Dairy and beef markets have made a positive start to the year buoyed by high prices, while there are also indications sheepmeat prices may finally begin to move in the second half the year, Rabobank says.

Dairy and beef markets have made a positive start to the year buoyed by high prices, while there are also indications sheepmeat prices may finally begin to move in the second half the year, Rabobank says.

Global milk supplies are still struggling to get positive momentum, while stronger global dairy prices will help with improved farmgate margins, with global milk supply lifting by the year’s end, Rabobank says in its latest monthly agribusiness report.

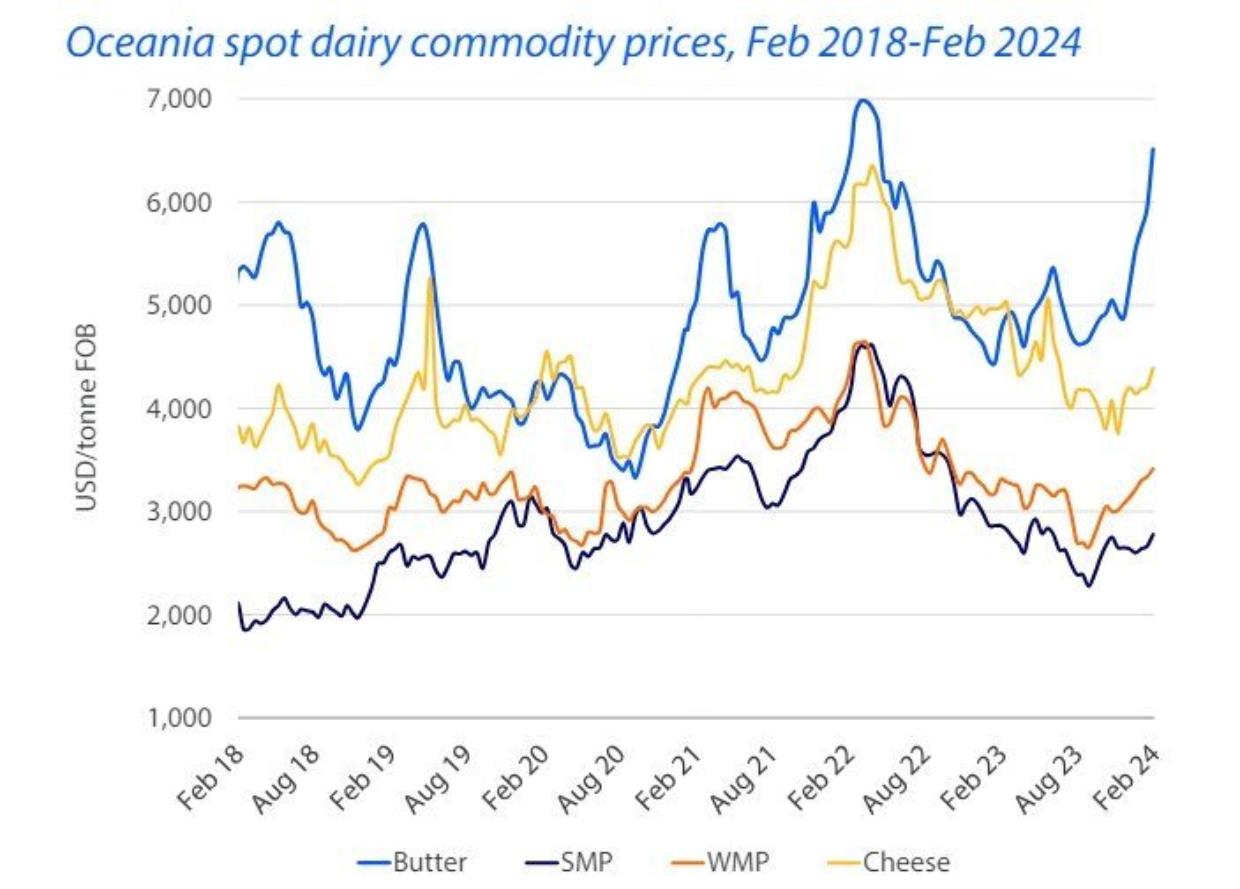

Dairy commodity markets have largely continued their positive trend in February. Butter prices have continued to soar, lifting 12% and were 20% higher at the end of February than at the beginning of the calendar year. SMP continues to recover, lifting 8% in February, while gains for WMP slowed to 1% and cheddar prices stalled over the same month.

