Southern Australia’s minimum milk prices for the season are solid with a new quarterly report forecasting production will continue to expand across the nation’s dairy exporting regions.

Rabobank’s report Waiting for the Dust to Settle, released today, said recovery in milk production was gathering pace in the southern Australia export pool, up 6.7 per cent in April year-on-year.

“Favourable seasonal conditions will support milk production growth into the 2020/21 season,” Rabobank senior dairy analyst Michael Harvey said.

He said the report forecast national production would be back above nine billion litres signalling a return to growth in the exportable surplus from quarter two in 2020 for the first time since 2018.

But Harvey warned while the industry was on the path toward recovery, “we are not out of the woods”.

It is promising news for the more than 250 diary farms in the state after the South Australian Dairyfarmers’ Association recently introduced an industry-first plan for unique ‘grass to glass’ branding as it builds a premium, boutique trademark around the globe.

A minimum price announcement for dairy farmers for the season in Southern Australia was modelled at $6.35 per kg milk solids.

The news follows Beston Global Food Company recently announcing it had signed an agreement to sell its four dairy farms in Mount Gambier to Aurora Dairies for $40.4 million.

Under the sale terms subject to Foreign Investment Board Review approval, Beston would receive all milk from the farms – currently around 17 million litres per year – over a 10-year period.

Aurora was also expected to grow production at the farms in the future.

Beston chairman Dr Roger Sexton said funds from the sale would be used to expand Beston Global Food Company’s cheese production facilities at Murray Bridge and Jervois in South Australia.

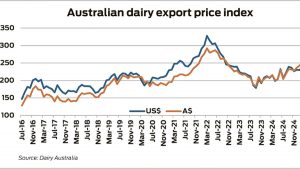

The Rabobank report is revising up milk price forecasts for Australia and New Zealand.

However, Harvey said while the northern hemisphere recently experienced a rebound in milk and dairy product prices, it maybe too soon to call a true dairy market recovery.

“We are on the path to recovery, but we are not out of the woods,” he said, adding that as the world emerged from COVID-19 lockdowns into economic recession, slower growth would weigh down dairy demand.

The report forecasts a one per cent year-on-year increase nationally in production across the Big Seven dairy regions of the United States, European Union, Brazil, Argentina, Uruguay, New Zealand and Australia.

South Australia’s four main dairying regions are the South East, the River and Lakes region, Fleurieu Peninsula and the Barossa Mid North .

SA Dairy Association figures show dairy is now Australia’s third largest agricultural industry, with South Australia producing nearly 10 per cent of national production.