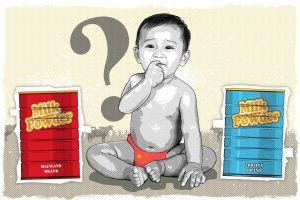

The future of infant formula markets in Asia in connection with the dwindling population in China has come into the spotlight following Nestlé’s closure of a manufacturing plant in Ireland that serves the Chinese market. The food giant and instant formula maker cited China’s declining birth rate as one of the key reasons for the closure, and this has prompted further analysis and discussion over future opportunities and challenges within the infant formula space.

However, several companies believe that innovation and stricter regulation provide plenty of opportunity for infant formula development in the years ahead, despite a growing global trend where women are having fewer babies, or having babies later in life.

The United Nations (UN) reports that the global population is expected to increase by two billion by the year 2050. However the UN Population Fund notes that, regardless of growth, the global birth rate is in decline and has fallen from five births per woman in the 1950s to 2.3 births per woman in 2021, with Europe and Asia being some of the hardest hit countries.

In South Korea, the current birth rate of .84 births per woman no longer meets the replacement rate of 2.09 births, according to the World Bank’s data center. In China the birth rate has dropped to 1.09 in 2022, leading to what some experts are calling the “birth rate crisis.” Moreover, the coming population projections show that Europe will have a negative seven percent population growth rate by 2050.

In light of these figures, some in the industry are taking a fresh look at the infant formula and infant nutrition markets.

Nutrition Insight speaks with Nestlé and industry experts from Arla Food Ingredients, Fonterra and FrieslandCampina Ingredients.

“Although constant evolution has always characterized the early life nutrition (ELN) market, today it is poised for dramatic transformation,” explains Floor van der Horst, marketing director ELN at FrieslandCampina Ingredients. “We experienced decades of growth that recently slowed down and then stalled altogether during the Covid-19 pandemic, which substantially impacted market dynamics.”

“With declining global birth rates, disparate market circumstances and a new generation entering parenthood over the coming years, it is more important than ever to understand the future of our industry and prepare our businesses for success.”

Nestlé’s plant closure

A spokesperson from Nestlé, provided some information on the background behind the Ireland plant closure. According to the company, in 2008, a melamine contamination incident affected domestic infant formula producers in mainland China and led to a decline in trust among consumers regarding locally made items.

The contamination caused a substantial drop in sales of domestic products and a surge in the demand for imported high-quality infant formula products. However, in recent times, Chinese authorities have strengthened and enforced substantial enhancements in regulatory controls for locally manufactured infant formula, resulting in a resurgence of consumer trust in domestically produced infant formula.

Nestlé cited China’s declining birth rate as one of the key reasons for the closure of a plant in Ireland.The representative states that the decision to close the plant is a result of the combination of heightened consumer confidence in domestically produced infant formula and the country’s declining birth rate.

Nestlé cited China’s declining birth rate as one of the key reasons for the closure of a plant in Ireland.The representative states that the decision to close the plant is a result of the combination of heightened consumer confidence in domestically produced infant formula and the country’s declining birth rate.

“We have announced a proposal to cease operations in our Wyeth Nutrition infant formula factory in Askeaton, Limerick, Ireland, by Q1 2026,” the representative reveals. “We propose to close the co-located R&D center by Q1 2025. We will now consult with all employees and their representative unions. Regrettably, this announcement means approximately 542 colleagues will be placed at risk of redundancy.”

“External trends have significantly impacted demand for infant nutrition products in the greater China region. The number of newborn babies in China has declined sharply from some 18 million per year in 2016 to fewer than 9 million projected in 2023. The market, which had previously been reliant on imported infant formula products, is also seeing rapid growth in locally-produced products.”

The company reveals that in response to these shifts it plans to relocate production from Askeaton to two established facilities — Suzhou, in Mainland China, and Konolfingen, Switzerland.

A shrinking market?