Rabobank chart showing Oceania spot dairy commodity prices (source: USDA, Rabobank 2024)

Rabobank chart showing Oceania spot dairy commodity prices (source: USDA, Rabobank 2024)Milk supply growth from global dairy exporters continues to struggle and a return to meaningful production expansion from these regions will take some time.

Higher dairy commodity prices will translate into firmer farmgate milk prices in all regions providing welcome relief for farmers who struggled to be profitable in 2023. It’s likely that it will take until the second half of this calendar year for volumes from the dairy exporting heavyweights to move back into positive territory.

New Zealand milk supplies eased 1.2% year on year on a tonnage basis, while milk solids similarly declined by 1% over the same period. Milk supply is 0.5% down YOY for the season to January, largely driven by weaker North Island collections.

Sluggish demand remains the key influence on commodity prices. Pockets of demand optimism remain China. Retail and foodservice sales showed some strength through the Lunar New Year – although it is too soon to declare a trend, Rabobank says.

Prices will improve as milk production continues to struggle but demand subtly improves.

New Zealand beef markets are looking positive, and are expected to remain this way throughout the year, with pricing at or above the five-year average. This is fuelled by strong US demand and lower-than average slaughter numbers.

Conditions have been drier notably in the upper South Island and parts of the lower North.

Due to the overall good growing conditions to date, onfarm pressure to send cattle and cull cows off farm has been lower than during the same time in 2023. According to provisional NZ Meat Board numbers, the national bull kill till early February was down 4.5% and the cow kill was down 6.4%, the bank says.

