Cheese prices have been up and down since September, but higher cheese prices have more than offset lower dry whey prices. Dry whey prices which were $0.3975 per pound mid-September are now $0.2865.

On the CME cheddar barrels were a low of $1.6125 per pound on September 26, reached $2.025 on October 15, the first time at $2.00 since 2014, and are now $2.105. The price of 40-pound cheddar blocks reached $2 per pound on September 9, also the first time since 2014, but fell below $2 by September 24. Prices didn’t reach $2 again until October 8, only to fall again below $2.00 on October 17 to $1.9675 with a rally on October 22 to $2.1025.

The cheese market perhaps is a little more settled now with the spread between barrels and blocks more than $0.30 per pound during parts of September and are now closer together.

Higher nonfat dry milk prices have more than offset lower butter prices to increase the Class IV price. CME butter prices have been averaging lower in October than in September.

October butter was as high as $2.185 per pound and is now $2.09. The nonfat dry milk price which started September at $1.475 per pound increased steadily since to now $1.165. The Class IV price which was at a yearly low in January at $15.48 was $16.35 in September and will be near $16.45 in October.

Continued small increases in milk production, favorable butter and cheese sales, dairy exports doing better than predicted with the ongoing trade war with China, and tighter stock levels have all supported higher dairy product prices and higher Class III and Class IV prices.

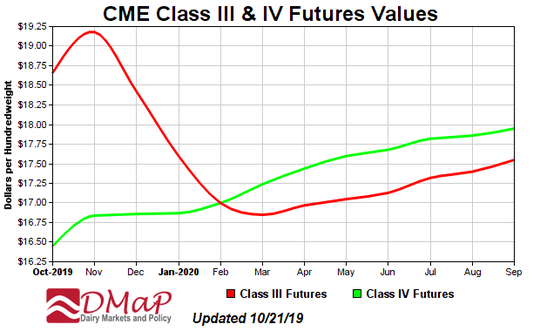

We can expect some further price strengthening for November before some drop off for December. For the year, the Class III price could average around $16.75 compared to $14.65 last year and the Class IV price around $16.30 compared to $14.65 last year.

Milk production

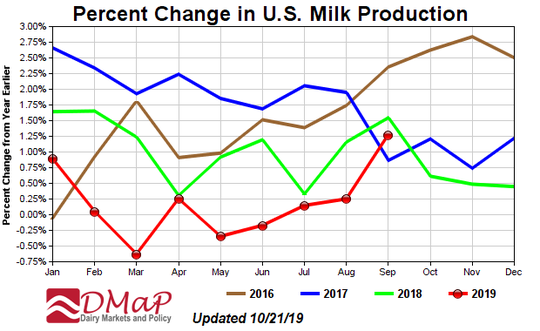

USDA’s estimated milk production for September is forecast at 1.3% higher than a year ago due to higher milk production per cow. Milk production per cow was 1.8% higher than a year ago with milk cow numbers down 0.6%. Relatively strong increases in milk production across the country occurred in Texas at 9.3%, Colorado at 5.6%, South Dakota at 5.4%, Michigan at 3.8% and Idaho at 3.6%.

Milk production was 1.6% in California, 2.0% in New Mexico, 1.7% in New York, and just 0.6% in Wisconsin. Milk production fell by 7.3% in Virginia, 4.9% in Arizona and 3.8% in Pennsylvania.

Exports and stocks

Compared to August 2018, exports were down 18% for nonfat dry milk, 55% for butterfat, 21% for dry whey and 6% for cheese. Cheese exports year-to-date were still 2% higher than a year ago.

Lower dairy exports to China, Japan and Oceania have been partially offset with higher exports to Southeast Asia, South Korea and South America. On a total milk solids basis, January through August exports were still 14.1% of milk production, but down from 16.5% a year ago.

Compared to a year ago, September 30 stocks of American cheese were 4.0% lower, total cheese 0.8% lower, but butter was 7.0% higher. August 31 stocks of dry whey and nonfat dry milk were down 1.8% and 3.8% respectively.

Milk price forecast

Market indicators are for milk prices to average higher in 2020. Milk prices below the cost of production all of 2015 through the first half of 2019 placed a lot of financial stress on dairy producers and resulted in a loss of equity. This will keep the increase in 2020 milk production to a modest level.

A build back of lost equity will be needed before we see dairy producers responding to higher milk prices. We will likely see no or little increase in the average number of milk cows. July 1 dairy replacement numbers were 2.4% lower than a year ago. With higher milk prices some dairy producers may find lower producing cows still profitable and keep them in the herd longer.

With a wet spring, summer and fall which delayed corn planting and made harvesting quality forages a challenge will likely dampened increases in milk per cow. USDA is forecasting a slight increase in the average number of milk cows at 0.1% and a 1.43% increase in mill per cow resulting in a 1.56% increase in total milk production.

Barring a recession, domestic butter and cheese sales will be positive for milk prices. Dairy exports could be a little higher in 2020.

A summer drought in parts of Western Europe and compliance to environmental issues is keeping the increase in milk production well below 1%. Milk production in both Argentina and Australia is running almost 6% lower due to weather issues. Milk production is running a little higher in New Zealand.

Overall it looks like world milk production will be up less than 1% resulting in higher world dairy product prices. Excluding a world recession that dampens world demand, this should open opportunities for U.S. dairy exports. USDA is forecasting U.S. exports to be up 3.3% on a milk fat basis and 6.5% on a skim solids basis.

As of now I could see the Class III price averaging in the strong $17’s for the first half of the year and the strong $18’s in the second half with an average for the year around $17.85, more than a dollar higher than 2019. With anticipated stronger nonfat dry milk prices, the Class IV price could average around $17.10, about $0.65 higher than 2019.

USDA’s forecast is not quite as optimistic with Class III averaging just $0.65 higher and Class IV $0.10 lower. But, all forecasts will no doubt be modified as we move through the year and see what actually is developing. Nevertheless, 2020 should be a better year than 2019.

*Cropp is Professor Emeritus of the University of Wisconsin Cooperative Extension, University of Wisconsin-Madison