The inputs market is in a considerably different position compared to this time last year.

From varied weather conditions across Australia to changes in global supply and demand, the market is facing pressures on multiple fronts.

Weather has played a major role in shaping the current situation.

While March 2024 recorded lower rainfall deciles than March 2025 across many dairying regions, it followed a much wetter summer.

January 2024 delivered widespread above-average rainfall to nearly all dairying areas.

In contrast, this season has been marked by prolonged dry conditions in the south, particularly in South Australia, where multiple months of below-average rainfall have placed mounting pressure on feed and water availability.

Meanwhile, northern NSW and Queensland have faced a distinct set of challenges.

Extreme rainfall and wind events linked to ex-Tropical Cyclone Alfred have disrupted dairy operations across the region.

Unsurprisingly, these significant dry spells have impacted the water market across southern dairying regions.

Water availability is low across all monitored storages in south-eastern Australia.

Lake Glenmaggie recorded the smallest year-on-year decline, sitting seven per cent below March 2024 levels, while the Hume region saw the largest drop, down 60 per cent.

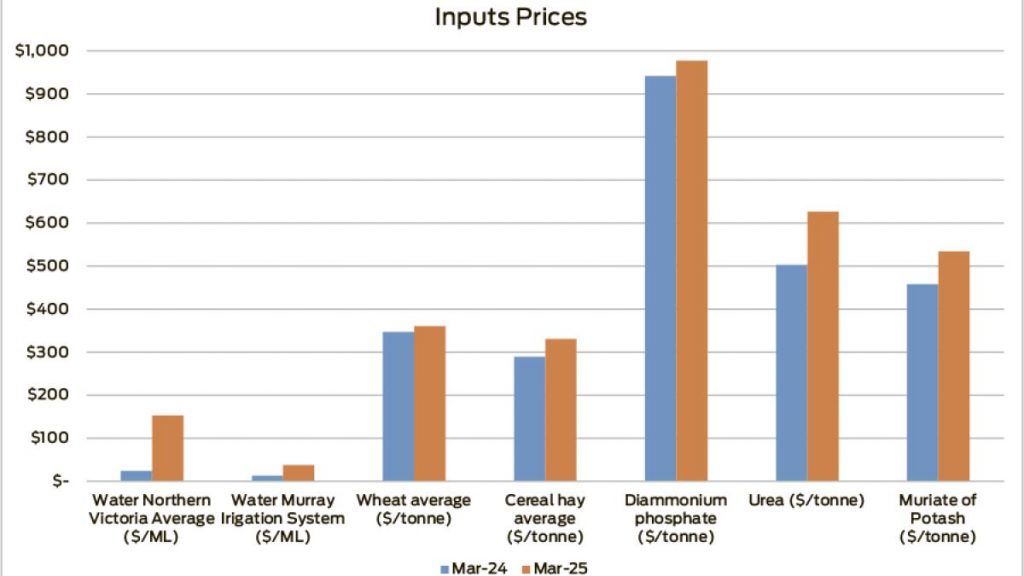

This tightening of water availability is reflected in temporary water prices.

In northern Victoria, prices are averaging 537 per cent higher than in March last year, while Murray Irrigation prices have risen by 187 per cent over the same period.

However, it’s important to note that these increases are compared to a relatively low base in March 2024.

Limited rain and water availability have also reduced pasture growth, driving up demand for supplemental feed.

At the same time, hay and grain supply have been negatively affected by the lack of water, further pushing prices.

Conversely, in the north, flash flooding and strong winds from ex-Cyclone Alfred have disrupted pastures and crops, similarly adding to feed demand.

There are also concerns that crops currently in the ground may deliver lower yields and quality when harvested, suggesting that tight feed supplies may persist for some time yet.

In conjunction with weather events on home soil, global conditions are disrupting input markets.

Firmer offshore markets are supporting Australian wheat prices, as dry conditions across several key Northern Hemisphere growing regions raise concerns about global supply.

Export demand into South-East Asia is also contributing to price support, while uncertainty around potential tariff announcements is adding volatility to the market.

Global factors have also pressured Australian fertiliser prices, with urea, diammonium phosphate (DAP) and muriate of potash (MOP) prices all sitting above prices last year.

Extended outages in Iranian urea production and ongoing constraints in European production have restricted global supply. Meanwhile, Chinese exports of urea and DAP remain limited, and rising demand for MOP from both China and the United States has added further strain.

Across all fertiliser markets, uncertainty around US tariffs is also contributing to upward price pressure.

The inputs market is under pressure from local weather and global disruptions.

Dry conditions across the south are tightening water and feed availability, while global uncertainty continues to drive volatility in grain and fertiliser markets.

With little relief in the forecast and international dynamics still shifting, cost pressures are likely to persist through the months ahead.

Madelyn Irvine is a Dairy Australia industry analyst.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K