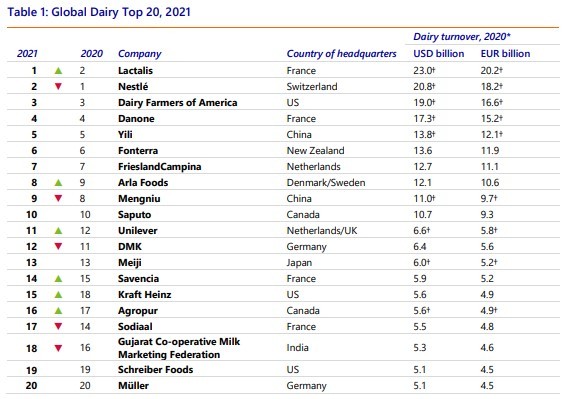

The combined turnover of the Global Dairy Top 20 fell by just a mere 0.1% in US dollar terms, following the prior year’s 1.8% gain. In euro terms, the combined turnover decreased by 1.9%. Merger and acquisition activity slowed in 2020, with approximately 80 announced deals vs. the prior year’s 105. Activity picked up in 2021, with over 50 deals announced through midyear.

† estimate

Source: Rabobank 2021

Distinguished by the global Covid-19 pandemic, 2020 was an unprecedented year in which dairy companies faced significant challenges, including (but not limited to) retail and foodservice marketing channel disruptions, volatile raw material costs, government intervention, changing consumer purchasing behavior (e-commerce, take-away, and pantry stocking), and elevated global trade, despite widespread logistic challenges. Overall, the dairy sector fared better than many feared at the onset of the worldwide pandemic, demonstrating the sector’s resilience.

Homebound consumers ate more breakfast cereal with milk, stemming the decline in fluid milk sales for the first time in several years.. With out-of-home dining restricted, the masses returned to the kitchen, preparing meals and baking, resulting in record sales for some cream, butter, and cheese companies.

The pandemic also heightened consumers’ awareness of environmental challenges. According to a 2020 Boston Consulting Group (BCG) survey of more than 3,000 people across eight countries, 70% of respondents indicated they are more aware now than they were before Covid-19 that human activity threatens the climate and that degradation of the environment, in turn, threatens humans.

Consumer sentiments are being heard, and many companies included in the Global Dairy Top 20 have made sustainability commitments for 2030 and carbon-neutrality commitments for 2050. According to NYU Stern Center for Sustainable Business, sustainability-marketed products in the US are growing and represent around 16% of consumer goods marketed and more than 50% of the dollar share of market growth between 2015 and 2019. In the dairy case, sustainabilitymarketed milk sales grew more than 20% from 2013 to 2018, compared to negative growth for the category as a whole. Sustainability-marketed natural cheese and yogurt sales grew over 30% and 20%, respectively, compared to near 10% growth for those categories broadly over the fiveyear period.

To achieve their sustainability commitments, leading dairy and global consumer product companies will have to partner with farmers to market a more sustainable product and to reduce emissions within their own supply chains.

A New Leader of the Pack

In 2021, privately held Lactalis, spurred by M&A deals, unseated long-time industry titan Nestlé as the world’s largest dairy company. Lactalis’s attention to organic growth, as well as its dedicated global M&A strategy, propelled the company from ninth place, with a turnover of USD 4.8bn, in 2000 – a level that would not make today’s top 20 list – to a dominating lead position in 2021, with a turnover of USD 23.0bn, representing an increase of more than 370% since the start of the century. Since 2010, Lactalis has grown its empire by adding approximately 60 deals, expanding its global footprint in the Middle East, Africa, and North and South America. Lactalis’s pending acquisition of the Kraft Heinz natural cheese business and Groupe Bel’s Royal Bel Leerdammer, Bel Italia, Bel Deutschland, and Bel Shostka Ukraine, which have a combined annual turnover of about USD 2.5bn, will extend the company’s lead in next year’s ranking.

Nestlé’s repositioning was foreshadowed in 2019 when it sold its US-based ice cream business to Froneri, narrowing the gap between the two companies to USD 1.1bn. Still, Nestlé’s estimated 2020 dairy-related turnover of USD 20.8bn represents a solid 60% increase compared to the start of the century.

The US’s largest dairy cooperative, Dairy Farmers of America (DFA), retains the third position. The co-op nudged Danone out of third place in 2019 after acquiring Dean Foods. Both companies reported lower dairy-related sales in 2020. DFA disposed of some assets and milk volumes due to the Dean Foods’ acquisition, while Danone faced some headwinds in the infant formula market. Like Nestlé, Danone’s portfolio continues to evolve, with a greater focus on acquisitions in the alternative dairy space.

