As global populations continue to rise, with projections estimating a staggering 10 billion people by 2050, farmers worldwide are faced with an immense challenge: ensuring food security for all. This pivotal issue was the focus of discussions at the International Dairy Federation (IDF) World Dairy Summit in Paris, France, where industry experts gathered to share insights and explore solutions.

South America

Marcelo Carvalho, CEO of MilkPoint Ventures in Brazil, shared insights into the transformative landscape of milk production in South America. Brazil, a significant player in the region, contributes over half of South America’s milk supply.

Carvalho highlighted the growth in South American dairy farming over the past decade. In 2010, 60% of farms were producing just 27% of the milk supply. Fast forward to 2023, and we see a shift where 48% of farms are responsible for 13% of the milk supply. Interestingly, a small percentage of farms, those producing more than 10,000 liters a day, now account for a third of the milk supply.

A major hurdle for dairy farmers in the region is the intense climate variability. Extreme weather events, such as the La Niña and El Niño phenomena, alongside severe floods in Brazil this year, pose formidable challenges to farmers striving to maintain stable production rates.

Despite the varied sizes of farms across the continent, there is a notable trend towards larger consolidated farming operations. However, the average farm size remains relatively small, with an average daily production of just 437 liters.

North America

In examining global production growth trends since 2000, Dr. Andrew Novakovic, a professor at Cornell University, shared that North America stands out with a 1.02% per capita production growth. This figure positions the continent as second only to Asia’s impressive 1.95% growth rate and markedly ahead of Africa, at -0.02%, and Oceania, at -3.90%.

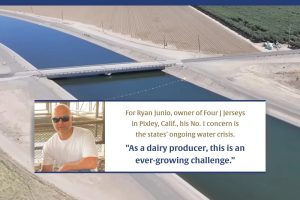

Novakovic highlights that the effects of climate challenges may particularly influence growing conditions throughout North America. In Canada, climates will shift as warmer weather patterns move north and west, potentially favoring agricultural production from the Maritimes to Manitoba. Meanwhile, in the U.S., regions will experience their transformations. The southeastern U.S., known for its hotter summer climates, will see these conditions shifting closer to the Great Lakes. Similarly, California’s Central Valley, famous for its Mediterranean climate, may witness such weather patterns moving toward the Pacific Northwest.

Despite these shifts, Novakovic suggests that North America’s dairy production might enjoy certain advantages. The region’s ample rainfall is expected to continue providing benefits, particularly in the eastern half of the U.S. and Canada.

Australia and New Zealand

Australia and New Zealand have experienced divergent, however, similarities in their outlooks, as shared by Joanne Bills, Global Insights Director with Ever.Ag Insights.

Bills noted a few key similarities between the two countries:

- Stabilized Milk Production: Both countries focus on higher-value dairy products.

- Increased Cheese Production: Australia emphasizes domestic consumption, while New Zealand and Australia both concentrate on exports.

- Strong Trade Linkages: Australia’s import opportunities are increasing, reinforcing trade connections.

The impact of climate change on the dairy industries of Australia and New Zealand is significant.

- GHG Reduction: New Zealand farmers have the skills and infrastructure to respond to commercial drivers for greenhouse gas reduction.

- Policy and Community Pressures in New Zealand: There’s a potential overreaction to policy changes, with strong community pressures remaining.

- Australia’s Climate Challenges: Although there’s limited government pressure for change, Australia faces severe climate impacts.

Water policy is a critical issue for dairy producers on both sides of the Tasman Sea:

- New Zealand: Restrictions on winter grazing impact production.

- Australia: Water scarcity has decreased water availability for dairying in irrigation regions.

European Union

Milica Kocic, Lead Product Development for IFCN Ag, spoke on the shrinking raw milk pool and sustainability constraints facing Europe.

Kocic shares that farm prices in 2022 were profitable, but this comes after multiple years of negative profit. Farmers in Europe are battling for land, with more competition and rising costs. She points out that old farming practices, low efficiencies, and quality issues will force dairies out of business.

