“Global dairy commodity prices have already priced-in the uncertainty,” says Michael Harvey, RaboResearch Senior Dairy Analyst. “But a less-than-favorable expected finish to the New Zealand production season is providing some price support.”

Rabobank anticipates China’s consumer buying patterns to normalize by 2H 2020, with evidence of improvement in some supply chains already visible. The risk of a setback or a delayed economic recovery in China presents a major downward price risk to Rabobank’s current forecasts.

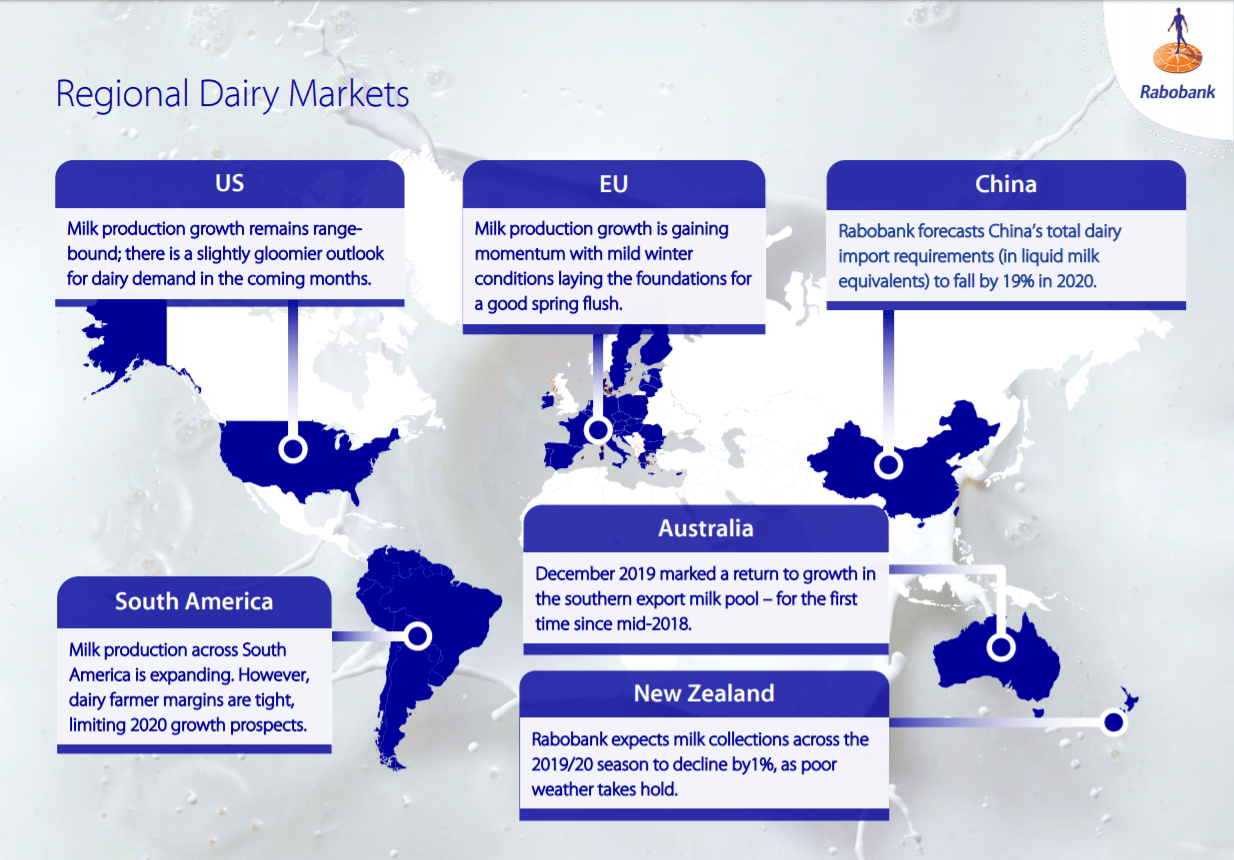

Against this backdrop, global milk production from the Big 7 is rising. All regions within the Big 7 will report year-on-year growth in Q2 2020, granted against low comparables.

The combination of reduced Chinese imports, significant supply chain disruptions, including extreme competition for shipping containers across the globe, and rising dairy surpluses in export regions will keep downward pressure on global markets through much of 2020.

Nonetheless, the rate of growth in surplus milk will be restrained, and lower commodity prices in the face of weaker economic growth will support buyers in price-sensitive regions that are not dependent on oil revenue. Based on the forecast fundamentals through 2020, this should lead to a down cycle in global dairy markets.