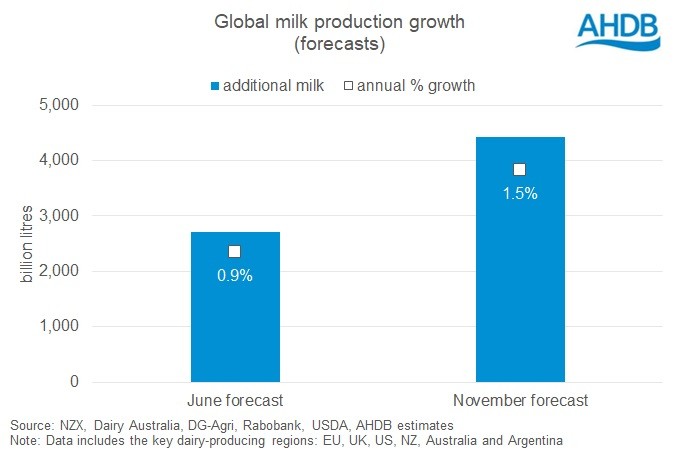

This is an increase on the volumes predicted earlier this year, due to better than expected production in both the US and Europe[1].

Earlier in the year, forecasts suggested lower growth, at just under 1%. This assumed the widespread closures of the hospitality industry would result in a significant drop in demand. As the lockdowns coincided with the spring flush in the northern hemisphere, this was expected to push down milk prices and squeeze farm margins.

However, government support programmes in the EU and US helped to maintain consumer spending on dairy, and limited the pressure on farmgate milk prices. Overall, dairy consumption was held up by higher retail sales, offsetting much of the lost out of home demand. In the US, this was further supported by the government food box programmes.

At a global level, we have seen a reduction in total dairy import demand (Jan-Aug 20 v Jan- Aug 19). Over the same period, production of storable products, such as cheese and butter, has increased in line with higher deliveries in both the EU and the US. In the absence of any demand growth in the coming year, prices may come under pressure as stocks build.

[1] excluding the UK, where 2020 milk production is forecast to be flat year-on-year