This is a slight increase (+0.2%) from the Commission’s previous estimate, but it is lower than the growth seen in 2020 (+1.7%). It comes despite EU heifer numbers at the start of 2021 being the lowest in 10 years, with milk yields lifting 2.8% in 2020. For 2021, milk yields are expected to continue this trend, assuming favourable spring weather conditions and good grass growth, which should outweigh concerns of rising feed costs.

During the second half of 2021, foodservice demand is expected to recover as lockdown restrictions are eased. As a result, butter consumption in the EU is expected to lift by 1% in the year. EU butter prices have lifted in recent months, although prices remain competitive on the world market. As such, the Commission anticipates 4% year-on-year lift in EU butter exports for 2021, as the global demand for butter continues to grow.

Similarly, the re-opening of foodservice is expected to support a 1% increase in EU cheese consumption, while cheese exports are anticipated to grow by 4% in 2021. The main driver for this is increased shipments to Japan, and the US, following the temporary lifting of additional tariffs on EU products.

Following an increase in cheese production, whey production is expected to increase by 2%, with exports expected to rise 5%, driven by increased demand from China.

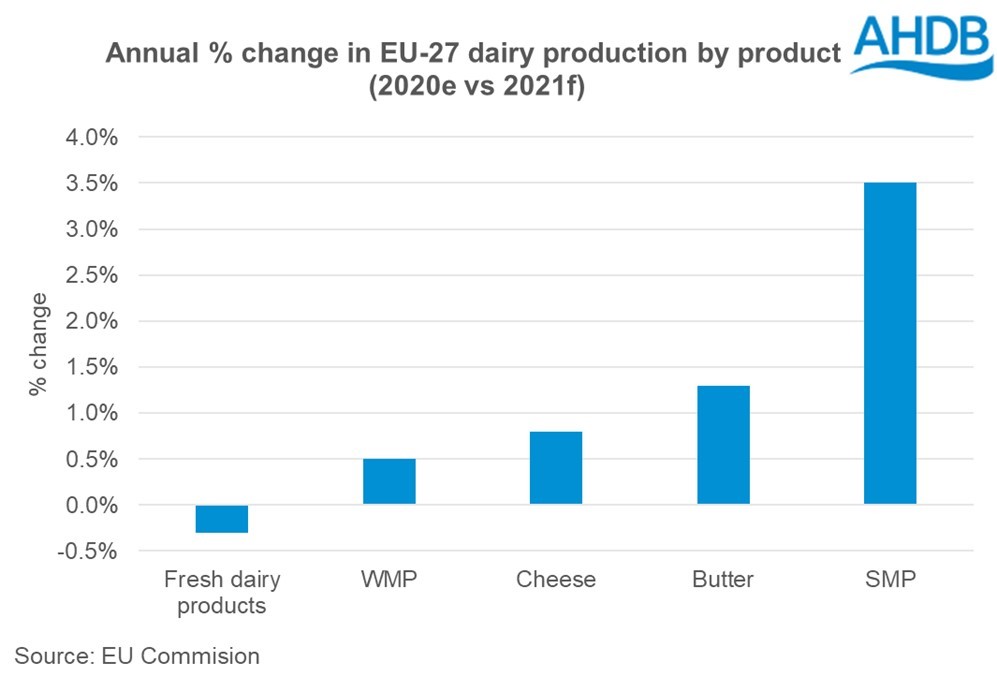

EU SMP production is also expected to increase, up 3.5% year-on-year in 2021, following increased demand from South-East Asia. As such, EU exports of SMP are expected to grow 6% in 2021, further supporting the higher prices seen.

For WMP, EU production is expected to remain stable (+0.5%) on 2020 levels, to keep up with domestic and higher export demand seen last year.

Overall, the consumption of butter and cheese are expected to particularly benefit from the recovery of foodservice, with the retail sales of these products expected to remain above pre-COVID-19 levels. Meanwhile, the consumption of fresh dairy products is expected to fall in 2021 year-on-year, as more people continue to work from home, limiting the use of fresh dairy in cafes and cafeterias. However, consumption of fresh dairy products is expected to remain above 2019 levels.