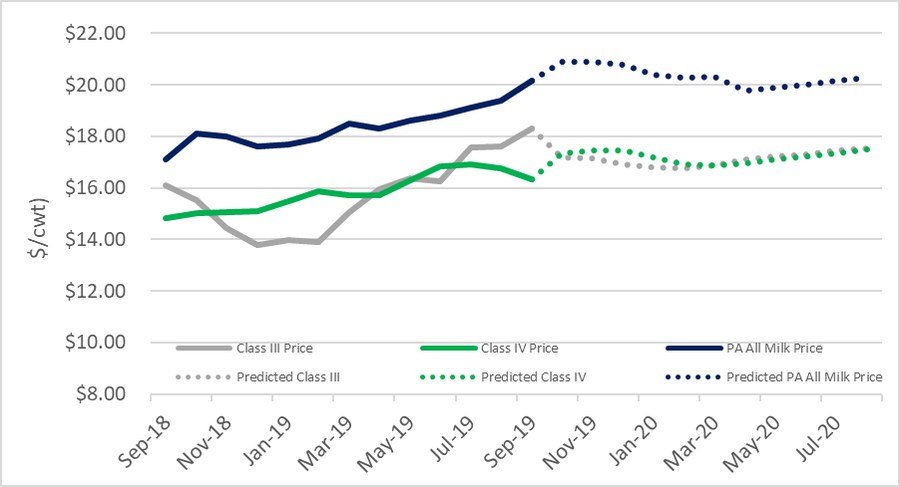

USDA in their October World Agriculture Supply and Demand estimates report forecast milk production to increase in 2020 based on strengthening cow numbers and production per cow (USDA, 2019). The same report also forecasts slighter higher Class III and Class IV prices from the previous month due to stronger cheese and nonfat dry milk prices which offset the lower butter price. The all milk price of $18.85 remained the same for the last two projections on this report. It is also worth noting the report expects a reduction in dairy imports due to EU and reductions on exports because of weaker cheese, skim, and nonfat dry milk exports. According to Scott Brown from the University of Missouri, looking forward into 2020, milk prices will move more into a sideways pattern unless the demand for dairy products will increase within the U.S. or in our export markets and if the U.S. milk supply will grow well under one percent during the year.

The U.S. dairy herd has decreased to its smallest size since early 2016 (9.318 million cows). However, because of continuing productivity increases, the amount of milk produced was up 2% from last year’s August 2018 numbers according to the Livestock Monitor (Livestock Monitor Information Center, 2019). While the states with the largest herd numbers (Wisconsin, California and Texas) did not have a change in cow numbers, Pennsylvania stood out as the state accounting for half of the milk cow decline in August (LMIC). From August 2018 to August 2019, Pennsylvania’s milk cow herd decreased from 519k to 485k and milk production decreased from 882 to 829 million pounds (NASS).

Related, cull cow prices, which have been depressed for the past two years, are slowly increasing. Recent cutter value (90% Lean), on a national live basis, was $55.77 per cwt compared to 2018’s $50.01 per cwt. The downward pressure was caused by depressed milk prices, limited cow slaughter capacity and the drought in Australia (LMIC).

Income Over Feed Cost, Margin, and All Milk Price Trends

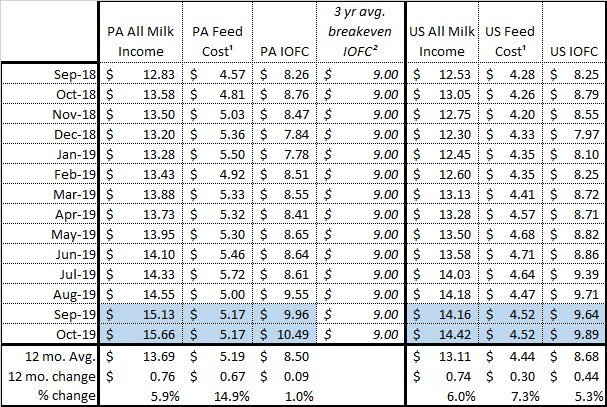

Table 1: 12 month Pennsylvania and U.S. All Milk Income, Feed Cost, Income over Feed Cost ($/milk cow/day)

¹Based on corn, alfalfa hay, and soybean meal equivalents to produce 75 lbs. of milk (Bailey & Ishler, 2007)

²The 3 year average actual IOFC breakeven in Pennsylvania from 2015-2017 was $9.00 ± $1.67 ($/milk cow/day) (Beck, Ishler, Goodling, 2018).

