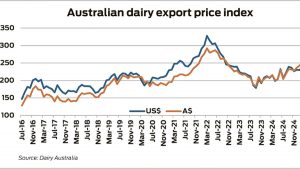

NAB’s dairy export price index has risen 10.2 per cent since December, the biggest monthly gain since 2016.

The index is based on the weighted prices of an Australian mix of dairy products converted from US dollars to Australian dollars.

But while it might seem a huge boost for the dairy industry, NAB senior agribusiness economist Phin Ziebell said it must be tempered by the fact lower dairy commodity prices persisted for much of 2018.

Year on year, the export dairy price index rose 13 per cent.

But a major contributing factor was a much lower exchange rate.

A year ago, the Australian dollar was trading at 80 US cents.

Mr Ziebell said dairy farmers would not necessarily see the rise in the export price index relating back to their farm.

“That’s because half of what we produce goes into the domestic market but also because dairy farmers get paid on a seasonal basis,” he said.

Mr Ziebell said Saputo and Fonterra had announced step-ups which took their seasonal prices to nearly $6 a kg milk solids and some other companies might be paying more than that.

“That’s not a bad price,” he said.

“The thing that has made it really tough are the input costs.

“They are much higher than they have been previously.

“If you were a dairy farmer, what you would be focused on over the next six months is what happens to grain prices, what happens to water prices, what happens to fertiliser prices.

“And let’s see what happens to fuel prices.”

NAB’s feed grain price index rose 74 per cent during 2018 and the bank expects prices to remain elevated in coming months.

The bank’s fertiliser index finished 2018 32 per cent higher, year on year, while the bright light was lower petrol prices since last November’s peak — falling 24 per cent.

Mr Ziebell said he did not expect global dairy prices to lift in US dollar terms in the short term.

He said some of the recent rise was due to the European Union reducing its skim milk powder stockpile.

“I am not expecting a big increase in export prices,” he said.