The mumbling inventor Wallace and his loyal dog companion Gromit are closely associated with Wensleydale in the minds of many British consumers: a pair during the popular 1995 animation. Cheese sales were boosted when praised Shaving. When it appeared on the big screen 10 years later, export orders also increased.

In contrast, the Sapt name is relatively unfamiliar to most British people. However, the group already has a strong presence in the UK with the acquisition of the largest dairy producer in the UK. Daily RestWith a £ 975m deal in 2019.

What is the move by the Montreal-based group, one of the world’s top 10 dairy producers in terms of revenue? Also the latest The desire for British food makers has not fully recovered since the 2016 referendum on Brexit in a series by foreign predators fueled by a surge in trade and a weaker pound.

PepsiCo of the United States purchased Piper’s Crisp for £ 20 million in 2019, and in March another Canadian group, Sophina Foods, took Caro, a young seafood and meat producer, from private-equity fund Cap Best Partners. Acquired for a private amount.

Saputo’s decision to procure Wensleydale dairy products for £ 23 million demands higher prices for food multinationals, in addition to changing consumer tastes and a relentless focus on cost control It tells how we came to appreciate the value of unique traditional products.

Caroline Lou, an analyst at consultancy Mintel, said:

Wensleydale claims the legacy of Spades. According to the company, this cheese was first made by Cistercian monks in the 12th century and also has the coveted protected geographical position shared by Italian Parmesan cheese and French champagne. I will. Only cheese made in a particular valley and in a particular way can be called Yorkshire Wensleydale.

“The story of local sources and heritage … Add value to cheese.”

In 1992, Dairy Crest, now owned by Saputo, Wensleydale Creamery Moved production from Yorkshire. The modern Wensleydale company was born out of dairy products repurchased by local owners and local businessman John Gibson.

With a staff of 210, the company is the largest employer in the remote Hose village, providing a lifeline to 40 local farms by purchasing milk.

Saputo’s chairman and chief executive officer, Lino Saputo, acknowledged this when the deal was announced and said the company was “a home of a vast amount of passion, care and tradition.” The group declined to comment further on the acquisition, which is expected to close by the end of this month.

Large consumer groups such as Sapt meet customer demand, even though they remain minnows compared to bestsellers such as Country Life Butter, Clover Spreads, Britain’s Most Popular Cheese, and Cathedral Cheddar. Analysts say they are increasingly looking for unique locally produced foods for this purpose.

Wensleydale reported earnings of £ 309,000 before deducting interest, depreciation, taxes, amortization and exceptional items from £ 34.8m in revenue for the year to March 2020. Saputo recorded a total revenue of $ 14.3 billion (£ 8.3 billion) and adjusted ebitda of $ 1.5 billion (£ 870 million) over the same period.

Other small heritage brands it has scooped up since 2018 include Shepard Gourmet, a US feta cheese maker, and Tasmanian Heritage in Australia, which produces French-style soft cheese.

But the group also needs to navigate the increasing consumer demand, especially from younger customers. Animal-friendly alternative Oats and soybeans.

Purchased by Sapt last month Butte Island Foods, Scottish manufacturer of vegan alternative seeds. “There are more opportunities for the company to pursue, both dairy and non-dairy,” said one unnamed analyst. The group also owns Vitalite, a vegetable oil-based spread.

Some of our competitors follow the same playbook. In February Danon purchased Earth Island, a maker of plant-based cheese and egg-free mayonnaise veggie, and in the United States, Bellbrand launched Boursin’s vegan version of garlic and herbal goat cheese.

Sapt, which has closed 10 deals since 2018, emphasized the importance of organic growth, but recent strategic plans have not ruled out Europe as an area of interest and further acquisitions. did. Margins in the region are about 50% higher than in North America, reflecting consumers’ more expensive tastes.

The business was started by Giuseppe Sapto In 1954, four years after he emigrated from Sicily to Canada with a $ 500 and delivery bicycle.

Its growth was fueled by the desire to pack mozzarella cheese into millions of pizzas in North America in the 1960s. We also have large businesses in Argentina and Australia, the largest dairy processors. Gizeppe’s grandson, Reno, became Chief Executive Officer in 2003.

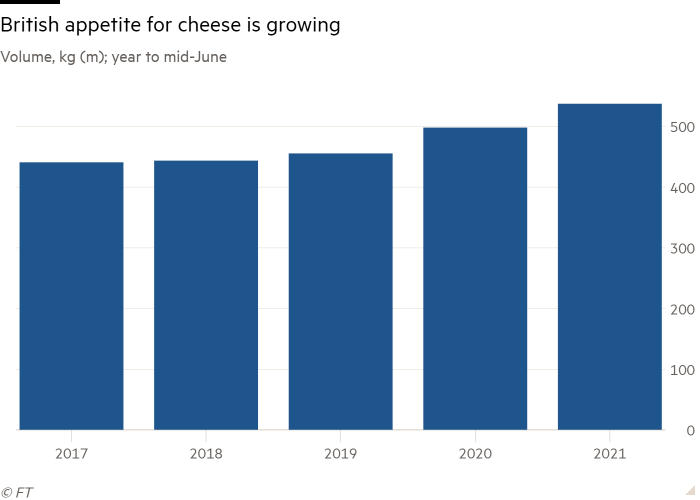

Regardless of Growing popularity of veganism According to Kantar, the UK turned to dairy products in search of a pandemic and comfortable diet for the coronavirus. Dairy sales were £ 12.8 billion over the year to June 13, up 8% year-on-year, according to market research firms.

Lou of Mintel said: “Of the UK cheese buyers, 33% are more likely to pay more for British cheese, while 29% will pay more for their favorite brands.”

But despite her lasting romance with British cheese, she added: “Saputo is one of the few global dairy companies seeking a market-first advantage. [for vegan products].. In recent months, competition between vegan cheese brands has intensified for the benefit of consumers, who will soon find more affordable products on the shelves. “

Wallace may still be persuaded to trade his favorite cheese for seeds.