Milk pricing regulations in Federal Milk Marketing Orders (FMMO) are among the most complicated commodity pricing regimes across all of agriculture.

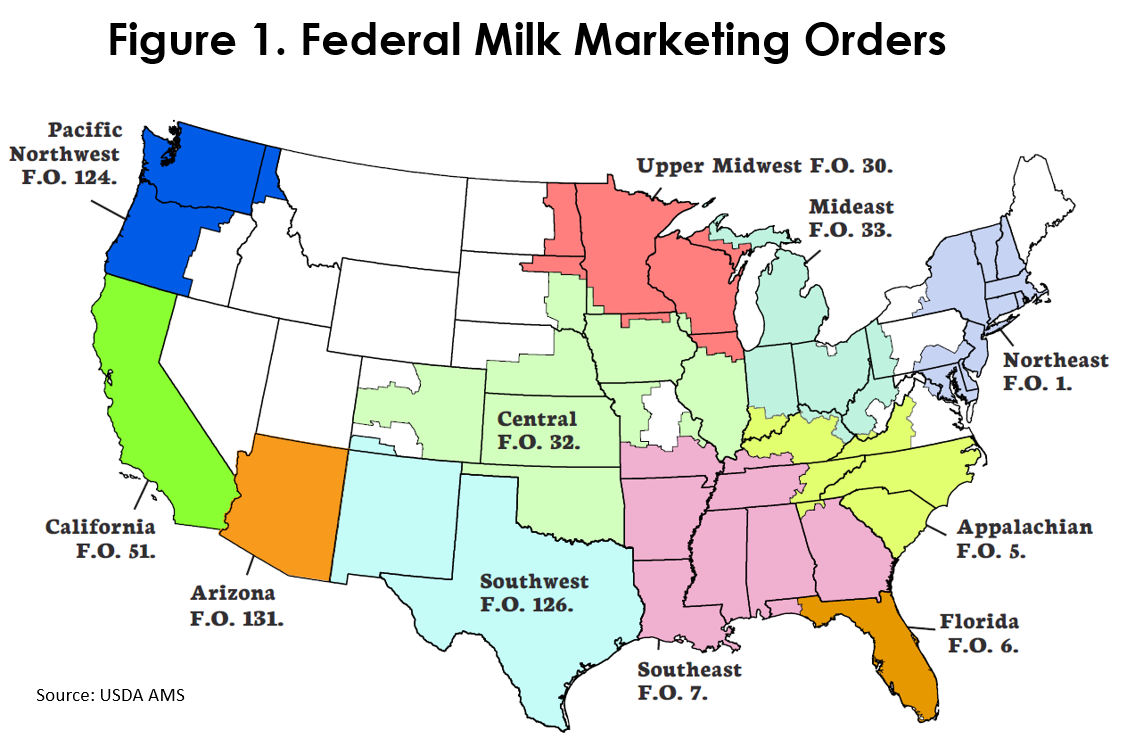

Milk pricing regulations in place today stem from pricing reform in 2000 that introduced end-product pricing formulas, by which regulated milk handlers are required to pay producers based on their utilization of the milk. Producers in a marketing area (Figure 1) share in the proceeds of all milk sales “pooled” on an order, and the regulated minimum milk prices reflect the end-product pricing formulas and the farm’s share of the revenue sharing pool. For nearly 20 years there were only 10 milk marketing orders, but in September 2018 California was introduced into the FMMO system as a result of the 2014 farm bill (2014 Farm Bill: Key Factors to Consider with a California Federal Milk Marketing Order). Today, there are 11 FMMOs in the United States.