A wide gap separates the chasers from the leaders. Asian giant Yili moved into the fifth position last year, growing sales by 20% after acquiring the New Zealand-based Westland Cooperative Dairy Company. Despite narrowing the gap between itself and the lead group with a 6.5% gain in 2020 turnover (US dollar terms), Yili remains USD 3.5bn behind the lead pack. Fonterra is close on Yili’s tail, with a 5.3% gain in turnover measured in NZ dollars (3.8% in US dollars) in the 2019/20 financial year, including revenues from its pending sales of China Farms and DPA Brazil, which will not be in next year’s tally.

EU-based cooperatives remain a bunched group among the chasers. Less than EUR 500m in turnover separates FrieslandCampina and Arla Foods. The latter was the only EU-based cooperative in the top 20 to report a higher turnover in euros of 1.1%, due to its strong retail branded position that performed well during the pandemic. In contrast, FrieslandCampina experienced a loss of 1.4% in euros (+0.3% in US dollars), attributed to unfavorable FX developments, geopolitical tensions, and costs associated with a large internal restructuring. The recent disposal of its powder plant in Aalter, Belgium and (pending) sales of their non-core Russian (Campina LLC) and animal nutrition (Nutrifeed) business units will be included in next year’s ranking. Nevertheless, FrieslandCampina retained the seventh position, while Arla Foods improved to eighth place.

Mengniu and Saputo round out the top 10 global dairy companies, with little headspace between the two. After gaining two positions last year, Mengniu slipped to ninth place, as renminbi turnover fell by 3.8% and was 5.2% lower in US dollar terms, due to Covid disruptions in 1H 2020 and the sale of its 51% stake in Junlebao Dairy. Mengniu’s acquisition of Australia-based organic infant nutrition company Bellamy’s was insufficient to offset the Covid disruptions and divestment. Publicly traded Canada-based Saputo retained the tenth position, which it acquired after 2019’s USD 1.5bn purchase of UK-based Dairy Crest Group. Most recently, Saputo announced two strategic acquisitions: one in the dairy alternative space and the other in valueadded ingredients, for a combined investment of CAD 187m. Scotland-based Bute Island Foods is a manufacturer, marketer, and distributor of alternative dairy cheeses. Wisconsin Specialty Protein manufactures value-added ingredients, including goat whey, organic lactose, and other dairy products. While these investments are not elephant deals, they represent on-trend acquisitions and diversification for Saputo.

In the second half of the list, there’s a shuffling among positions but no new entries. That will change next year, as Kraft Heinz disappears from the Global Dairy Top 20 list for the first time since its inception.

Notably, in 2021, French dairy cooperative Sodiaal will regain control of Yoplait’s activities outside of North America from General Mills. In 2011, General Mills purchased 51% of the operating company from French investment fund PAI Partners. As part of the deal, General Mills obtained full ownership of the Canadian Yoplait business and a reduced royalty rate for the use of the Yoplait and Liberté brands in the US and Canada. The integration of CF&R – a producer of French specialty cheeses and former joint venture between Savencia and Sodiaal – advanced Savencia one position this year compared to 2019.

Dairy alternatives continue to grow and blur the definition of dairy

The sales growth of liquid milk and yogurt alternatives – especially oat- and almond-based – have not gone unnoticed. Most significantly, Danone’s turnover in dairy alternatives, following its acquisition of WhiteWave Foods in 2017, was recorded at EUR 2.2bn (USD 2.5bn) in 2020, a gain of 15% compared to the previous year. Adding these sales would lift Danone to third position. Even though other companies in the ranking also have dairy alternatives in their product portfolio, the turnover is of a much smaller magnitude. Dairy alternative du jour Oatly surged in market capitalization, to more than USD 10bn, after its IPO debut in May 2021. The company reported revenue of USD 0.4bn in 2020, so it’s unlikely to enter the Global Dairy Top 20 for a few years. The designation of dairy is also becoming more blurred as hybrids like DFA’s Live Real Farms brand, which features “real milk and plant goodness,” enters the marketplace.

Looking forward to the next year, we anticipate investment activity to remain robust in the ontrend channels and categories, including specialty cheese, innovative dairy ingredients like human milk oligosaccharides, dairy alternatives ranging from plants and fermentation to cell-based, and lifestyle nutrition. In addition, acquisitions in adjacent sectors, such as logistics and inventory management, are likely.