According to Angela Rowan, head of innovation advanced nutrition at Fonterra, China is presently a key market because of its substantial infant formula market size and it is currently implementing stricter regulations regarding product re-registration.

She also notes growing possibilities for brands that introduce novel and innovative products.

“Even when growth in the infant formula market is slowing, we continue to see more demand for ingredients that allow premiumization of formulations — such as probiotics, alpha-lactalbumin, milk fat globule membrane (MGGM), phospholipids, sn-2 palmitate, oleic-palmitic-oleic (OPO), peptides and higher addition of lactoferrin.,” Rowan highlights.

“Outside of China, the growing use of human milk oligosaccharides (HMOs) is also becoming popular. At Fonterra, we understand the need to research and develop these high-quality ingredients and offerings to meet what parents are looking for, such as hydrolyzed protein-based products for digestive comfort and tolerance.”

China recently authorized the production of two human milk oligosaccharides (HMOs) for infant formula fortification. This authorization applied to several companies.

Van der Horst, notes that counteracting marketing stagnation requires innovative ideas.

“With the first signs of the stagnating growth, we embarked on an ambitious research initiative to shed light on upcoming opportunities to drive the ELN business in a market under significant pressure,” he notes. “Our aim is to ensure our innovation pipelines — and those of our customers — are future-ready.”

“Inspired by our commitment to support customers’ success through changing times, we explored the future ELN sector from three key perspectives — consumer, market and science & technology.”

Experts see growing possibilities for brands that introduce novel and innovative products in infant nutrition.Regulatory influence

Experts see growing possibilities for brands that introduce novel and innovative products in infant nutrition.Regulatory influence

Rowan further highlights that competitive advantage in many markets is influenced by regulation.

“For example, the lower protein limits set by the Chinese government will translate to greater use of higher-protein quality ingredients and amino acid fortification to ensure nutritional adequacy,” she explains. “There is also a move towards natural ingredients such as whole milk powder and milk fat that can reduce or replace the need for palm oil.”

“Across the world, parents continue to be highly invested in their child’s growth and development and are always looking up the latest ingredients and research. We see that their concerns are fairly consistent — growth and height, digestive comfort, immune protection, brain development, emotional balance, mobility and energy, obesity and too much sugar.”

Viorela Indolean, the industry marketing manager for early life nutrition at Arla Foods Ingredients also spotlights the growing demand for lower-protein options.

“Another major trend is demand for low-protein formulations. Multiple studies have shown that high protein intake during infancy accelerates weight gain, increasing the risk of obesity in later life,” she reveals. “Driven by such evidence and regulatory changes, the protein content of infant formula has gradually fallen in much of the world.”

“One of the most effective ways to create formulas that are lower in protein but high in nutritional quality is to formulate with alpha-lactalbumin. Hence the number of infant formula products enriched with alpha-lactalbumin is steadily increasing.”

Van der Horst further notes that the launch of its “Step Up Nutrition” ELN platform was the direct result of these factors.

“With the decline in the number of newborns in China — and worldwide — and the contraction of the regular infant milk formula market, the ELN industry is looking for new pockets of growth,” he explains. “At the same time, there is a growing focus on ensuring young children worldwide get the nutrition they need beyond their first years of life.”

“By 2030, milk formula for children, the fortification of dairy drinks and supplement formats like gummies, will all surge in popularity, making child nutrition a key category for growth< Van der Horst concludes. “Step Up Nutrition has the potential to enhance our customers’ child nutrition innovation plans by inspiring appealing applications with various health benefits, delivered by a portfolio of highly nutritious ingredients.”

![A nurse instructs a mother in the process of breast milk donation at the Maternity and Child Care Center in Qinhuangdao, Hebei province, last year. The milk is provided to premature and critically ill infants whose mothers cannot produce enough milk. [Photo by CAO JIANXIONG/FOR CHINA DAILY]](https://en.edairynews.com/wp-content/uploads/2019/05/Marketing-of-infant-formula-must-be-regulated-300x198.jpeg)