By Andrew Laming, a director of NZAB with 22 years’ experience in the agribusiness and advisory industry

New Zealand has been through and continues to experience a period of pretty ugly inflation.

It impacted all sectors of our economy but farming felt it more keenly, being exposed to some big increases in wages, fertiliser and fuel.

So what does a “good” milk payout look like now, given the inflationary changes?

We think it is useful to look at graphs showing the difference between inflation- and non-inflation-adjusted payouts over the past 20 years.

This will help farmers making investment decisions and considering hedging their milk prices.

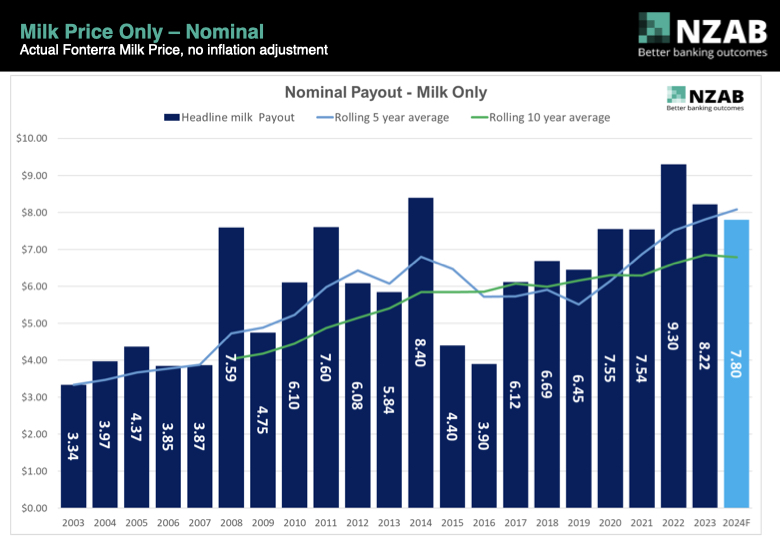

First up is the nominal milk payout from Fonterra, not including dividends, since 2003.

Nominal is just that, being the actual payout that year unadjusted for inflation.

We have added two lines:

• The rolling five-year average in blue, including this year’s current forecast of $7.80, which is currently $8.08.

• The rolling 10-year average in green, currently $6.80.

Both lines are trending up, which is obviously good, and this season’s $7.80 would be the fourth-highest nominal payout of all time.

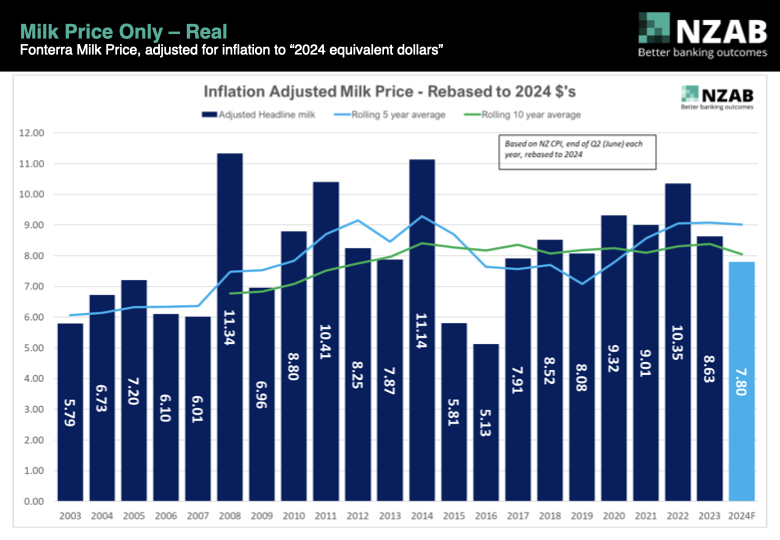

But given we have ongoing inflation, what does it look like historically adjusted for inflation all of the past 20 years of payout?

Look at the next graph, which now expresses each payout year in 2024 dollars, according to CPI inflation. This is where it gets super interesting.

