It was good news for the Morrinsville second hand farm machinery dealer, but it points to rough weather ahead in the heartland of New Zealand’s rural economy.

As times get tougher for farmers, they start looking for second hand gear and tractors, says Elgar, owner of AgParts NZ.

He dealt with many tractor dealers and said people who had placed orders six months or a year in advance would cancel when the goods arrived.

“Farmers are just like; ‘can’t take it, can’t afford

“There’s cancelled orders everywhere.”

Elgar isn’t alone in seeing farmers close their wallets as rising interest rates and inflation hammers the rural sector.

The New Zealand Tractor and Machinery Association statistics show in February 193 tractors were sold in New Zealand, compared to 298 in February last year, down 35%.

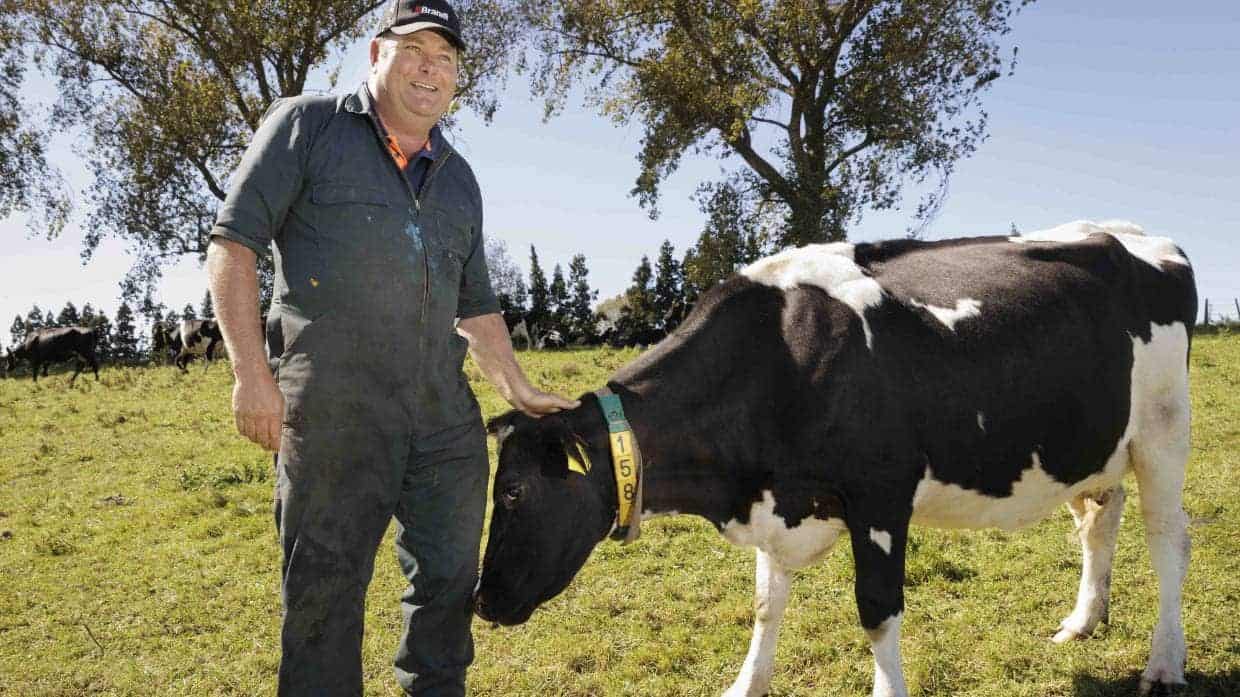

Waikato Federated farmers dairy chair Andrew Reymer says the cost of production for farmers has gone through the roof in the last 18 months.

And there’s set to be a little less in those wallets.

Fonterra revised its 2022/23 season forecast payout down early April – from NZ$8.20 – $8.80 per kg of milksolids to NZ$8.00 – $8.60.

Waikato Federated Farmers dairy chair and Waipā farmer Andrew Reymer said while the milk payout was still “historically pretty high”, the cost of production has gone through the roof.

