If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we’ll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed.

This shows us that it’s a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after briefly looking over the numbers, we don’t think Nestlé (VTX:NESN) has the makings of a multi-bagger going forward, but let’s have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

For those that aren’t sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Nestlé is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.16 = CHF16b ÷ (CHF136b – CHF40b) (Based on the trailing twelve months to June 2024).

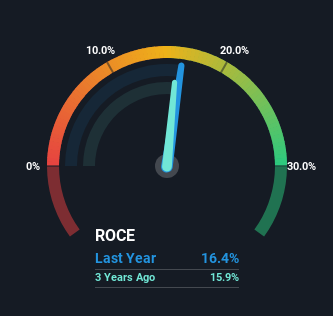

So, Nestlé has an ROCE of 16%. On its own, that’s a standard return, however it’s much better than the 12% generated by the Food industry.

In the above chart we have measured Nestlé’s prior ROCE against its prior performance, but the future is arguably more important. If you’d like, you can check out the forecasts from the analysts covering Nestlé for free.

The Trend Of ROCE

There hasn’t been much to report for Nestlé’s returns and its level of capital employed because both metrics have been steady for the past five years. Businesses with these traits tend to be mature and steady operations because they’re past the growth phase. With that in mind, unless investment picks up again in the future, we wouldn’t expect Nestlé to be a multi-bagger going forward. That probably explains why Nestlé has been paying out 64% of its earnings as dividends to shareholders. Most shareholders probably know this and own the stock for its dividend.

The Key Takeaway

In a nutshell, Nestlé has been trudging along with the same returns from the same amount of capital over the last five years. Since the stock has declined 22% over the last five years, investors may not be too optimistic on this trend improving either. All in all, the inherent trends aren’t typical of multi-baggers, so if that’s what you’re after, we think you might have more luck elsewhere.

One more thing to note, we’ve identified 1 warning sign with Nestlé and understanding it should be part of your investment process.