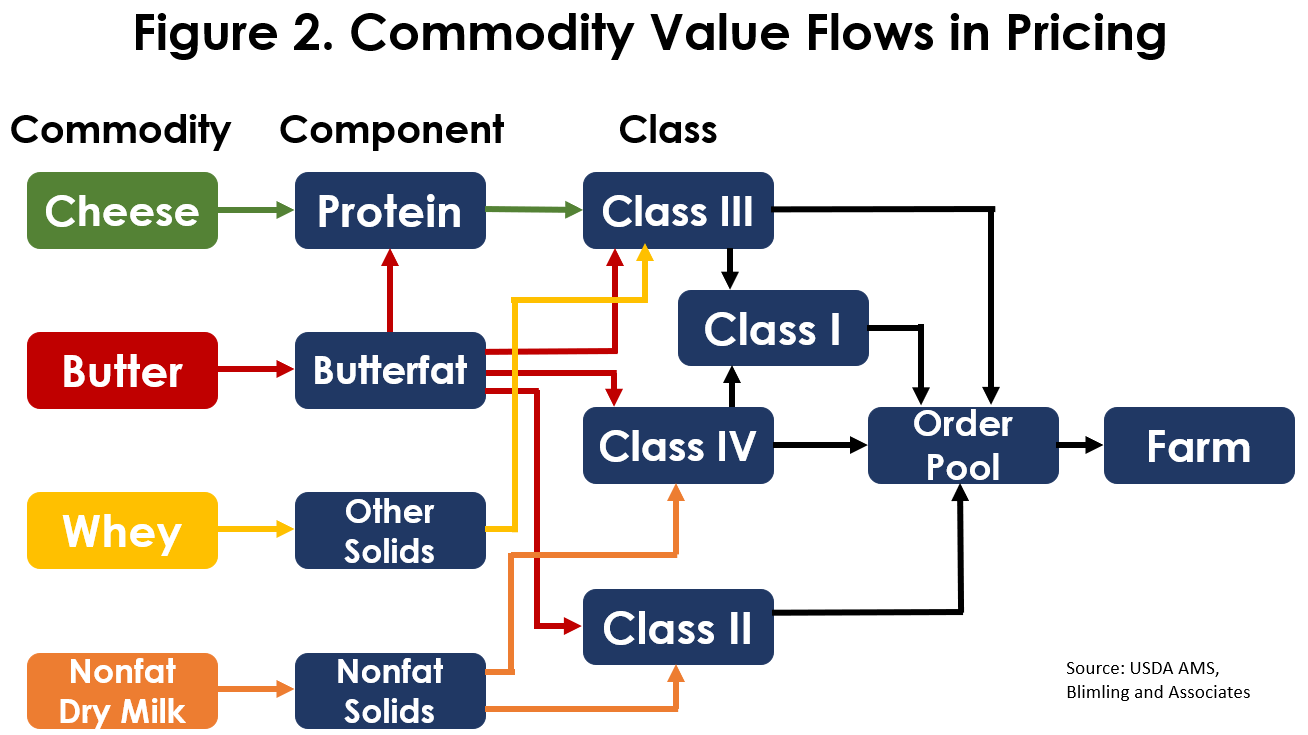

In FMMO milk pricing, we often talk about the three C’s: commodity, component and class. The different class prices are derived from various component values, which are in turn derived from several commodity prices.

There are several steps involved in determining farm-level milk prices for farmers pooling on a FMMO. First, each week, through mandatory price reporting, dairy manufacturers report to USDA the value and sales volume of wholesale butter, cheddar cheese, nonfat dry milk and dry whey.

Next, these prices are used to determine two-week and monthly weighted average commodity values. The two-week prices are used to determine advanced pricing factors for pricing fluid milk and cultured products. The monthly weighted average prices are used to determine both the component value and the classified value of milk. Both the two-week and monthly prices utilize end-product pricing formulas (described below) to determine the classified value. A flow chart of this end-product milk pricing system is depicted in Figure 2, and as an example of end-product pricing the cheese price is used to determine the protein value, which is then used to determine the classified value for milk used to produce cheese, which is then part of a revenue sharing pool to then determine the farm-level regulated minimum milk price.

Classified Pricing

A key part of the classified end-product pricing system is that the milk has a different value depending on how it is used. There are four classes of milk based on the end use of that milk:

Class I: fluid milk for drinking, including eggnog and buttermilk (Price Formula)

Class II: soft products like ice cream, yogurt and cottage cheese (Price Formula)

Class III: hard cheeses, cream cheese and whey (Price Formula)

Class IV: butter and dry products such as milk powder/NFDM (Price Formula)

Class I fluid milk typically receives the highest price under the FMMO system. The rationale for Class I milk prices being the highest value dates to an early economic argument that demand for fluid milk was inelastic, meaning a higher price wouldn’t significantly change demand for milk. As a result, fluid milk carried a higher price differential that was used to assist in facilitating the balancing of fluid milk supply and demand as well as transportation costs. However, in recent years fluid milk consumption has declined suggesting a review of the demand elasticity is warranted, e.g., Trends in Beverage Milk Consumption.

