Indicative offers for the $500 million-odd Lion Dairy and Drinks – which makes and sells milk-based drinks, yoghurts and juices – landed on Lion and adviser Deutsche Bank’s desk a fortnight ago and the race has entered its final furlong.

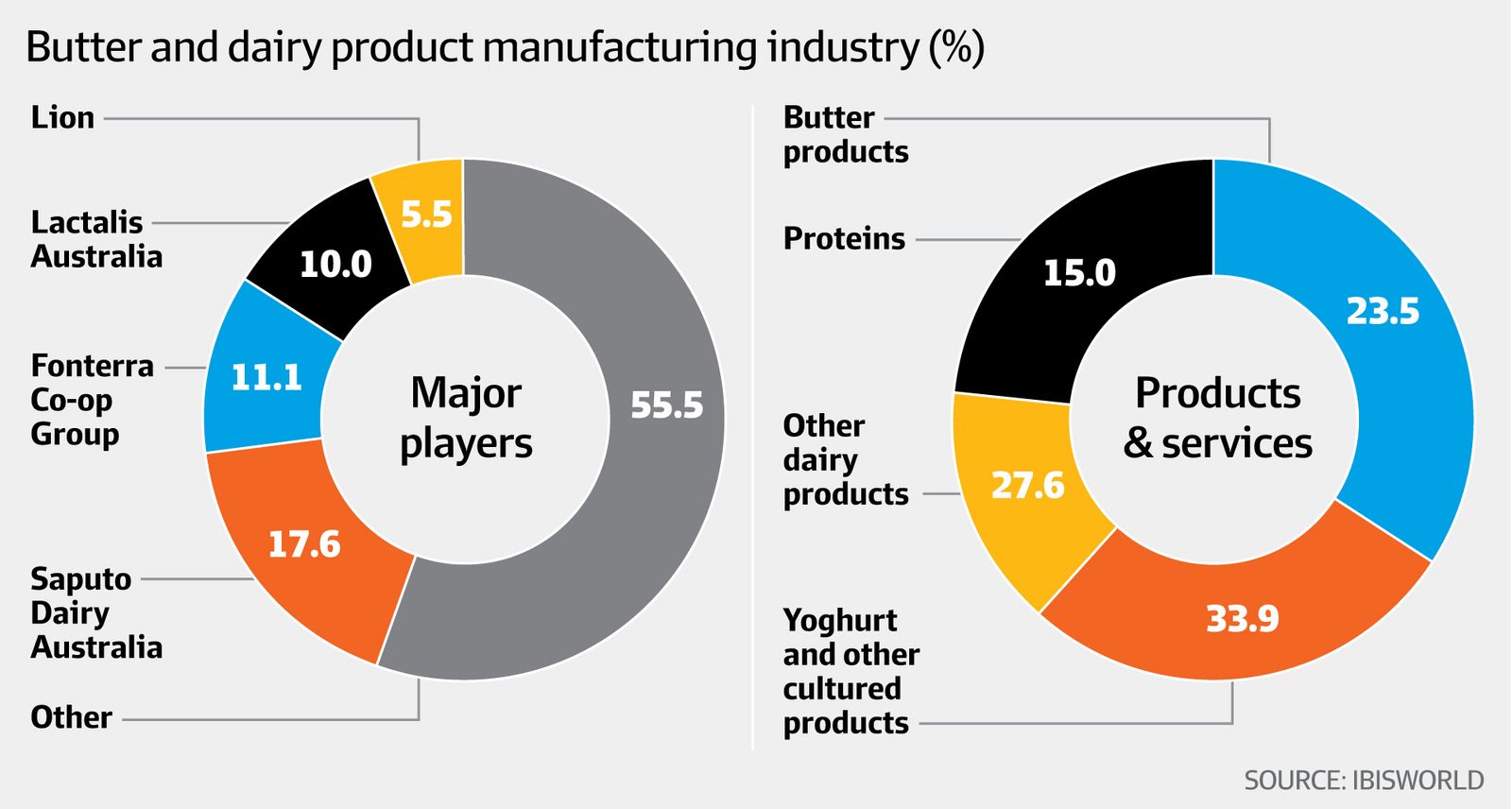

There was no clearer sign that we’re down to the short strokes than when the competition regulator launched a market inquiry into Canadian dairy company Saputo’s proposed acquisition of Lion late on Tuesday.

However, that doesn’t mean the Canadian player is the only party still left in the race.

ASX-listed Bega Cheese is understood to have also lobbed a bid and while the ACCC might not have launched an investigation into its offer just yet, you’d have to think it’d be asking questions.

Bega, which calls itself “The Great Australian Food Company”, is one of the most logical acquirers for the division and if its pursuit was to turn into a signed deal, Bega shareholders would quickly turn to their attention to one thing: how to fund it.

Bell Potter analysts put forward their two cents on Tuesday. They said if Bega paid a similar price to what China Mengniu Dairy agreed last year and equity funded it in full, then it would be “slightly dilutive” to its fiscal 2021 earnings per share.

