This has seen average milk prices plummeting at the same time as input costs remaining high (albeit stepping back from the rampant levels of agriculture cost inflation seen at the back end of 2022). The addition of poor weather conditions has caused milk production levels to lag behind expectations.

Milk production

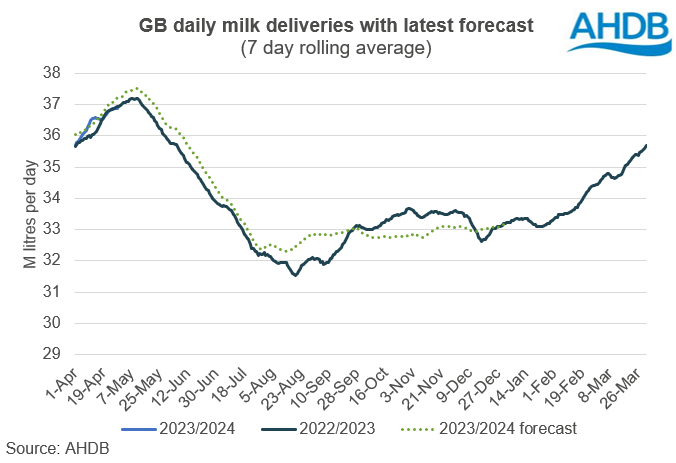

The higher milk yields seen in the last quarter of 2022 continued into February but are now softening. The full year for the 2022-23 milk season ended up by 0.2% on the previous year. However, poor spring weather and lower prices/squeezed farm margins have so far slowed production growth this year.

AHDB’s published GB milk production for 2023/24 is forecast to reach 12.46bn litres, 0.5% up on the previous year. Our baseline forecast assumes yields will begin to fall back following the spring flush with a combination of still high (although falling) input costs, falling milk prices putting pressure on farm margins. The extent to which this impacts on yields will be dependent on grass growth this spring, allowing silage clamps to be replenished. The combination of increased production costs, lower milk prices and strong cull cow prices could lead to higher-than-expected destocking, limiting production over the winter months.

So far this year we have seen a very dry February followed by a wet, cold spring that has limited firstly grass growth, and then access to pasture due to poaching. Despite this production was reasonable for March, ending up by 1.2% compared to March last year (although has since flattened off in April) but is now running -2% behind forecast with a later than average flush.

The risk that yields or retention rates could drop through the rest of the year as input costs and falling prices continue to pressure farm margins is now becoming increasingly likely. The timing of purchases will have been particularly influential on cash flows this year and last given how volatile prices have been. Those who managed to arrange fixed deals on key inputs such as feed and fertiliser in advance of the large spikes in prices will have likely fared better in the past year, with less pressure to reduce feeding or sell off cows. But, the full extent of price rises is yet to be realised for some farmers, particularly those whose fixed energy contracts have recently (or have yet to) come to an end.

EU are forecasting a drop of 0.2% in milk production for 2023. This is in response to a declining dairy herd and lower prices forecast to drive a decline in production in the second half of the year, despite good yield growth.

Recent pressures have exacerbated the trend towards dairy producers leaving the industry with 380 (or -4.8%) of producers leaving the industry between October last year and April 2023.

Demand

Demand remains fairly soft both globally and domestically. Domestically demand has been suppressed by high price inflation on dairy products leading consumers to buy less. Demand is forecast to fall further through 2023 due to recessionary pressure, with retail sales of key dairy products expected to fall by 3%. Liquid milk sales will see a smaller drop of 1%, returning to its long-term trend. The latest Agri-market outlooks are available on the website.

There is a similar pattern internationally but a large factor that could influence this is the important Chinese market. Demand fell in 2022 due to high stock levels build up in 2021. With Covid restrictions still in place demand was poor. We would expect to see this recover as the economy reopens. Based on predicted economic growth of 4.5% for 2023 and 2024, Chinese dairy import volumes would be expected to increase by around 6.7% per year. While imports in the first two months remain below previous year levels, it is estimated that demand will recover through the year, pulling up import demand.

Farmgate prices

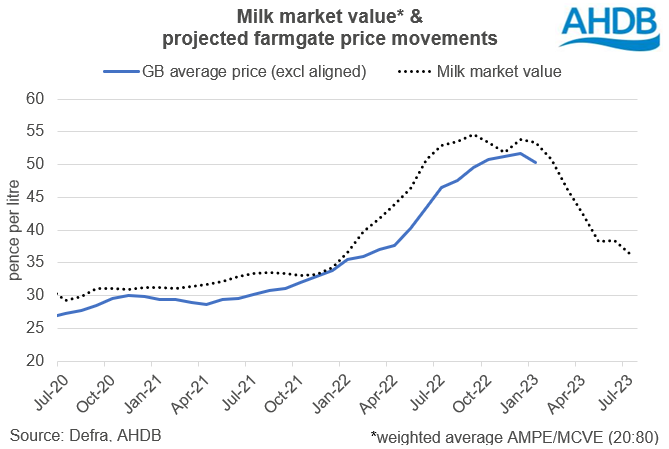

The average UK farmgate milk price reached 45.98ppl in March according to Defra. The average for 2022 was 44ppl, up from 31ppl in the previous year (annual averages have been around 29-30ppl in the past 5 years). Market-related farmgate prices have been declining in response to the reduced market returns and higher milk availability.

In the first four months of this year, cuts to milk prices (excluding aligned) have ranged from 3.5ppl and 10.5ppl, with further cuts expected for May, although Freshways have held price for May while Tesco are returning to its cost model, increasing the milk price by 1.0ppl in May.

However, with reduced market returns it looks likely that farmgate milk prices will fall significantly in the coming months, the average milk price is predicted to fall to between 36 and 38ppl by July.