Before the White House’s 90-day pause on higher tariffs for other countries expires on July 9, India is one country rushing to negotiate a trade deal with the U.S.

As trade tensions continue to impact both commodity and financial markets, the White House says the Trump administration is making progress on additional trade deals. The news comes as Vice President JD Vance was in the middle of a four-day visit to India, with both countries saying they had made progress in negotiating a bilateral trade deal. Delhi hopes this deal will help it avoid higher tariffs.

Vance announced the U.S. and India have “officially finalized the terms of reference for the trade negotiation.” He called it a “vital step,” saying it sets a roadmap toward a final deal.

India is just one of several trade deals in the works, according to the Trump adminstration. White House press secretary Karoline Leavitt said on Tuesday the Trump administration now has “18 proposals on paper” for trade deals.

“You have Secretary Bessent, Secretary Lutnick, Ambassador Greer, NEC Director Hassett and Peter Navarro, the entire trade team meeting with 34 countries this week alone,” Leavitt said in the press briefing. “We are moving at Trump speed to ensure these deals are made on behalf of the American worker and the American people.”

Leavitt also announced “the president and the administration are setting the stage for a deal with China.”

The Wall Street Journal reported the White House is considering slashing tariffs in order to de-escalate the trade war. Currently, tariffs are at 145%, but the White House isn’t considering cutting those to zero. Instead, the Wall Street Journal reports those tariffs will likely fall anywhere between 50% to 65%.

However, Treasury Secretary Bessent declined to comment on that report, saying there’s no unilateral offer from President Trump to cut tariffs on China. He also said it could take two to three years to reach a full trade deal with China.

Progress With India

Before the White House’s 90-day pause on higher tariffs for other countries expires on July 9, India is one country rushing to negotiate a trade deal with the U.S.

Just this week, Vance and Prime Minister Modi announced the terms of reference for a bilateral trade agreement between the U.S. and India. The progress toward the agreement was a result of the meeting between the two this week.

“I am pleased to confirm that USTR and India’s Ministry of Commerce and Industry have finalized the Terms of Reference to lay down a roadmap for the negotiations on reciprocal trade,” Greer said. “There is a serious lack of reciprocity in the trade relationship with India. These ongoing talks will help achieve balance and reciprocity by opening new markets for American goods and addressing unfair practices that harm American workers. India’s constructive engagement so far has been welcomed and I look forward to creating new opportunities for workers, farmers and entrepreneurs in both countries.”

During Vance’s speech in Jaipur prior to that, he said that the two countries had finalized the terms of reference for the negotiation.

“This is a vital step toward realizing President Trump and Prime Minister Modi’s vision because it sets a roadmap toward a final deal between our nations,” Vance said.

India’s Tariffs on U.S. Agriculture Products

India’s tariffs on U.S. agricultural goods are significant, which is a major point of contention in the U.S. and India trade relationship. Walnuts, for example, face a tariff of 100% into India. Vegetable oils have a tariff of up to 45%.

The U.S. argues these tariffs are unfair trade barriers, and Mark Knight of Farmer’s Keeper Financial told AgDay the U.S. relationship with India over the years has been complex and strange.

“Sometimes it’s friendly, for the most part. But that’s a giant population, and it would go a long way toward making a potential deal with China less important if we could strike some deals with some of these other countries — especially India. We haven’t had something in place with India for years.”

India Has the Most Potential, But Poses the Biggest Problem

If you want to understand just how problematic India has been for trade in the past, just talk to Gregg Doud. He’s the current CEO of National Milk Producers Federation (NMFP) but served as the chief ag trade negotiator during the first Trump administration.

During an episode of “Unscripted” earlier this year, he said India has the most potential, but is the biggest problem.

Doud says history shows you India has been a problem, as the U.S. essentially kicked India out of the World Trade Organization (WTO) in the past. The U.S. did finally agree to allow India back into the WTO, but under certain terms.

“I don’t want what I’m about to say to be seen as being negative toward the discussion between Modi and President Trump earlier this year, but one of the wins we did get in agriculture — which is my understanding based on some conversations — is that India lowered the tariff on U.S. bourbon from 150% to 100%,” Doud says.

He says while that may not have been the only win, it serves as an example for how difficult it is to negotiate with India.

India is a big customer of one main U.S. ag product, though: almonds.

