We wouldn’t blame China Mengniu Dairy Company Limited (HKG:2319) shareholders if they were a little worried about the fact that Minfang Lu, the CEO & Executive Director recently netted about HK$13m selling shares at an average price of HK$26.33. That’s a big disposal, and it decreased their holding size by 15%, which is notable but not too bad.

The Last 12 Months Of Insider Transactions At China Mengniu Dairy

In fact, the recent sale by CEO & Executive Director Minfang Lu was not their only sale of China Mengniu Dairy shares this year. Earlier in the year, they fetched HK$36.60 per share in a -HK$25m sale. While we don’t usually like to see insider selling, it’s more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (HK$24.05). So it may not shed much light on insider confidence at current levels.

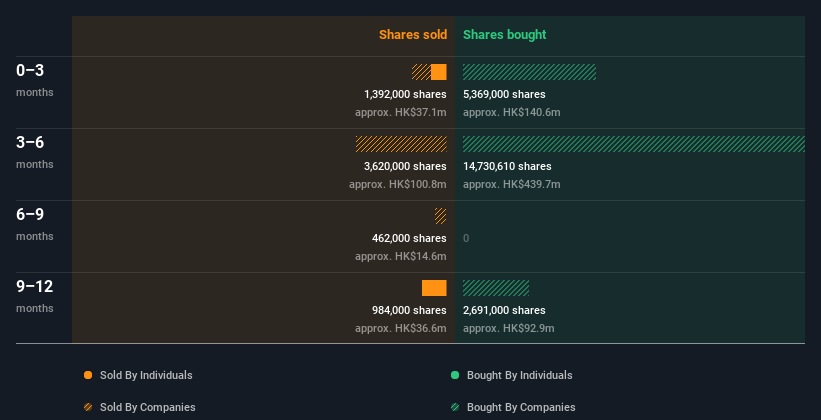

Minfang Lu ditched 1.62m shares over the year. The average price per share was CN¥32.79. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Does China Mengniu Dairy Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It appears that China Mengniu Dairy insiders own 0.09% of the company, worth about HK$87m. While this is a strong but not outstanding level of insider ownership, it’s enough to indicate some alignment between management and smaller shareholders.

So What Do The China Mengniu Dairy Insider Transactions Indicate?

An insider sold stock recently, but they haven’t been buying. And there weren’t any purchases to give us comfort, over the last year. Insider ownership isn’t particularly high, so this analysis makes us cautious about the company. So we’d only buy after careful consideration. So while it’s helpful to know what insiders are doing in terms of buying or selling, it’s also helpful to know the risks that a particular company is facing. You’d be interested to know, that we found 2 warning signs for China Mengniu Dairy and we suggest you have a look.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.