The eroding health of the overall farm economy was the emphasis of the latest Ag Economists’ Monthly Monitor, which is a survey of nearly 70 leading agricultural economists from across the country.

A sharp drop in net farm income among row crop farmers has held a hefty grip on the ag economy this year. 2025 isn’t forecast to be much better, with margins expected to be in the red again for all major row crops. The high input and high interest rate environment, coupled with low commodity prices, is a recipe that could also mean more consolidation in agriculture in 2025.

The eroding health of the overall farm economy was the emphasis of the latest Farm Journal Ag Economists’ Monthly Monitor, which is a survey of nearly 70 leading agricultural economists from across the country.

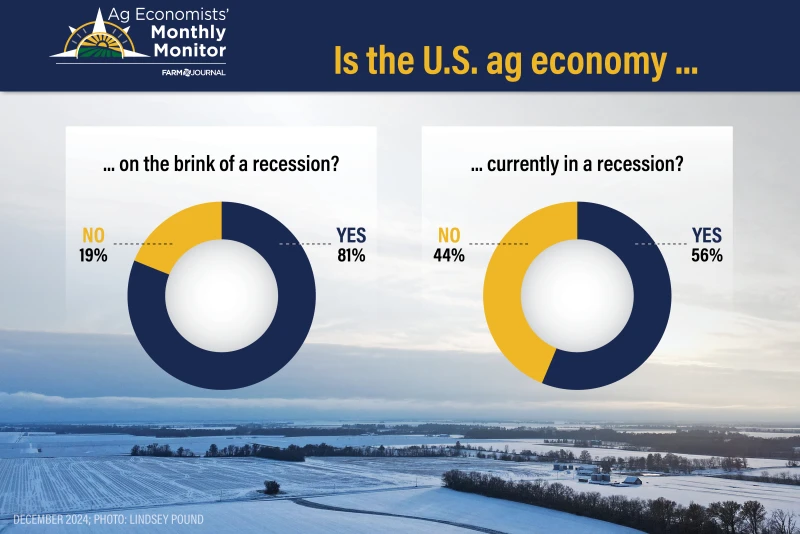

When asked if agriculture is either currently in a recession or on the brink of one:

- 56% of ag economists responded by saying agriculture is currently in a recession, which is up from the 53% who responded that way in October.

- And 81% of economists surveyed said the U.S ag economy is on the brink of a recession, which is a significant jump from the 56% of economists who responded that way in the October survey.

One of the main reasons more economists didn’t respond that ag is already in a recession, is the fact the livestock sector is doing better than expected at the beginning of the year.

Farm Journal asked economists to weigh in on whether they thought agriculture is currently in a recession. Economists in the anonymous survey said:

- “A recession is a sustained period of economic decline. We may not be able to say the entire agriculture sector is in recession, but the row crop sector has been in economic decline since 2022 and looks like that will continue into 2025.”

- “I would argue we are largely already there…incomes have already fallen…used machinery values have fallen…but there is room for more decline from the livestock sector should those prices turn lower. Land values holding up are probably the one thing in my opinion that has yet to give, and that MAY only be a matter of time. “

- “Farm income has already dropped considerably from the 2022 peak, and the crop sector is seriously affected. There are many downside risks in 2025 that could make a difficult situation worse.”

- “I believe we are already in a recession. Farm income is and has been declining, and I don’t see a reversal of this in the next 12 to 24 months given policy uncertainty, surplus inventories, large ex-U.S. production, and likely declines in export viability.”

- “Higher interest rates are making it hard to manage debt that is outstanding and likely to come with next year.”

- “Some producers have not built an adequate asset base to weather these low returns and will be forced to change their business in an attempt to survive.”

- “Negative profit margins relative to recent years are driving capital investment and land prices lower, reducing the financial position of agriculture amid lower income.”

- “Specifically for the row crop sector, we are looking at another year of negative returns and that really wears on liquidity and puts pressure on longer term solvency.”

