Despite this, the REINZ said in its March monthly sales data release that two sales in Southland of larger dairy units were significant in terms of total price involved and there was a good level of activity on finishing properties

In Otago, there was restrained activity in the drystock sector where prices eased 10% to 15%, with reports of capital constraints from banks making finance difficult to obtain and therefore harder to get transactions together.

The institute also said prices across the board in the grazing sector were under pressure.

Overall there were 14 fewer farm sales (-3.6%) for the three months ended February 2019 than for the three months ended February 2018 throughout the country.

The 370 farm sales in the three months ended February 2019, compared to 420 farm sales for the three months ended January 2019 (-11.9%), and 384 farm sales for the three months ended February 2018.

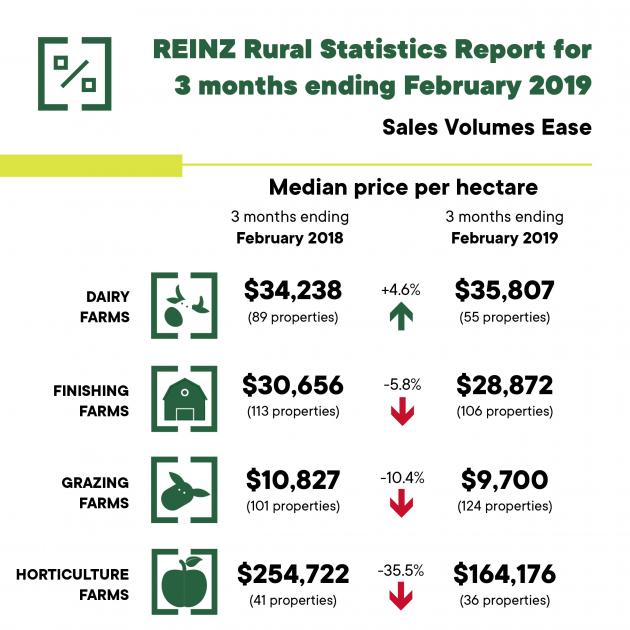

The median price per hectare for all farms sold in the three months to February 2019 was $22,462 compared to $27,523 recorded for three months ended February 2018 (-18.4%). The median price per hectare fell 17.1% compared to January 2019.

Eight of the 14 regions recorded increases in the number of farm sales for the three months ended February 2019 compared to the three months ended February 2018. Taranaki (+8), Hawke’s Bay (+7) and Gisborne (+6) were the top regions to increase the number of farm sales compared to February 2018.

Bay of Plenty recorded the most substantial decline in sales (-16 sales) followed by Otago (-11 sales). Compared to the three months ended January 2019, four regions recorded an increase in sales with the biggest increase being in Taranaki (+4 sales).

Brian Peacocke, rural spokesman for REINZ said the easing in total sales volumes for the three-month period ending February 2019 was the main point contained in the sales data just released, particularly so for the dairy sector.