Food prices saw their first monthly fall in two years, but fuel prices rose sharply, official figures show.

It came as the UK’s overall rate of inflation held steady at 6.7%, ending a run of three consecutive monthly falls.

Milk, cheese and egg prices all fell easing the pressure at supermarket tills, but petrol rose by 5.1p a litre.

The latest inflation figures shows the battle to slow soaring prices is not over and means uncertainty over whether interest rates will rise further.

Analysts had expected the overall rate of inflation to fall slightly, and the Office for National Statistics said there may be “some disappointment” about the unchanged figure.

However, its chief economist, Grant Fitzner, told BBC Radio 4’s Today programme: “If you look across Europe, many countries have seen either periods lately of no change or in some cases of actual increases in the headline rate, before they started to resume their falls.”

UK interest rates were left on hold at 5.25% last month, after a succession of rate rises aimed at getting inflation under control.

While most economists expect rates to remain unchanged again next month, Bank of England governor Andrew Bailey has acknowledged further decisions might be tight.

Resurgent oil prices in the wake of the crisis in Israel and Gaza is a reminder of how volatile and tricky inflation can be.

On Tuesday, separate figures showed wages outpaced inflation for the first time in almost two years between June and August.

However, many households remain under pressure because of the high cost of living and charities have warned things could get worse this winter.

Other benefits – significantly universal credit – also usually rise in line with this rate, but this is at the discretion of ministers.

Hannah Nagy, a mum-of-two from Stainland in West Yorkshire, said her pay had gone up by about 5% since April but that it “hasn’t really touched the sides, particularly with the cost of shopping”.

“It’s not going towards holidays or days out – it’s going towards electricity, petrol, food, shopping – day-to-day living,” the recruitment professional told the BBC.

Mrs Nagy said the pace of price rises meant she felt like she was in a better position a few years ago when she earned less but things didn’t cost as much.

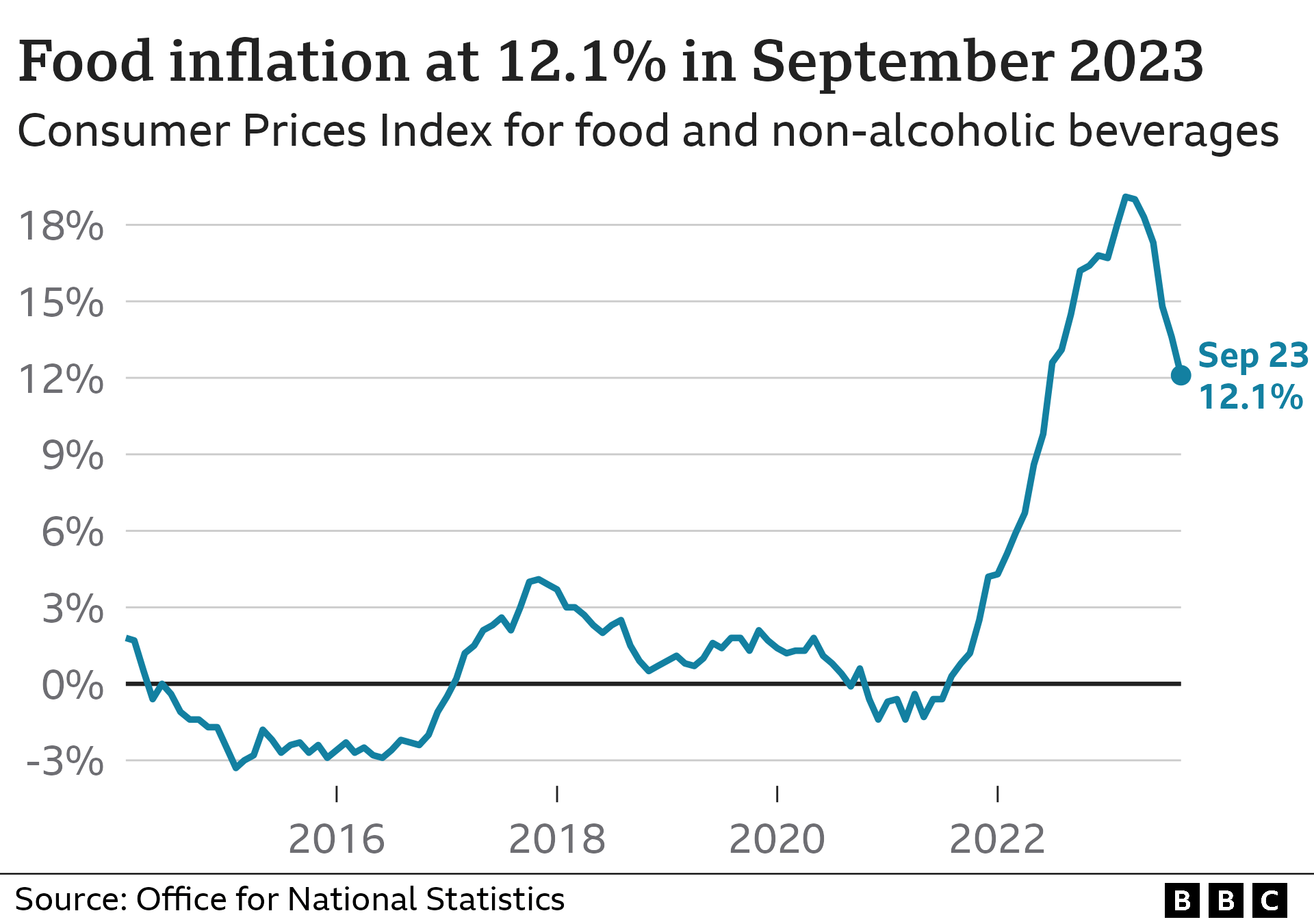

High food prices have driven up inflation over the last few years, with the cost of a weekly shop soaring due to supply chain issues and the war in Ukraine.

While food price inflation remains high at 12.2% on an annual basis, it has been easing.

Food prices fell by 0.1% between August and September, led by dairy produce and soft drinks. The only food category that went up was fish, led by frozen prawns.

In contrast, drivers were hit at the pumps again as global oil prices rose.

Between August and September, petrol increased to an average of 153.6p per litre and diesel by 6.3p to 157.4p per litre. That was up from levels closer to 140p in June, although still well below the highs seen last year.

Oil prices have jumped since Saudi Arabia and Russia cut their production to support the global market, and events in Israel and Palestine have sparked further increases.

Further rate rises?

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said the high oil prices added to worries “that inflation will stay stubborn”.

It meant the door to another UK interest rate hike “has been kept ajar”, she added.

“At the very least still untamed inflation is pushing any chance of a rate cut further back into next year,” she said.

Higher interest rates have put pressure on households and businesses as the cost of mortgages and loans goes up. They are also having a knock-on effect on the wider economy, which has been slowing down.

Economists expect the new energy price cap which kicked in on 1 October to cut inflation by at least one percentage point next month. The cap limits what suppliers can charge households per unit of gas and electricity.

However, the UK’s inflation rate is affected by multiple factors, including food and fuel prices, so is difficult to predict.