That meant they were saved from having to entertain the possibility of bailing out the company using tax payer funds.

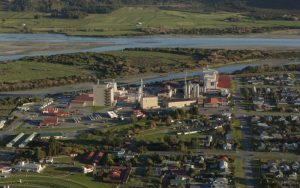

Shareholders voted overwhelmingly on Thursday to sell Westland Milk Products to China’s Yili conglomerate for $3.41 a share, or $588 million all up.

This deal now needs approval from the Overseas Investment Office, which is thought likely to be granted.

As the sale loomed, several politicians including two ministers – Damien O’Connor and Shane Jones – expressed opposition to the Chinese buy-out, blaming Westland management for letting the situation get to the point it did.

But RNZ understands ministers might also be breathing a sigh of relief that farmer-shareholders gave Yili the thumbs up.

That is because rejection of the Yili deal might have left the taxpayer being forced to pick up the tab.

RNZ knows that this possibility was considered at the highest levels of Wellington bureaucracy.

It was further told that there had been discussions about a potential bailout by government ministers.

Asked about this, a government official said he “couldn’t help with that query.”

But the matter has also been discussed by some farmer shareholders on the coast.

The argument went that any failure of Westland Milk Products would devastate a region like the West Coast, which was economically vulnerable already.

It is not certain that Westland would have collapsed if a sale had been rejected.

But analysis done for ANZ bank suggests it would have struggled.

Its debt was $342.5 million, which is almost 60 percent of the value of the company, according to Yili’s offer.

But an independent valuation offered before the sale put the the value of shares far lower, at $0.88 to $1.38.

At that rate, Westland would have been in negative equity.

And meeting payments on the $342.5 million debt would have been hard without Yili’s buy-in, according to one farmer shareholder, Peter Langford.

“Shareholders (would have been) tapped into to cover that debt with retentions between 20 to 40, maybe 50 cents (per kg of milk solids),” said Mr Langford, who is also West Coast President of Federated Farmers.

“No-one knows when it will stop, and if you take 50 cents off a farmer’s potential payout, it is hundreds of thousands of dollars over time.”

Mr Langford also said 31 farmers within range of Fonterra’s collection systems would have quit the company if it had not sold, leaving even fewer farmers available to pay Westland’s debt.

“It would be a nightmare.”