When we line up our current $7.80 against this data, the fourth-best payout drops to 14th place.

And what becomes “average” in these inflation-adjusted payouts?

Including this year, the five-year average is $9.02 (blue line) and the 10-year average is $8.06 (green line) in 2024 dollars.

Another way of putting this: if this year’s payout nudges up to $8, it will be only average for the past 10 years when adjusted for inflation.

But in the context of the past five years, it looks a little underwhelming, being behind by over $1 the average of $9.02.

If we took the inflation-adjusted average over the entire 20 years (all the data), this would be $8.23.

If you decided to ignore the extreme market dynamics caused by increased world milk supply that occurred in 2015/2016, the five-year average has been consistently around $9 in 2024-dollar terms since 2011.

However, if you thought that this volatility was going to be an ongoing feature of the market, then something around $8.25 would be your average.

Either way, we start to get a relatively tight range of $8-$9 that we can start using as “average” for investment and hedging planning.

On this basis alone, the current year of $7.80 would seem to be an underside outlier and where we started the season at $6.75 certainly was.

Furthermore, if an average of $8.50 was put into every dairy farmer’s budget this year, most would be continuing to enjoy a very sound (without being spectacular) rate of return.

And importantly, given the inflation-adjusted average line is level (and in the case of the past five years, increasing), this means that the New Zealand dairy payout is at least keeping track with inflation and arguably moving ahead.

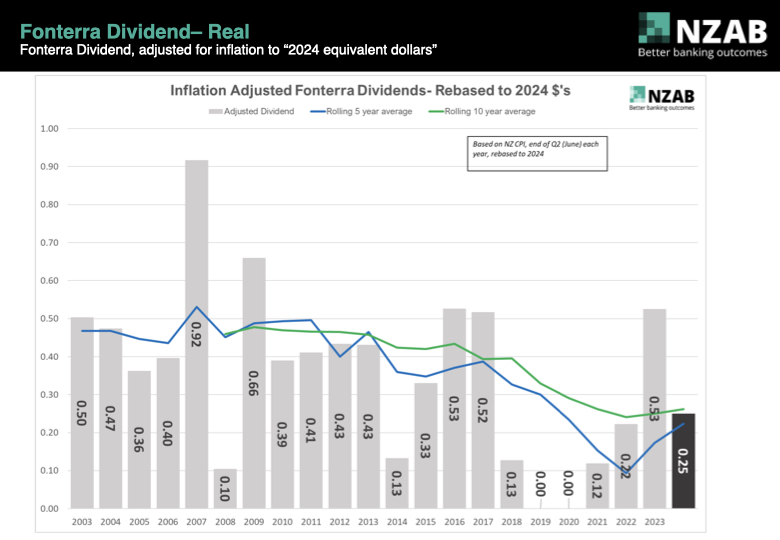

The final graph of inflation-adjusted Fonterra dividends, without milk payouts, shows some interesting rolling averages as well.

Putting the inflation-adjusted dividend together with milk payout, a fully shared Fonterra farmer has received averages of $9.25 over the past five years, $8.32 over the past 10 years and $8.57 over the past 20 years.

So how should we use this information and what are its limitations?

The overall CPI for the NZ economy does not equal the cost inflation for farming.

A better way to examine whether dairy farm returns are tracking with or ahead of inflation is to also take into account farm inflation as well. We will explore this in the future.

However, using some adjustment for inflation is better than not at all, particularly when we have been through some significant step changes in inflation in the past two or three years.

Using nominal data alone has risks. This inflation-adjusted data might help farmers form part of their decision making for what average might look like when assessing their investment strategy or putting in place hedging policy.

At the same time, it’s worth noting that farmers need to assess a multitude of factors beyond just payout when forming their own policies for risk management and investment decisions.

These other factors include debt leverage levels, regional climatic and production volatility, facility headroom and credit availability, balance sheet strength and liquidity, income diversity, shareholder risk appetite and operational leverage.

With significant commercial experience in financing with both bank and non-bank funders and private equity placement. www.nzab.co.nz

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K