The report found Lactilis’ turnover rose to USD26.7 bln in 2021 (an increase of USD4.7 bln or 16.2 per cent on the prior year) and it now sits well clear of second-placed Nestlé, from Switzerland, which recorded turnover of USD21.3 bln during the same period.

Rabobank senior agri analyst Emma Higgins said Lactalis’ double-digit percentage sales growth was driven by the acquisition of the KraftHeinz’s US natural cheese business and Groupe Bel’s Royal Bel Leerdammer, Bel Italia, Bel Deutschland, and Bel Shostka Ukraine, with these purchases adding a combined estimated annual turnover of about USD2.1 bln.

“This acquisition spree has continued into 2022 with the recent purchases of Australian-

based Jalna Dairy Foods and German-based Bayerische Milchindustrie’s (BMI) Fresh Dairy Division,” she said.

Danone (France) climbed to third place on the list (turnover of USD20.9 bln), swapping places with US-based Dairy Farmers of America (USD19.3 bln). Yili (China) remained fifth despite its acquisition of Infant Milk Formula producer Ausnutria which helped increase its 2021 turnover to USD18.2 bln, up from USD13.8 bln the prior year.

Ms Higgins said New Zealand’s Fonterra claimed sixth spot on the list for the third consecutive year with 2021 sales of USD14.8 bln, up by USD1.2 bln on a year earlier.

“During 2021 we saw Fonterra complete the sale of its two wholly-owned China farming hubs. The company’s disposal of DPA Brazil and Soprole, along with potential changes in the Australian-based business, are still pending,” she said.

“Despite the sales of its Chinese hubs, greater China remains an important market for Fonterra – particularly for foodservice sales – as do other countries in the broader Asia Pacific region.

“Fonterra’s annual results for the 2022 financial year will be announced next month.”

High turnover growth for Top 20

The report says the combined 2021 turnover of the Global Dairy Top 20 companies jumped by 9.2 per cent in US dollar terms, following the prior year’s modest decline of 0.1 per cent.

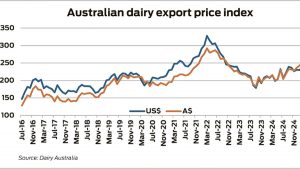

“Supported by the recovery in foodservice channels after the initial Covid pandemic and continued strong retail channel sales, global dairy demand firmed during the course of 2021. And this, combined with lower-than-anticipated milk production growth in the main exporting regions and exceptionally strong Chinese import demand, saw dairy product prices rally to elevated levels,” Ms Higgins said.

While 2021 sales were up, Ms Higgins said that what is designated as dairy is becoming much more blurred.

“Numerous product launches, dairy alternatives from beverages, yogurts, frozen desserts, cheese and hybrid products have become more common in the product portfolio of Top 20 companies, making it more difficult to extract pure dairy revenues.” she said.

GHG targets

The report says more dairy companies are aligning their climate ambitions with the ‘Science Based Targets initiative’ (SBTi) with eight of the Top 20 companies having made a public commitment to (some of) the SBTi targets or have targets that are considered to be aligned by SBTi.

“We expect this number to grow in the near term as evaluation and target setting is still underway. As such, dairy companies are also moving from just acknowledging their climate and sustainability ambitions for 2050, towards setting the targets in that direction,” Ms Higgins said.