Throughout 2024, and for more than two years, South Dairy Trade has established itself as the main source of open access and transparent information on the trade performance of Uruguay and Argentina in the global dairy market.

The work carried out has provided accurate and reliable information of great added value for commercial agents, dairy suppliers, traders, journalists and key players in the global dairy industry, who seek to understand and analyze the South American dairy market in depth, facilitating strategic decision making and fostering greater competitiveness in the sector.

Analysis of Uruguay’s Dairy Exports in 2024: FOB Volume and Value

Uruguay closed 2024 with a solid performance in the dairy sector, consolidating its position as a leading exporter in the region.

According to data compiled by South Dairy Trade Uruguay, the country exported a total of 209,081 tons of dairy products, reaching a total FOB value of US$739,189,065.86, reaching 71 different international destinations, reflecting its great diversification and wide reach to the world.

The following is an analysis of the composition of exports by volume and value, highlighting the most representative products of the Uruguayan dairy industry and their relative participation.

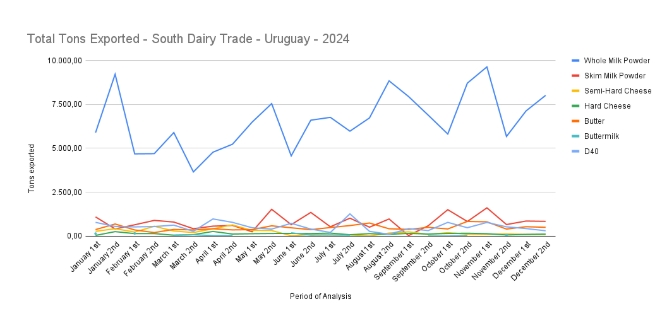

1. Exports by Volume: Predominance of Whole Milk Powder (WMP)

Whole Milk Powder (WMP) continues to lead the list with 157,381.96 tons, representing 75.31% of total exports. Its wide demand in international markets reaffirms its strategic role for the Uruguayan dairy industry.

Other exported products in terms of volume:

- Skim Milk Powder (SMP): 19,101.20 tons (9.14%)

- D40: 12,883.95 tons (6.16%)

- Butter: 11,466.29 tons (5.48%)

- Semi-hard cheese: 5,074.17 tons (2.43%)

- Hard Cheese: 3,087.44 tons (1.48%)

- Buttermilk: 886 tons (0.42%)

The main export markets in terms of volume were Brazil, Algeria and China, consolidating their position as strategic destinations for the Uruguayan dairy industry.

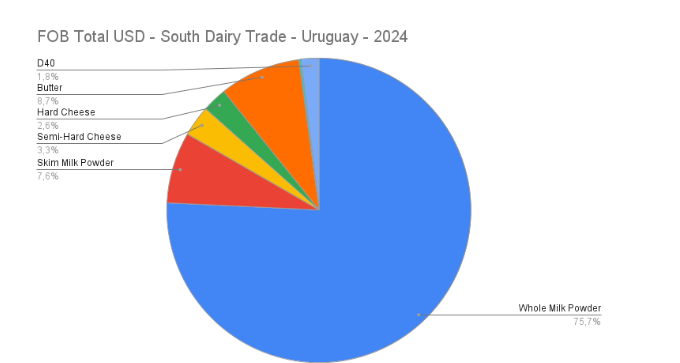

2. Exports by FOB Value: Economic Contribution of Each Product

In terms of FOB value, the LPE also dominates, with revenues of US$559,864,797.80, representing 75.74% of the total value of dairy exports.

However, some products show a more favorable volume-value ratio, especially butter and cheeses due to their added value.

FOB value breakdown by product:

- Whole Milk Powder (WMP): $559,864,797.80 USD (75.74%)

- Butter: $64,009,773.20 USD (8.66%)

- Skim Milk Powder (SMP): $55,981,972.81 (7.57%)

- Semi-hard cheese: $24,542,259.22 USD (3.32%)

- Hard Cheese: $19,213,213.16 USD (2.60%)

- D40: $13,539,791.88 USD (1.83%)

- Buttermilk: $2,037,257.79 USD (0.28%)

- Volume vs. Value Ratio: Opportunities for Growth

While WMP dominates in both volume and value, products such as butter and cheeses show a higher average price per ton exported, suggesting opportunities for growth in premium markets. Some key insights:

- Butter, with a volume of 5.48%, contributes 8.66% of the total value, indicating a higher value product per unit exported.

- Cheeses (semi-hard and hard) represent only 3.91% of the volume and contribute 5.92% of the total in value, reflecting their potential in quality niches.

Conclusion and Prospects for 2025

The performance of Uruguayan dairy exports in 2024 shows a high dependence on the WMP, which generates stability but also a certain degree of vulnerability to international price fluctuations.

Although we know that the main volume flow is destined to Brazil, a country with which there are benefits linked to the Mercosur treaty, and where there is also a strong acceptance and historical positioning of the product of Uruguayan origin, there is a conflict at the door due to the accusation of the Brazilian government for alleged dumping practices of exports from Uruguay and Argentina, in December 2024, which leads to rethink the trade strategy for 2025.

Diversification of target markets, such as higher value-added products (butter and cheeses, for example), could be a determining factor in increasing the sector’s profitability in 2025 without affecting international dairy trade in the first months of the year until the situation normalizes.

Author and South Dairy Trade Manager: Gonzalo Peralta Palomas