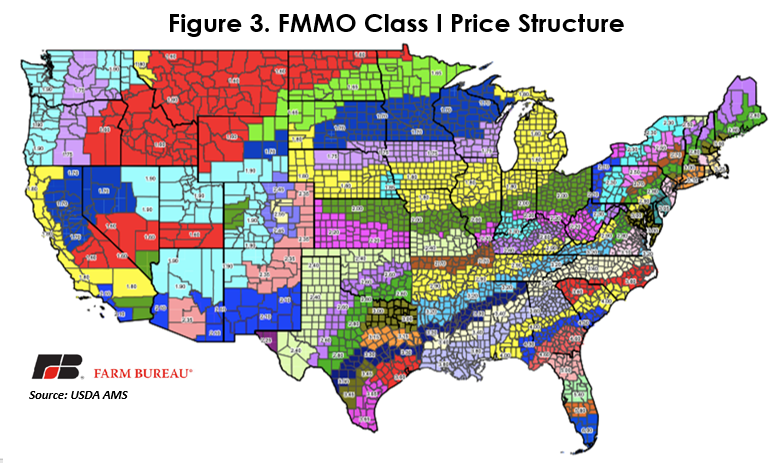

Until recently, Class I prices were calculated by using the higher of Class III and IV advanced pricing factors. As of May 1, 2019, the Class I skim milk price formula is the average of the monthly Class III and IV advanced skim pricing factors plus 74 cents per hundredweight and including the applicable adjusted Class I differential, Proposed Changes to Fluid Milk Pricing.

Class I prices share a common base value but will vary by location. This is due to the Class I differential, which varies across the country due to specific supply and demand fundamentals of beverage milk in each region. Class I price differentials range from a low of $1.60 per hundredweight in the Upper Midwest to $6 per hundredweight in Florida, Figure 3. The manufacturing value of milk in all other classes is the same across the U.S.

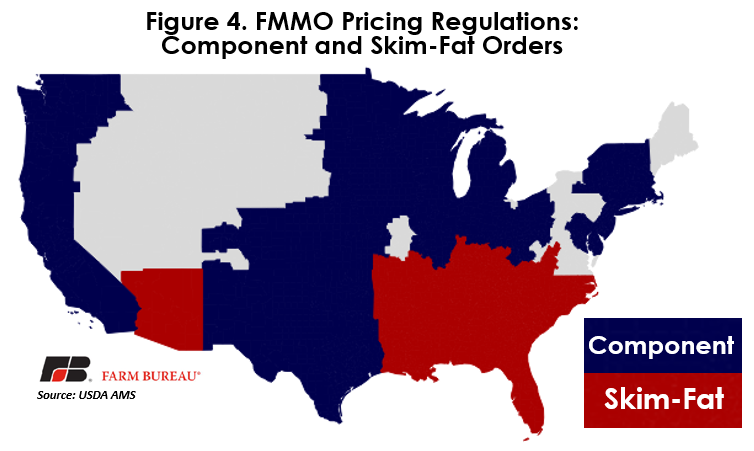

These classified milk values are ultimately used in revenue sharing pools to determine the regulated minimum price that is due to dairy farmers pooling on an order. There are two types of milk pooling schemes: multiple component pricing and skim-fat pricing.

Determining Component Values

The primary idea behind multiple component pricing is to arrive at a milk price that is derived from the end products made from the milk. On the face of it, the basic formula for component pricing is very simple:

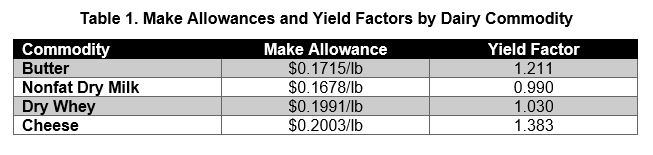

Component Value = Yield x (Commodity Price – Make Allowance)

The yield is how much of the commodity can be made from the milk, the commodity price is the value of the end product – based on the USDA surveys — and the make allowance is the manufacturing cost of processing the milk into the end commodity. These component values are then used to determine the minimum prices for the orders through the classified pricing system. Federal orders specify four different components: butterfat, which derives its value from the price of butter; nonfat solids, which derive their value from the nonfat dry milk price; protein, which derives its value from cheese and butter prices; and other solids, which derive their value from the dry whey price. In the component value formula, the yield and make allowances are fixed and can only be changed through a rulemaking proceeding, while the commodity prices change monthly.