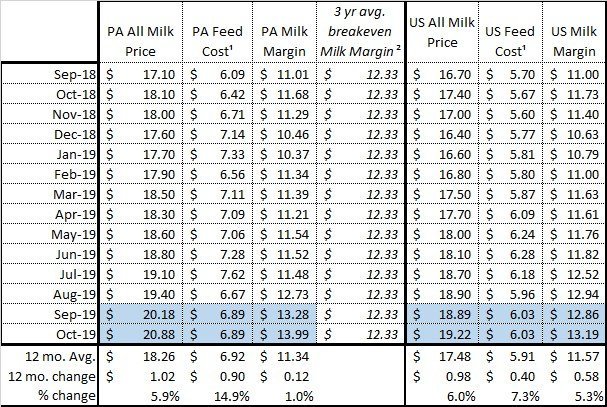

Table 2: 12 month Pennsylvania and U.S. All Milk Price, Feed Cost, Milk Margin ($/cwt for lactating cows)

¹Based on corn, alfalfa hay, and soybean meal equivalents to produce 75 lbs. of milk (Bailey & Ishler, 2007)

²The 3 year average actual Milk Margin breakeven in Pennsylvania from 2015-2017 was $12.33 ± $2.29 ($/cwt) (Beck, Ishler, Goodling, 2018).

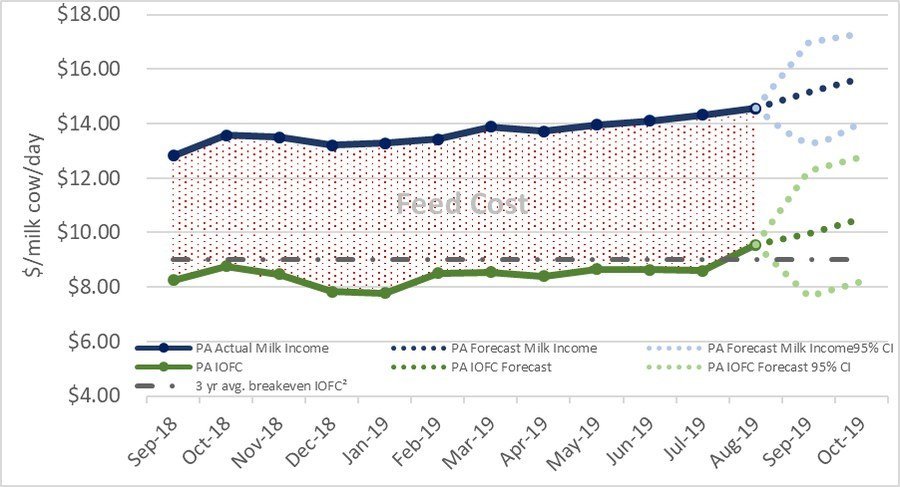

Figure 1: 12 month PA Milk Income and Income over Feed Cost

²The 3 year average actual IOFC breakeven in Pennsylvania from 2015-2017 was $9.00 ± $1.67 ($/milk cow/day) (Beck, Ishler, Goodling, 2018).

Figure 3: 24 month Actual and Predicted* Class III, Class IV, and Pennsylvania Average Mailbox Price ($/cwt)

*Predicted values based on Class III and Class IV futures regression (CME, 2019).

Table 3: Twenty-four month Actual and Predicted* Class III, Class IV, and Pennsylvania All Milk Price ($/cwt)