Bill Smith was only notified in August that his farm loan matured last March, leading to problems.

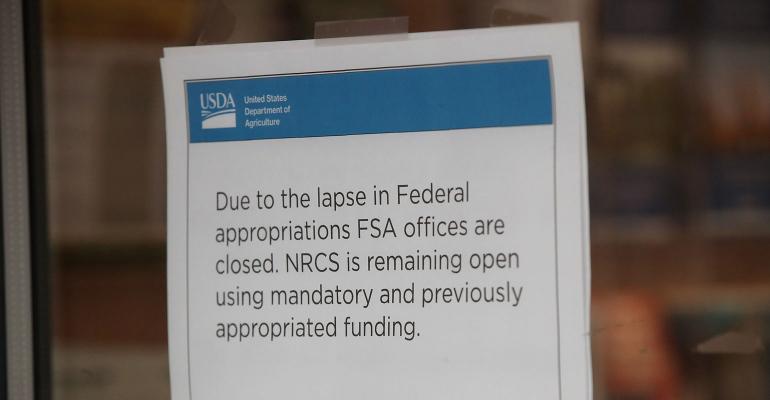

The impact of the government shutdown is real for Reynoldsville, Pa., dairy farmer Bill Smith.

He was having problems with his local USDA Farm Service Agency long before the shutdown, but his situation has gotten worse since the shutdown began.

Smith is the fifth generation on his dairy farm, which is located along Interstate 80. He has a milking herd of 120 registered Holsteins and prides himself in showing cattle, including winners at the All-American Dairy Show in Harrisburg, Pa.

In August, when Smith realized that his Margin Protection Program payment had not arrived, he called his local Farm Service Agency office. He learned, to his dismay, that he was delinquent on his FSA loan.

“How could I be delinquent?” he said in a recent phone interview. “They take their money out of my milk check before I even get it.”

According to the records, he was delinquent, and FSA stopped his MPP payment. In March 2010, the Smith family dairy applied for and received a loan that had to be paid back over the next seven years. This helped Smith during a difficult time with low milk prices.

Fast forward to March 2018. The loan matured, and Smith did not apply for a new loan. He says FSA did not contact him to let him know that the loan was about to come due.

“I didn’t get a letter or an email or anything,” he says.

Since that time, FSA reorganized, and Smith’s file was moved to a new loan officer in another office about an hour and a half away from his farm. He says the staff in this new office has not been as responsive, which has caused him stress as he only learned in August that his loan matured in March and that he was about to lose his farm.

When he asked why FSA had not contacted him before the loan came due, Smith says he was told that the office could not show partiality by notifying him.