Make allowances are processing credits designed to reflect the average processing costs associated with producing cheeses, butter, nonfat dry milk (NFDM) or dry whey. Yield factors represent the volume of the finished commodity produced from processing one pound of the component. Table 1 highlights the make allowances and yield factors used in the end-product pricing formulas.

The commodity prices used in the component value formulas are based on wholesale commodity prices collected weekly by USDA’s Agricultural Marketing Service. Each week, large manufacturers are required to report data on sales transactions for cheddar cheese (40-pound blocks and 500-pound barrels), dry whey, nonfat dry milk and butter to be aggregated and published in the National Dairy Products Sales Report.

Another characteristic of the classified pricing system is timing. AMS announces the advanced Class I price and the advanced Class II skim price, as well as the necessary information to calculate them, on or before the 23rd of the preceding month. For example, the January 2020 Class I beverage milk price will be announced in December 2019.

AMS announces the commodity prices, and therefore the Class II fat and Class III and IV prices on or before the 5th of the following month. You can’t value protein and butterfat for a certain month until you know what the cheese and butter prices were in that month.

These component and classified values are used in the final step of milk pricing: revenue sharing pools. There are two types of revenue sharing pools: skim-fat pricing and multiple component pricing. In both cases the handler value of milk is determined by summing the value of all milk pooled on the order by class of utilization and the producer value is determined based on the pooling method.

Skim-Fat Pricing Pool

In four of the FMMOs, Appalachian, Arizona, Florida and Southeast, the milk pricing regulations are based on butterfat and skim pricing and do not incorporate proteins. In this pricing framework the handler’s value of milk is based on the classified skim and fat value of milk, whereby the Class I and II skim and fat values are higher value due to the differentials.

The producer value of milk in a skim-fat pool is then the weighted average value of butterfat and skim. These prices are referred to as the uniform fat and skim values. An example of a pool calculation is available here. Under skim-fat pricing, prices are set based on the fat content in the milk. The uniform butterfat and skim prices are announced after the monthly pooling process.

Since the formula bases the price on the fat content of the milk, it categorizes everything else as skim; as a result, the water contained in the skim portion receives the same price per pound as non-fat solids. Producers with a higher milkfat content will have a higher minimum regulated milk price – holding the location adjustment constant.

Component Pricing Pool

While the skim-fat pools determine the handler value of milk based on the classified values of skim and fat, in a component pricing order the handler’s value of milk is based on their utilization of butterfat, protein, non-fat solids and other solids, but also include the Class I and II differentials.

The producer value of the milk is then based on the components in the pool – and are based on the announced component prices for fat, protein and other solids. The equity payment from the pool is called the producer price differential and is defined as the difference between the handler value and the component value, divided by total pounds in the pool. An example of a pool calculation including the PPD can be found here. Producers pooling on a component pricing order will have a higher regulated minimum price based on the solids content of their milk.

Summary

The price of milk in the U.S. is one of the more complicated agricultural policy issues in the U.S. How milk is utilized affects the ultimate farm-level regulated milk price, which is a market-weighted average based on the end usage of the milk in the various classes in the order plus an equity payment from a revenue sharing pool. The more Class I, or beverage milk, in a pool, the higher the regulated minimum price. This means, an order in which a larger percentage of milk is used for fluid milk consumption will be more heavily weighted toward Class I prices than orders that use a larger share of milk in manufacturing classes.

Another key tenet of FMMOs is the concept of revenue sharing pools. Effectively, all similarly situated handlers and producers have a similar regulated milk price – absent differences due to quality or component levels. Processors each pay a different price for the milk, depending on what end product they are producing, while farmers receive an average price (the blended price) from how the pooled milk was used in the order.

In practice, the milk check that farmers receive will differ based on the actual components of their milk, even though they receive the same component prices. Processors then pay into or take money from the order’s pool depending on whether the price they paid was below or above the producer value of milk. Producers are paid the blend price including an equity payment from the pool, adjusted for location.

Non-cooperative-owned regulated milk processing plants are required to pay regulated minimum prices to farmers, unless prices are agreed upon in a forward pricing agreement. Re-blending provisions provided to cooperatives under the Agricultural Marketing Agreement Act allow cooperative-owned plants and cooperatives to pay prices below the regulated minimum to their members.

Contact:

Michael Nepveux

Economist

(202)406-3623

michaeln@fb.org