Obviously, that wouldn’t be ideal for the ASX-listed Bega, particularly when launching an equity raising. That means Bega would either need a lower price, a whiz-bang financing structure or a strong improvement in the Lion unit’s earnings, to make it an easier sell to investors.

Bell Potter’s voice is worth listening to given it’s arguably the broker that covers Bega the closest and is normally the first port of call when Bega pulls the trigger on these types of equity raisings.

China Mengniu agreed to pay $600 million for the business last year, but the offer was scuttled by Treasurer Josh Frydenberg on national interest grounds.

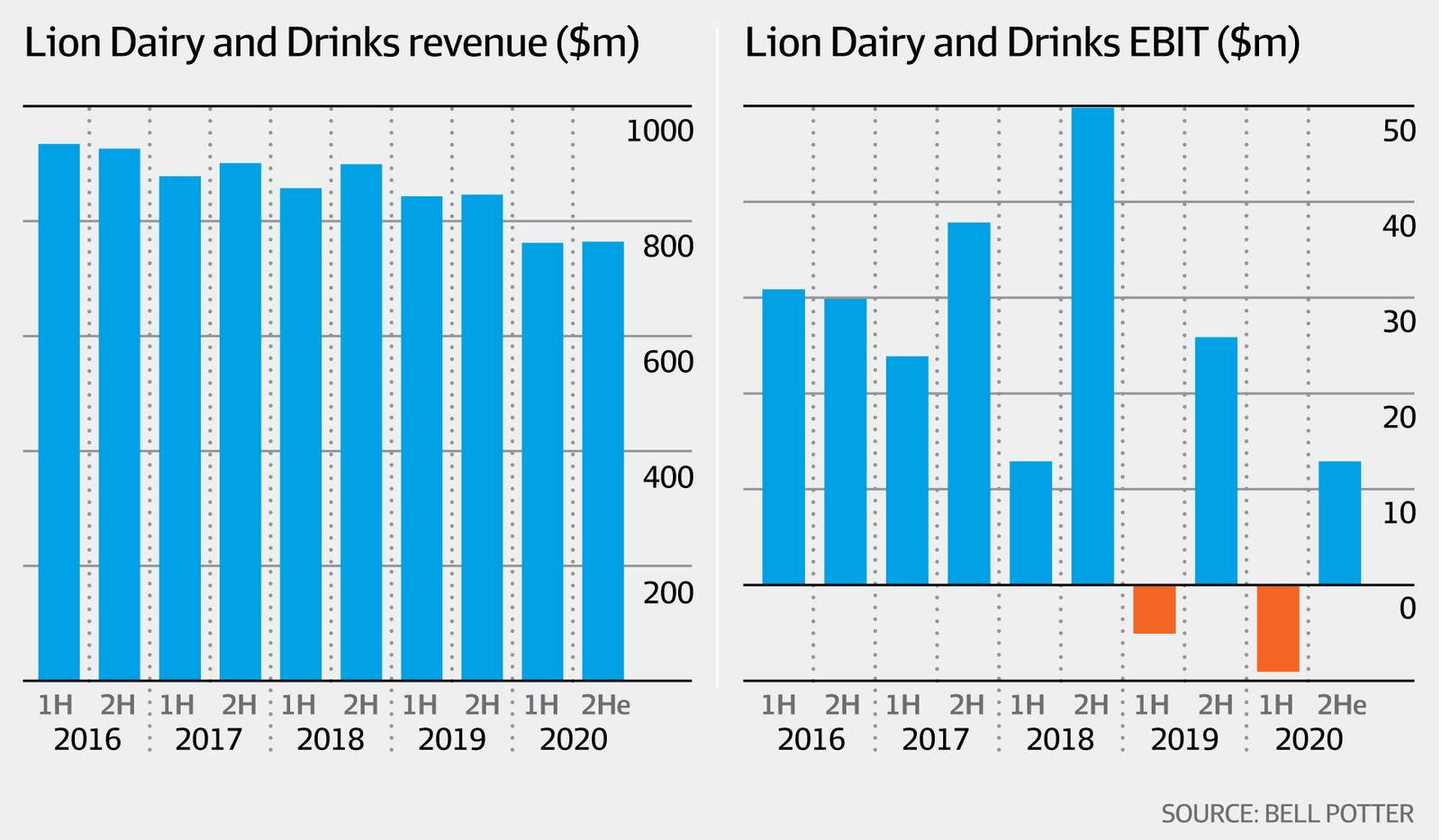

Bell Potter said Lion Dairy recorded a $9 million earnings before interest and tax loss in the six months to June 2020 and forecast $13 million EBIT for the second half of this year.

The company’s earnings are typically skewed to the December half, but this year’s numbers look set to fall below Lion-owner Kirin’s $25 million earnings expectations for 2020.

“The key to a successful acquisition of Lion Dairy is the extent to which the CY20 performance is reflective of COVID-19 headwinds as opposed to company-specific issues,” Bell Potter said.

“Assuming a $25 million underlying EBIT base, then an equity funded acquisition of the Lion Dairy and Drinks business by Bega would be slightly dilutive on FY21e EPS prior to any synergy extraction.”