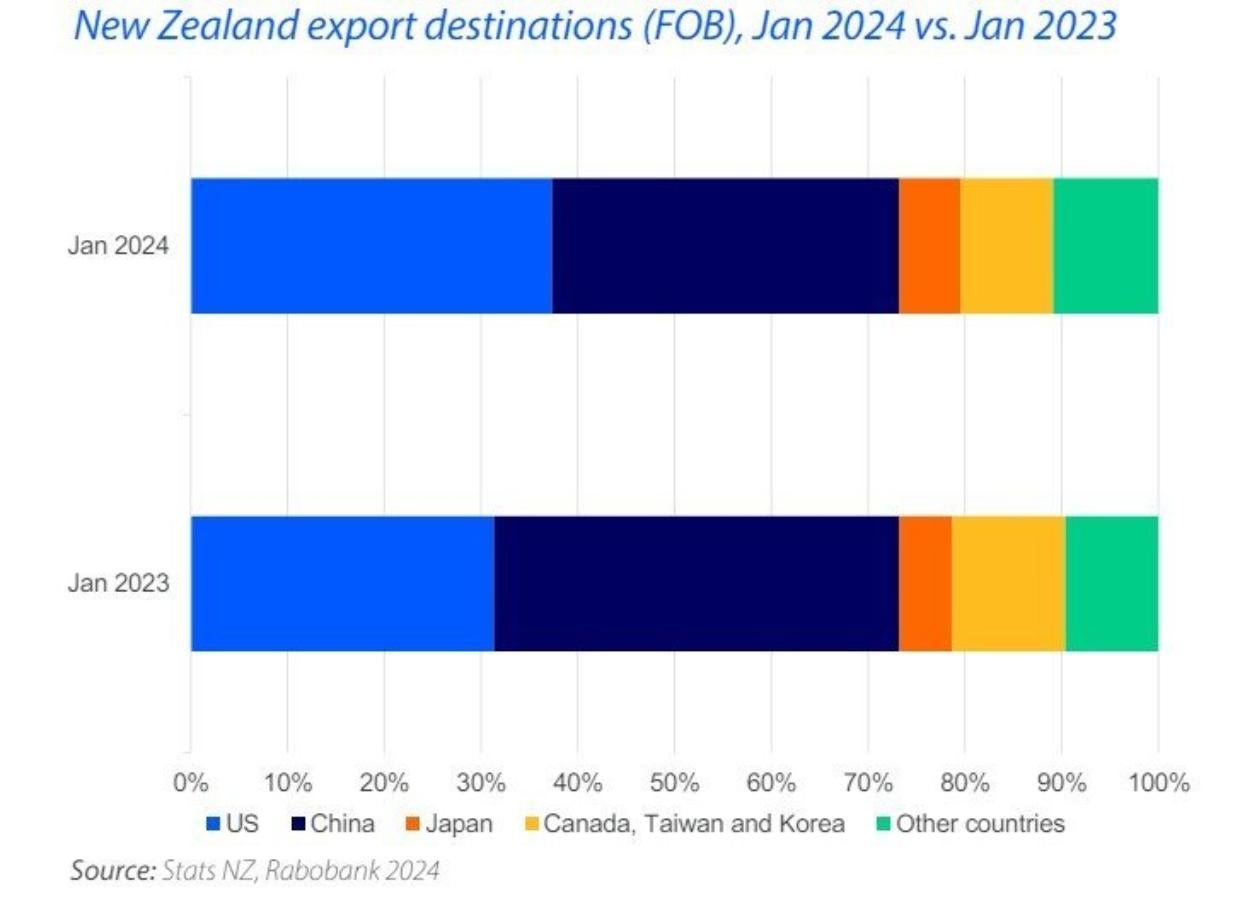

New Zealand export destinations (source: Stats NZ, Rabobank 2024)

New Zealand export destinations (source: Stats NZ, Rabobank 2024)Beef exports to the US were up 12% YOY by value in January. Exports to China were down 19% YOY by value in the same period. This reflects what we expect to be a 2024 trend, with the US driving good demand due to low domestic supply and beef herd numbers (the lowest since 1961), Rabobanks says.

Chinese demand remains soft. with less consumtion during the Chinese Lunar New Year celebrations than expected. Production in Australia and Brazil is up, but lower in Europe and the US. New Zealand remains well poised for beef exports to these markets with lower domestic supplies.

“Overall, New Zealand beef markets are looking positive to start 2024 and look to remain this way throughout the year with pricing at or above the five-year average.”

A small silver lining throughout the first quarter of 2024 has been on-farm feed supplies in terms of pasture and crops in most sheepmeat-producing regions. The most notable is Southland, which had good pasture growth.

With lamb prices lower producers have opted to put extra weight on lambs to make up for a lower price per kilogram.