At the farm level, the rising cost of production due to drought-induced higher feed costs and inflationary pressures will keep margins tight, limiting milk production growth in the Big-7 exporting regions to less than 1.2%. As a result, dairy markets are expected to remain in balance.

Reflecting on the past, consolidation is the keyword to describe the evolution of the Global Dairy Top 20 over the past two decades, with 14 companies still present as independent or as comparable entities in this year’s ranking. From 2000 to 2020, the combined turnover of the top 20 companies more than doubled, expanding by 3.8% annually.

From 2010 to 2020, we saw the rise of China and the loss of iconic names. Yili and Mengniu catapulted from #18 and #19, respectively, in 2010 to the top 10 in 2020, highlighting the evolution of China as a dairy-consuming nation and the world’s largest dairy importer. Both Chinese dairy giants have ambitious growth targets. With domestic competition intensifying, the two Chinese dairy companies are proactively looking for overseas growth opportunities. There has been a subtle shift of the investment focus, from solely concentrating on sourcing from key export regions to a combination of sourcing and gaining exposure to overseas consumer markets. As such, both Yili and Mengniu have made investments over the years in select markets in Southeast Asia via export, acquisition, and greenfield projects in categories like ice cream, milk drinks, and

ambient liquid dairy products.

This decade also witnessed the loss of several iconic dairy companies: Parmalat (acquired by Lactalis in 2011), Dean Foods (primarily acquired by DFA in 2019), and Dairy Crest (attained by Saputo in 2019). During the past decade, the growth in combined turnover of top 20 companies slowed to 2.0% annually. Through this decade, dairy product exports, in liquid milk equivalents, grew from nearly 52m metric tons to over 82m metric tons.

Over the next decade and beyond, changing demographics will drive dairy opportunities. According to the UN, from 2020 to 2030, an additional 750m people will share our planet. Over 35% of the population growth will occur in Africa, followed by India with 16%, Pakistan with 5.6%, Indonesia with 3.4%, China with 3.3%, and the US with 2.5%. India and Pakistan will continue their quests to be self-sufficient. Though challenging, it will be an opportunity for the farm inputs sector to provide technology, equipment, feed inputs, and genetics to decrease waste and increase milk yields in order to reduce the region’s high on-farm carbon footprint.

Africa remains a net – and growing – dairy importer, largely importing from international players in the Global Dairy Top 20. Still, there will be pockets of flourishing regional domestic production growth, such as in East Africa, based on the availability of natural resources and social, economic, and political stability. Similarly, Indonesia remains a growing market for global dairy exporters.

Barring any geopolitical fallout, China will continue to reign as the world’s largest dairy importer. Rather than being dominated by the infant nutrition market of the past two decades, China’s dairy sector will find growth in the ‘Active Silvers’ (i.e. people over 50 years old) market. China’s population is projected to grow by about 25m during the decade, but the demographic changes are significant. The number of people less than 4 years of age is projected to decrease by nearly 13m, while the number of people over 50 years old will increase by 100m.

The US population is forecast to grow by 18.6m people, to reach nearly 350m. It will be an aging and affluent market that attracts innovation and competition. The EU-27 market – with a consumer base near 450m people in 2030 – will also be aging and affluent but only 2.3m larger than in 2020. As a result, European dairy companies will face limited growth in their domestic consumer markets. At the same time, EU milk production is forecast to grow by just 0.6% annually during the decade, compared to a 1.2% CAGR from 2016 to 2020.

At the farm level, consolidation continues worldwide, and dairy farms will market ecosystem credits along with their milk. The largest dairy operations in North America, China, and Russia will exceed 250,000 head, with greater vertical integration in processing. Elsewhere, the average herd size will increase, but social and environmental pressures will limit herd-size growth in Europe and New Zealand, resulting in most of the production gains coming from greater production per cow.

Dairy cooperatives in the EU and New Zealand will become even more challenged to deliver organic turnover growth, due to a combination of a matured domestic market and, most significantly, to limited growth in milk volumes in response to sustainability constraints. As a result, these companies are likely to focus on value strategies, including bolt-on dairy alternatives, rationalization of plant capacity, and global marketing alliances.

By 2030, we anticipate that consumers will have the option to buy competitively priced plantbased and cell-cultured dairy alternatives. Non-GMO-sensitive consumers will likely choose plantbased alternatives. Natural dairy’s nutrient density will keep it a dietary staple. But, it is also imperative that the dairy sector be part of a global carbon-reduction solution that resonates with climate-sensitive consumers and prevents food manufacturers and foodservice operations from taking natural dairy out of their products and off their menus.