- “Prices are too low to pay input costs and create a profit. At the moment, producers are fighting to break even.”

However, not all economists agree agriculture is in a recession. One economist points to land prices as the reason why.

“It is hard to say that agriculture is facing a recession when land prices are holding the way they are,” said one economist in the anonymous survey. “It appears that (many) full-time, commercial-scale row crop producers have used their working capital on recent land purchases and have nothing left to withstand a financial shortfall. Frankly, the current conversation about passing economic relief will go to those that have overextended their means to buy land the last couple years.”

Concerns About Consolidation

Another year of negative margins could create more consolidation in the row crop sector, according to economists. The latest Ag Economists’ Monthly Monitor found 94% of economists think the current environment of low commodity prices and high input costs will accelerate consolidation in row crop operations and allied industries .

- “Some farms are expanding while others are leaving the industry. It is interesting to compare the percentage of U.S. businesses that go broke in the first 10 years to the percentage of U.S. farms that go broke in the first 10 years. The role of government intervention has really limited the realized risk in agriculture and, as a result, lowered the ability for young producers and ranchers to get into agriculture and increased the consolidation of land.”

- “A sustained period of high costs and low prices will likely result in some farmers going out of business sooner than expected, which may be due to point of financial need or stopping by choice ahead of that. When farm consolidation is accelerated, there are fewer farmers buying inputs. Even if the acres are the same, fewer input retailer are needed to serve the customer base. Also, we have greater pressure on the whole industry as big farmers grow.”

- “Low-cost producers, and those without any land rents or borrowing costs, are better equipped to weather a downturn in the farm economy.”

- “Average margins are typically higher for larger farms. They also have more ability to borrow money.”

- “The only way to survive is to increase quantity (number of bushels) and low margins.”

- “Those who have managed well, kept production costs low, and have responsible cash balances should be in a good position to expand, absorbing those who made poor choices or experienced bad luck. Lending and federal disaster payments could delay this some. So, the magnitude of this is uncertain.”

- “People will always be entering and leaving the industry, but when returns are low, more people leave because they have to, rather than because they want to.”

- “The last time we were at the start of a commodity down cycle in 2014/15, it presaged a wave of consolidation in input developers over the next several years, such as Bayer/Monsanto; Dow/Dupont; ChemChina/Syngenta; Mosaic/Potash.”

- “Operations and allied industries will expand to find additional economies of scale, one of the few options on the table to help with the tough financial situation.”

What to Watch in the Ag Economy in 2025

The health of the farm economy into the new year relies on a number of factors. What happens in South America with crop production will have a major impact on commodity prices in the U.S. However, economists said there are other factors to watch, including what happens with the incoming Trump administration.

When asked, “What are the two most important factors driving agriculture’s economic health today as well as in12 months,” economists said:

- “South American production and input costs.”

- “Farm financial conditions: there’s been a little price improvement recently, but still high costs mean 2025 is likely another year of negative margins for row crop producers. 2. Relative global competitiveness: We continue to see cropland area expansion in Brazil and, at the same time, they have a more favorable biofuels policy and are expanding trade agreements.”

- “Congressional efforts to deliver economic and natural disaster aid, and U.S. agricultural export markets.”

- “Declining commodity prices and associated margin squeeze.”

- “As a sector as a whole, the livestock sector returns are important to the overall health in the short run. In 12 months, how the markets adjust (input prices, crop prices, and cash management/debt levels).”

- “Demand side: uncertainty about renewable energy policy and potential international market loss through trade disputes. Production side: outlook for labor availability, given political rhetoric. Overall margin compression on lower commodity prices (likely larger Brazilian production forthcoming) and sustained high interest rates.”

- “If 2018 is any indication, in 12 months we are likely to see adverse effects of tariffs, as well as immigration policy changes.”

Future of the Farm Bill

The Ag Economists’ Monthly Monitor also asked economists to weigh in on when they think Congress will pass a new farm bill, as well as if Congress votes on an extension this year, is it necessary to raise reference prices for producers.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K