“The pressure is really starting to come on farmers, as milk price forecast is going down and cost of production – service, vets, fertilizer, contractors, interest rates – going in the opposite direction.

“Interest rates are hitting farmers in different stages, depending on where they are with their loans.”

Andrew Reymer says interest rates are hitting farmers in different stages, depending on where they are with their loans.

Stats NZ data shows dairy farm expenses jumped an annual 17% in the December quarter. Interest costs surged 43%, fuel costs were up 29%, fertiliser costs shot up 28% and feed costs gained 23%.

Reymer said it was the discretionary things that would disappear from the to-do list, for example, fencing, rebuilds or painting the shed, buying a new car or, as Elgar illustrates, not upgrading the tractor.

But regulations on farming were driving farmers out of the industry more than anything, Reymer said.

“The regulations come with a bill attached…there’s cost implication in everything, and greenhouse gases is the perfect example.

“Plan Change 1 is going to be a huge one for Waikato.

“Lot of farmers are seeing all these things and margins are just as tight.”

A 20ha block of land for sale around the corner from Reymer was on his radar for 20 years.

However, he could not afford it now.

“My monthly mortgage bill almost doubled from 18 months ago. Same farmer, same mortgage, same land, and I am paying more.

“And I am looking at milk prices, and it is dropping.”

ANZ agricultural economist Susan Kilsby says many farmers were seeing their interest costs double.

Back in Morrinsville, a fencing company principal, who asked not to be named had seen a downward trend in sales from August last year.

The additional compliance cost on farmers was diverting their spend from one end to another, he said.

“Higher priority jobs take precedence. Fencing can wait another year.

“The Fonterra forecast is trending down, so it is going to get worst before it gets better.”

ANZ agricultural economist Susan Kilsby said many farmers were seeing their interest costs double as they rolled off fixed rates.

“If you’re too leveraged and you are not as financially secure, it makes it challenging to get through times like at present when costs have gone up and incomes down.

“It’s certainly making it tougher. There is a higher likelihood of failure.”

Annual inflation plummeted to 6.7% on Thursday, much larger drop than economic forecasters had been expecting. For farmers, however, things weren’t likely to change a lot, Kilsby said.

“Inflation is still really high at the moment.

“We did have a drop and most of that was in the part of the inflation that’s offshore rather than our domestic side of things.

“So we are still expecting the Reserve Bank to put interest rates up, another 25 basis points or a quarter of a percent at the next review.”

Kilsby said the interest rates were expected to hold at high levels through to the end of 2023.

“So that financial pressures are going to remain for a while yet.”

She said the tighter financial conditions would typically see farmers pull back discretionary spending like maintenance and capital purchases which would flow through the economy, impacting everything from plumbers and electricians to local car sales businesses.

This was especially the case in rural service towns around the Waikato.

A Sportscraft Morrinsville spokesperson said there were hardly any boat sales happening. Around 90% of their customers were from Auckland, but even the small portion of local customers were nowhere to be seen.

“People just don’t have money and boats are luxury items.

“There was a little bit of movement in second hand sales of boat around Christmas, but even that has dropped now.”

Waikato Sheds Company has forward orders for an entire year, says general manager Jason Davis.

But, not all businesses were seeing a decline in sales.

A spokesperson from Peter Glidden Honda, which supplies and repairs farm bikes, said uptake was “still pretty good”.

“For us, it has just been normal and average.”

Waikato Shed Company in Eureka general manager Jason Davis said: “It has been busy. It had gone nuts around Covid, but it has now slowed down, but there is still massive strength to Waikato economy.

“As far as the economy is going, it is still pretty strong. We have got forward orders for an entire year.”

The company sold high-end stell sheets and did industrial and residential work.

“We will sell bit through retired dairy farmers, but our clients are engineers, fertilizer (spreaders), mechanics, the endless economy that surrounds around all the farms.

“It (sales) was crazy at one point, and it is coming back to some normality.”