ABARES analyst Andrew Duver said farmgate milk prices had hit record levels this year due to drought-induced constraints on supply and a lower dollar.

But this would not last, as supply stabilised and the dollar appreciated.

The market was also vulnerable to price and supply shocks, while the Australian industry would face potential challenges from climate variability and higher irrigation water prices.

Mr Duver said intense competition for milk had driven higher farmgate prices in Australia, which it forecast to hit 52.4 cents a litre this year.

“Recent investment in processing capacity has resulted in under-utilised factories that require additional milk supplies to maintain profitability,” he said.

“Processors will have an incentive to continue to offer farmers higher prices in an effort to encourage production.

“This may become unsustainable and increasingly risky for processors over the medium term.

“A forecast fall in world prices would put downward pressure on processor margins, potentially forcing further consolidation of domestic manufacturing facilities.”

ABARES was forecasting the price to fall to 52c/L in 2020/21 and to 51.9c/L in 2021/22.

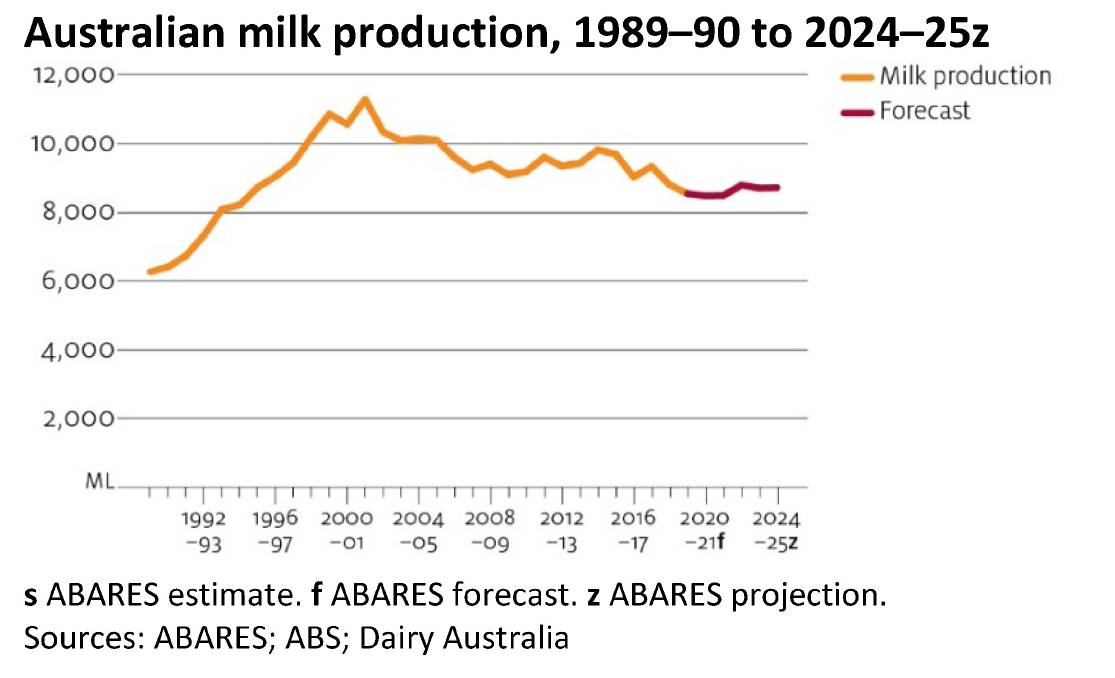

Milk production is tipped to continue to fall – down 1 per cent in 2019/20 to 8470 million litres.

“The recovery of production is expected to lag behind an assumed improvement in seasonal conditions,” Mr Duver said.

This was because farmers had been selling cows and it would take time to restock.

Farmers in the southern Murray Darling Basin would continue to face high water costs, and unless grain and fodder production increased and prices fell, farms exposed to these costs would continue to diversify.

But production is expected to recover by 2022-23, partly due to increased herd numbers and also to improved milk yield per cow on the back of improved pasture quality and availability and genetic improvements.

Production is forecast to hit 8708 million litres by 2024/25.

But this forecast depends on a return to normal seasonal conditions.

If drought conditions returned in 2022-23, milk production would fall to 8200 million litres in 2022-23 before increasing to 8300 million litres in 2024-25.