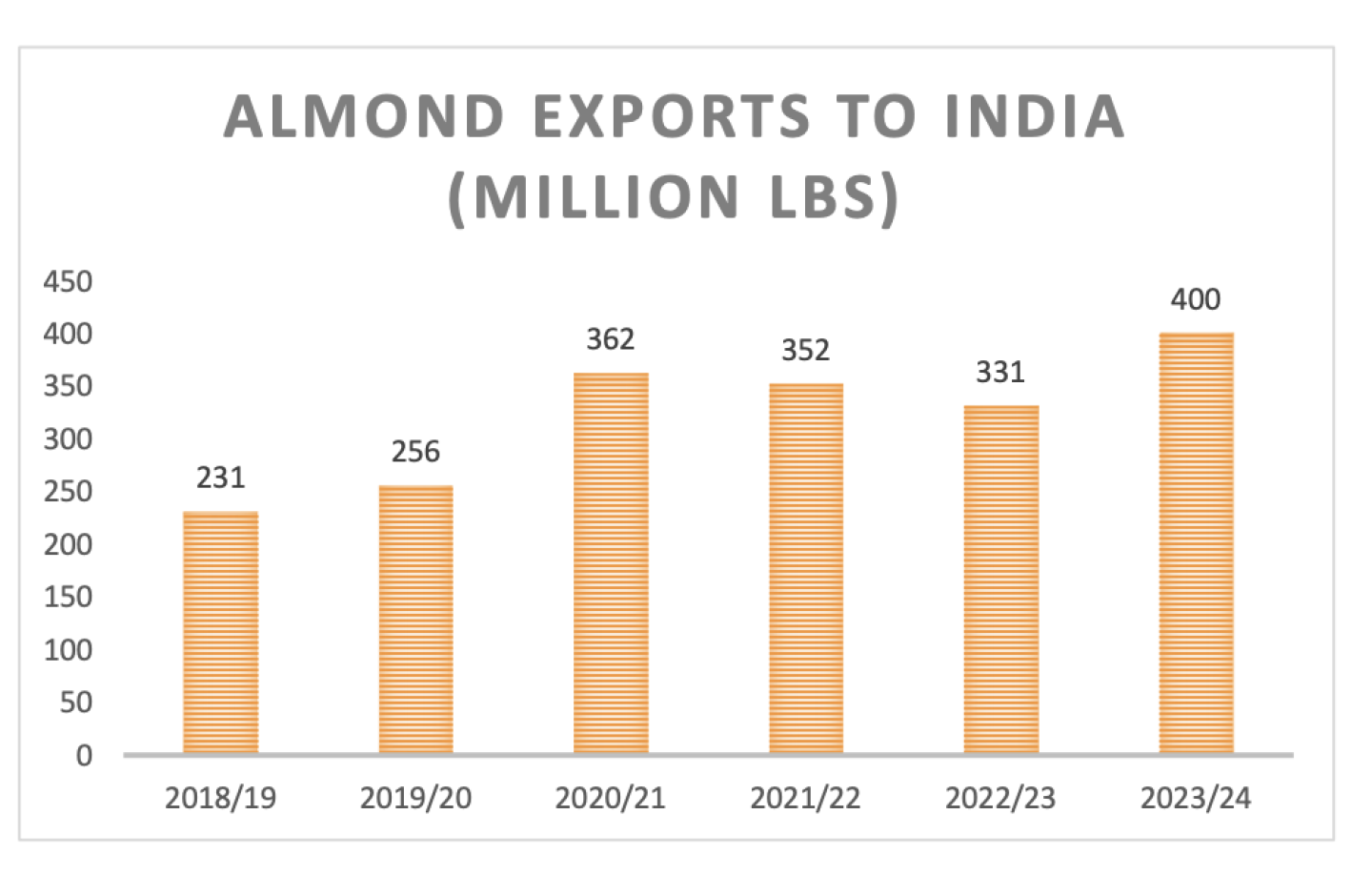

In the 2023/24 crop year, the U.S. exported over 400 million lb. of almonds to India, making it the largest export market for California almonds. This was a 21% increase compared to the previous year. India’s almond imports from the U.S. were valued at $932 million in FY 2023.

Doud says India has high tariffs to protect their own farmers.

“Think of it as a half billion farmers in India whose electricity, water, fuel, fertilizer and seed is all subsidized. India wants to keep that out in the country, and if we do anything that drives rural Indian folks into the cities, it would overwhelm them. This is the mindset,” Doud says. “I remind people, it was 5 or 6 years ago that India made a modicum of reforms of their domestic agricultural markets. There was so much unrest over those changes that Modi agreed upon to make, that three years later, they had to repeal the law.”