Kocic points out that farms with less than 100 dairy cows in countries like Germany are more likely to go out business. While farms with more than 100 cows are not expanding, noting that uncertainty in future policy and regulations plays a factor in farms not growing. The takeaway: policy solutions must be cost-effective to farmers.

Africa

With a varied landscape encompassing 54 countries, Africa’s milk production was estimated at 50 million tons in 2022, a figure representing 5% of global milk production. Despite its potential, the industry faces numerous challenges, as acknowledged by Bio Goura Soule, PAOLOA Coordinator.

As of 2021, Africa’s dairy imports stood at an estimated 5 billion U.S. dollars, reflecting the growing demand across the continent. Production is primarily dominated by two regions: East and North Africa.

Goura Soule highlights significant challenges and constraints impeding the progress of the dairy industry in Africa:

- Low Productivity: Predominantly pastoral in nature, dairy cow productivity is notably low in specific regions.

- High Costs: The escalating costs of animal feed and healthcare add to the financial burdens faced by dairy producers across the continent.

- Collection Difficulties: High atomicity in the supply of local milk, paired with inadequate infrastructure, poses significant collection challenges.

- Impact of Imports: Exported powdered milk presents perverse effects, often hindering investments in the early links of the value chain, such as milk collection.

- Insufficient Investment: Numerous countries display low or insufficient investment levels in the dairy sector, stifling growth and development.

Efforts driven by the Economic Community of West African States (ECOWAS) aim to address these issues, targeting to double milk production by 2030. Such initiatives hold potential to transform the sector, benefiting producers and consumers alike.

Asia

Li YiFan, Head of Dairy in Asia, points out that China’s raw milk production increased significantly in the past five years. YiFan shares China’s dairy industry revitalization plan that they plan to achieve by 2025:

· Raw milk production: 41 million mt.

· Further reduce feed cost.

· Large-scale farming, >75% farms more than 100 cows.

· Yield per cow: 9mt/year

· Improve cattle breeding capacity

· Support dairy enterprises to build their own farms

· Integration of Dairy farming and processing

Consolidation continues to occur with government support focused on large-scale farming in Asia. However, heat stress is a major constraint impacting dairy in Southeast Asia. Key challenges in that region include market competition, as importing dairy products are cheaper and makes it difficult for local producers to compete against price and quality. Furthermore, local consumers generally prefer imported dairy products.

With the increase in the efficiency of large-scale farming and the integration of dairy farming and processing, China has basically achieved self-sufficiency. Southeast Asia’s hot and humid weather and overly fragmented markets are major constraints to achieving self-sufficiency. Import dependence may be reduced in the future, but self-sufficiency will be difficult to achieve.

India

Sudha Narayana, an associate professor who has written about the history of Indian dairy, highlighted the significant role women play in India’s animal rearing industry, accounting for a substantial 60% of the days spent on this activity. India, renowned for its vast bovine population—which numbers a staggering 300 million and represents 13% of the global count—also boasts 57% of the world’s buffalo population.

Despite the country’s diverse regions, there is a notable upward trend in the number of crossbred cattle, alongside a burgeoning commercialization of the dairy sector. This shift is partly attributed to a continuous decline in the use of draught animals, prompting farmers and industry players to seek more productive alternatives.

Narayana also addressed a significant cultural aspiration within India—a widespread desire for a healthy diet. Yet, this aspiration is often thwarted by economic barriers. More than half of the population finds such a diet financially out of reach, a situation exacerbated by rising milk prices. The cost increase is largely driven by heightened production expenses within the country, thus placing a healthy diet further beyond the grasp of many.

The global dairy industry stands at a crossroads, faced with both daunting challenges and promising opportunities. From climate variability and market competition to policy changes and economic barriers, regions across the globe are navigating under a complex set of circumstances. Collaborative efforts will be vital in securing a sustainable and prosperous future for global dairy production.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K