Investments in capacity need to process enough product to run efficiently.

Increasingly one of the big questions facing the dairy processing industry in 2024 is where they will get enough milk to run their operation efficiently.

Following the ending of quota restrictions almost a decade ago, farmers reacted by increasing milk production, with processors following suit with investments in capacity. For years that relationship worked perfectly as all the milk delivered found a home in the industry.

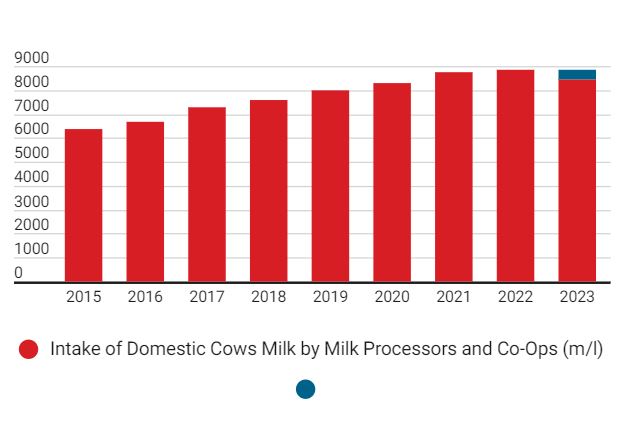

However, the tide has now firmly turned on that expansion, with milk supplies down more than 350m litres in 2023 and, if current trends continue, on track to be down even more than that this year.

There are indications that total milk supplied could fall below 8bn litres this year for the first time since 2019.

On the capacity side, the recent addition of Tirlán’s new 500m litre cheese plant will only further increase competition for milk supply.

Milk pool

If we add the numbers up, we can say there is possibly 800m litres less milk in Ireland’s milk pool this year compared to 2022 and 500m litres more capacity – just from that one Tirlán plant. For the industry that would mean a net reduction in capacity needs when compared to 2022 of 1.3bn litres.

To put that number in scale, in 2022 total processing at three co-ops, Aurivo, Arrabawn and Tipperary was a combined 1.3bn litres of milk.

That is a lot of capacity that may not be needed this year.

To be clear, the reduction in milk supply will be felt across the industry, so rather than the problem falling on any particular processor, it will be felt across all of them.

This means that they will, if nothing else changes, all be running at reduced capacity, reduced efficiency, and ultimately, reduced profitability.

Right now, it is unlikely that the problems will become existential for any of those processors, but if there are further drops in supply – for example through a loss or cut of nitrates derogation – then any co-op without a large piggybank or other assets to rely on will find themselves in serious trouble.

Interestingly, when it comes to piggybanks, it is Tirlán, Ireland’s largest processor, which also has the largest rainy-day fund. Tirlán owns over 75m ordinary shares of Glanbia plc.

So far during 2024 as the dairy market continues to struggle, shares in Glanbia have gone the other way, increasing by 20% to trade around €18 each. This means that Tirlán’s stake is currently valued at around €1.35bn.

To paraphase Homer Simpson, Tirlán (through the expansion of its cheese business) is both the cause of, and (through its Glanbia’s shares) the solution to its own problems.

For many other processors, their future will be more reliant on fair weather and favourable environmental decisions, and improving markets.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K