A look at the world’s biggest dairy conglomerates reflects the state of the industry and what’s to come. Rabobank’s annual Global Dairy Top 20 report particularly noted how last year’s mergers and acquisitions are shaping the wider market.

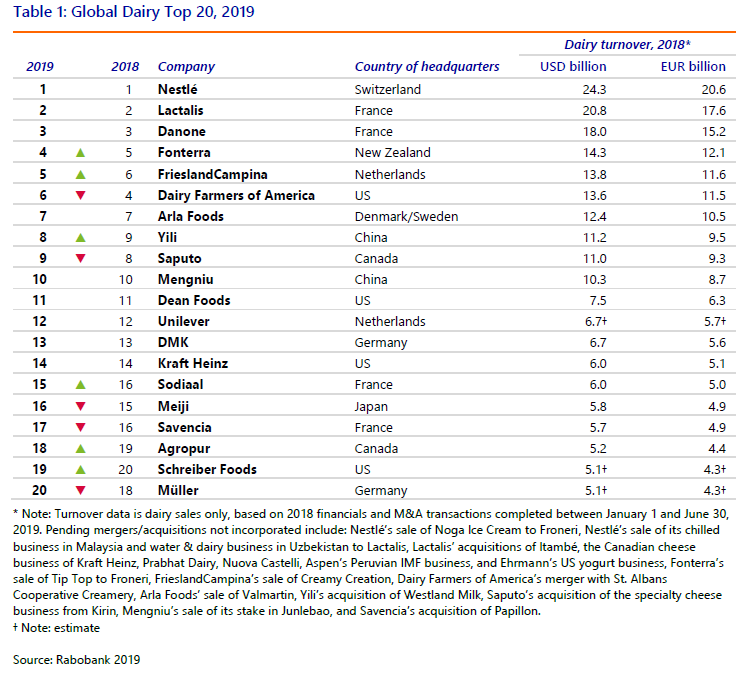

Nestlé topped the list again, supported by organic growth coming from its infant nutrition business, rather than from its big milk and ice cream brands. Lactalis is a close second with Danone not far behind in third; and the gaps between the top three continue to shrink.

Fonterra moved into fourth place following its acquisition of the remaining stake of the Darnum IMF plant in Australia. FrieslandCampina moved up to fifth thanks to small investments in cheese in the Netherlands, the US, and Spain, according to Rabobank.

The Dairy Farmers of America dropped from fourth to sixth, and Yili surpassed Saputo, moving into eighth place, with sales up by 13.4% in US dollar terms.

Saskia van Battum, a dairy analyst, said, “The top three remained the same, although the gap between numbers one and two continues to narrow. For the third year in a row, there are no new entrants in the list, due to a lack of elephant deals over the past 18 months, but some reshuffling took place.”

Overall, there was an increase of 2.5% on the year, compared to 7.2% in the previous year. However, the combined turnover of the top ten grew and neared $150bn.

Rabobank cited lower commodity prices, adverse weather conditions in key export regions, a strong US dollar and currency shifts as reason for the combined turnover of the top listed companies.

Of the top 20, 19 companies were involved in more than 75 mergers, acquisitions, joint ventures, and strategic alliances or disposals. Rabobank said that 111 deals total took place in dairy in 2018, down from 127 in 2017.

As of mid-2019, there have already been 85 dairy deals, but none of the recent deals have been “a real game changer,” according to Rabobank.

“We expect to see further growth from acquisitions, with a long-awaited shift in the top three of the global ranking likely. However, slower economic growth in China and a looming (US) recession will probably hamper organic growth,” the report said.

Dairy is also battling trade tensions between the US, the EU, Mexico and China, as well as dealing with Brexit and ‘increasing environmental constraints’ around the world.

Nestlé, Lactalis, Danone, Fonterra, FrieslandCampina, DFA, Arla Foods, Yili, Saputo and Mengniu make up the top 10. Dean Foods, Unilever, DMK, Kraft Heinz, Sodiaal, Meiji, Savencia, Agropur, Schreiber Foods and Müller round out 11-20.