India’s Tariffs Crushed Apple Exports

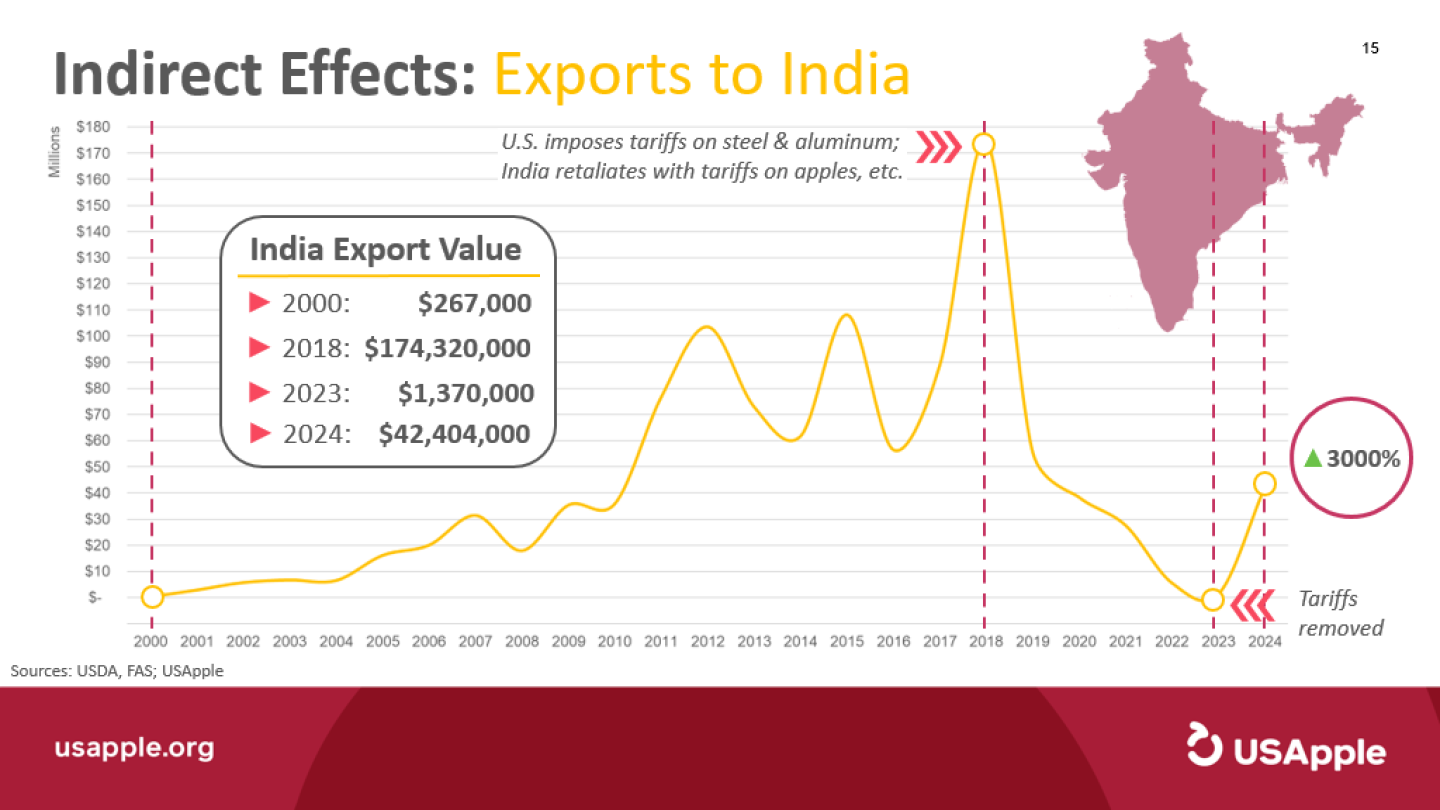

U.S. apples are one commodity that has suffered from India’s retaliation in 2018.

“In 2018, India was the No. 2 market for U.S. apples until their retaliatory tariffs crushed our exports to near zero. They are rebounding back, but it might take years to return to the previous levels,” says Jim Bair, president and CEO of the U.S. Apple Association, in an interview with Farm Journal’s The Packer. “If the White House can facilitate that in a trade agreement with India, U.S. Apple wishes them Godspeed, and not a moment too soon.”

Potential With India

As the world’s most populous country, India holds massive potential if a trade deal can be struck. It boasts one of the fastest growing economies in the world with households that are seeing a high levels of consumer spending. That means agricultural products would be more accessible to a larger number of people.

According to USDA, top agricultural prospects for U.S. exporters include:

- Cotton

- Dairy products

- Ethanol

- Fresh fruit

- Forest products

- Processed food and beverages

- Pulses

- Tree nuts

USDA says in FY 2023, India imported $37 billion of agricultural and related products from across the world, with imports up 51% over the past five years.

“Proportional to its population, India imports a relatively small value of products. Comparatively, China, a country with a similar population size, imported $262.7 billion during the same period. Currently, India ranks behind much lower population countries like Canada and South Korea in total agricultural and related imports. This relatively low level of imports suggests good opportunities for future growth,” the USDA report stated.

Much of the recent growth of imports in India is with vegetable oils, which is the country’s top imported ag product.

USDA says imports of vegetable oil increased by $9 billion, nearly doubling in 5 years, to a total of $18.4 billion in FY 2023.

The United States has occasionally been a supplier of soybean oil to India, but imports face stiff competition from other substitutable oils like palm and sunflower, and from imports from India’s traditional soybean oil suppliers: Argentina and Brazil.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K