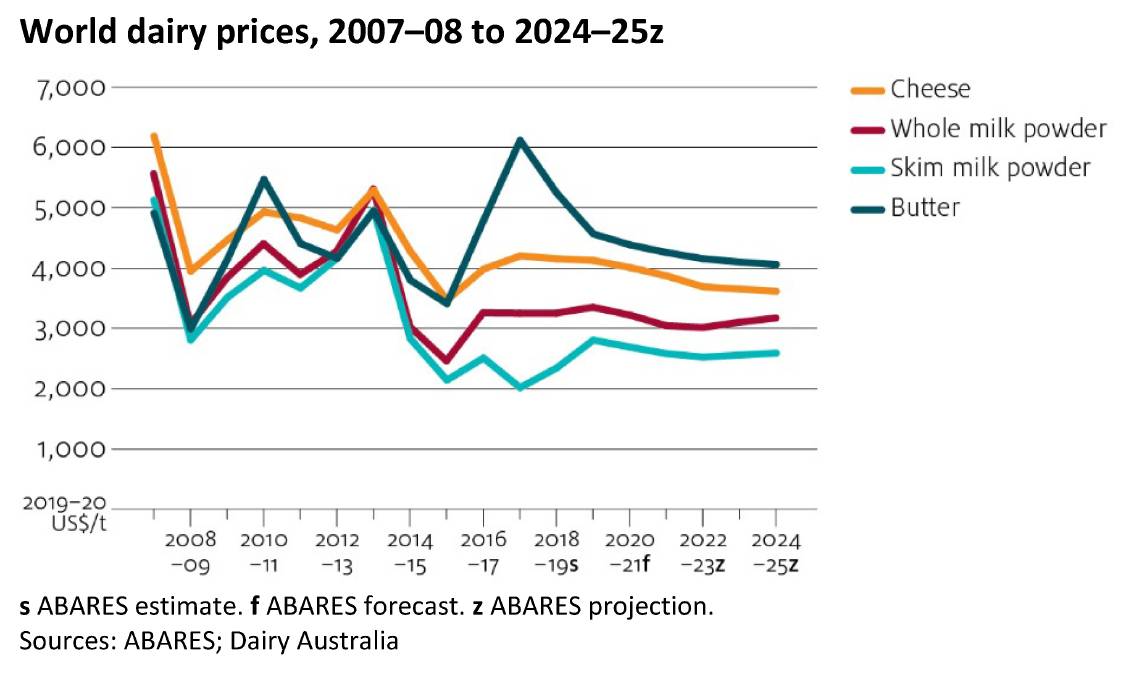

Global markets to remain volatile

Mr Duver said global prices for manufactured dairy products were forecast to fall in the short term, as improved climatic conditions led to increased supply.

“Global supply growth over the medium term is expected to be more subdued,” he said.

“A slowdown in production growth could increase prices if forecast demand materialises over the medium term.”

Record dairy prices set to fall

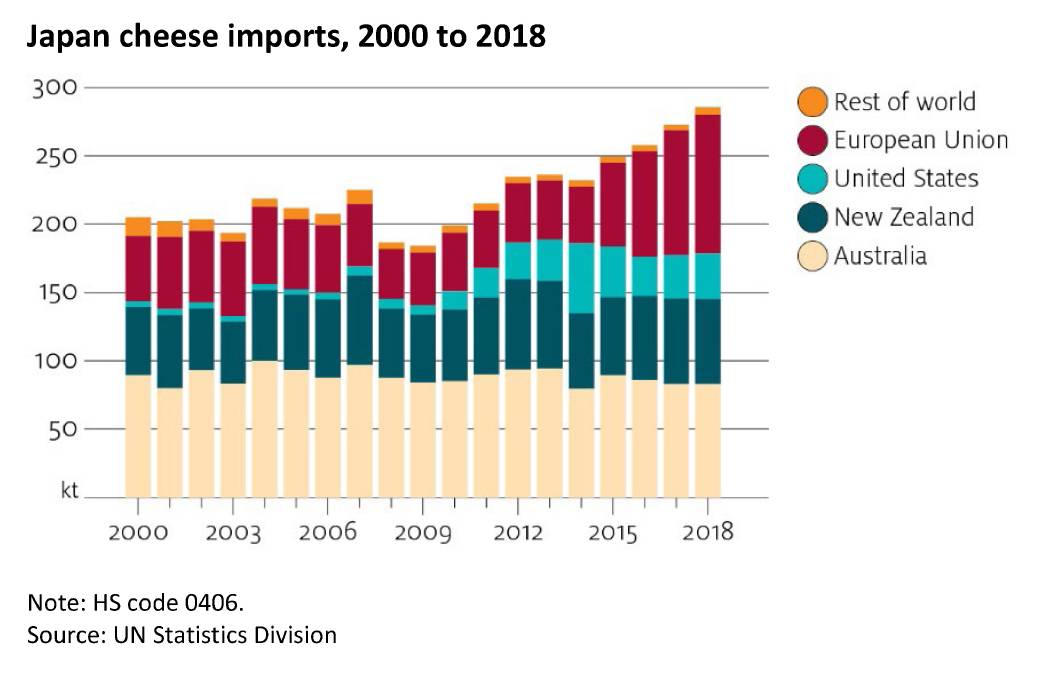

Cheese exports to Japan, Australia’s largest market for cheese, face increasing competition from the US and the EU, as the result of trade agreements signed in the past year.

Mr Duver said as global markets become more competitive, Australia would direct its falling milk supply to export higher-value manufactured products.

Australian manufacturers would also look to diversify markets away from China, particularly given it has implemented policy changes that had hit imports of products such as infant formula.

Mr Duver said the short-term implications of the coronavirus (COVID-19) outbreak were still unknown.

“If quarantine measures in China disrupt domestic supply chains then imports will be required to supplement domestic production, potentially through daigou channels,” he said.