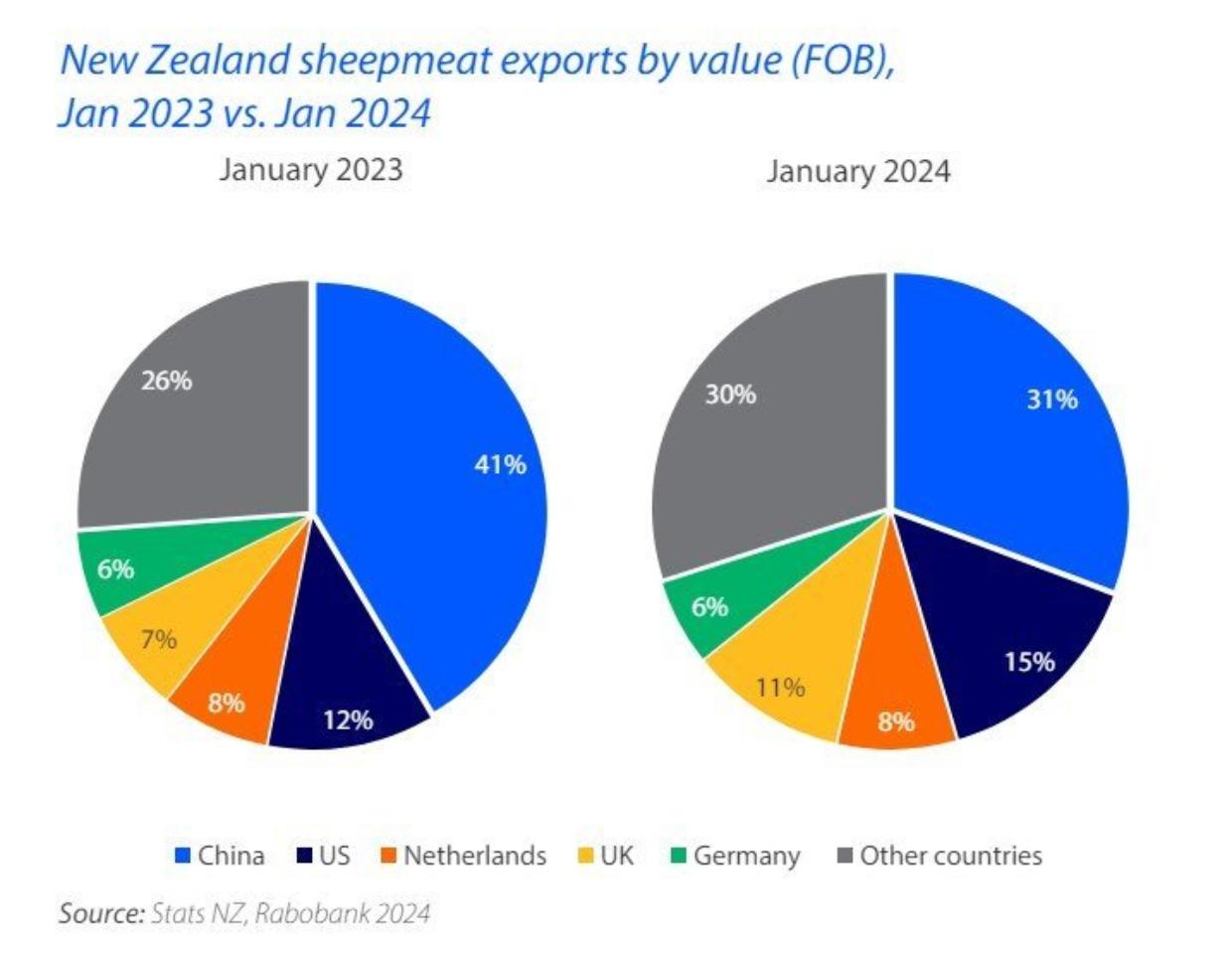

NZ sheepmeat exports by value (Source: Stats NZ, Rabobank 2024)

NZ sheepmeat exports by value (Source: Stats NZ, Rabobank 2024)Sheep meat export markets experienced a notable year-on-year shift in January. China’s continuing soft demand due to a sluggish economy and reduced consumption saw the total value of exports drop from 41% to 31% YOY for the month, Rabobank says. But there was an uptick in exports to the US and the UK. But total New Zealand exports for January were down 9% YOY in value and up 1% in volume.

For the week ending February 3, NZ Meat Board national lamb slaughter numbers were down 1.2% YOY. With dry hitting some regions through February there is an expectation that numbers will increase. Some processors are announcing minimum price contracts for the late April to May period, the bank says.

Meat processors appear optimistic prices will ift to global markets later in the year – especially to the UK, the EU, and North America.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K

Legal notice about Intellectual Property in digital contents. All information contained in these pages that is NOT owned by eDairy News and is NOT considered “public domain” by legal regulations, are registered trademarks of their respective owners and recognized by our company as such. The publication on the eDairy News website is made for the purpose of gathering information, respecting the rules contained in the Berne Convention for the Protection of Literary and Artistic Works; in Law 11.723 and other applicable rules. Any claim arising from the information contained in the eDairy News website shall be subject to the jurisdiction of the Ordinary Courts of the First Judicial District of the Province of Córdoba, Argentina, with seat in the City of Córdoba, excluding any other jurisdiction, including the Federal.

1.

2.

3.

4.

5.

eDairy News Spanish

eDairy News PORTUGUESE