This created a very muted market, with the market bearish on prices. There were five negative GDT auctions from June onwards; but in the world of dairy, it doesn’t take much news to create a fluster. This fluster really took off when the global dairy market realised that milk production would not be supported in the short term by high milk prices.

Globally, buyers in overseas markets had a very strong belief that a high forecast farmgate milk price in NZ would create a mad rush to increase milk production at any cost, as has been seen in the past. However, as we keep lamenting to these same buyers, it’s not really that simple at this time of the year.

Weather has the biggest call on what will happen to milk production, something that observers of NZ’s production system don’t easily understand. Our key production trait, pasture based milk production, also creates a black hole of knowledge for those outside of our systems.

A real knowledge gap is created, as the world watches one aspect of our weather and tries to paint it across the entire season. The perfect example of this is soil moisture. High soil moisture is a dream in summer, what more could you want! So it becomes a positive measure. However, that same measure in winter is a curse.

Weather has the biggest call on what will happen to milk production, something that observers of NZ’s production system don’t easily understand.

No one in their right mind likes mud, especially not when you want to grow grass in the place that the mud has appeared. So a positive soil moisture figure in winter is a negative, most of the time. However, often international dairy buyers see this positive figure and jump to the conclusion that grass will grow, there is enough moisture, creating a muted market, as milk production struggles through wet and cold spring conditions, as we’ve seen this year. However, when the truth is printed by DCANZ, that the high soil moisture figure has negatively impacted milk production due to lower pasture production and efficacy of pasture harvest, these same buyers react sharply.

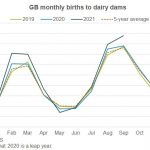

This creates what we have seen over the last two months. Shock and awe at a negative milk production growth figure for August 2021, and the expectation of both September and October delivering a negative number also. All of this results in dairy commodity prices being pushed higher as the potential sparsity of production becomes apparent.

An unintended consequence of this mad flip in buyers’ mentality, is milk price forecasts leaping around like crazy. We’ve seen milk price forecasts lowered during early spring, before exploding following the recent GDT events. Our own NZX farm gate milk price forecasts have followed the same trajectory, however, we remain firm in the belief that it’s too early to count all the chickens and are very cautionary when we make these forecast figures public. As a farmer, this sort of posturing of inflated milk price forecasts doesn’t help with budgeting and doesn’t help with the mindset if things move the other way.

As we’ve seen at the start of this season, the global dairy industry is a fast-moving game, and our local industry is fully exposed to this game. So, don’t count your chickens just yet, there is a lot of the season ahead of us all.

If we look back to soil moistures as a key indicator of production, it looks like milk production through late spring and summer will be better than last season; what effect will that have on commodity prices do you think?