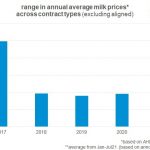

The company’s opening forecast for the 2022 season is $8, which is also the midpoint of Fonterra’s wide $7.25-$8.75 prediction band.

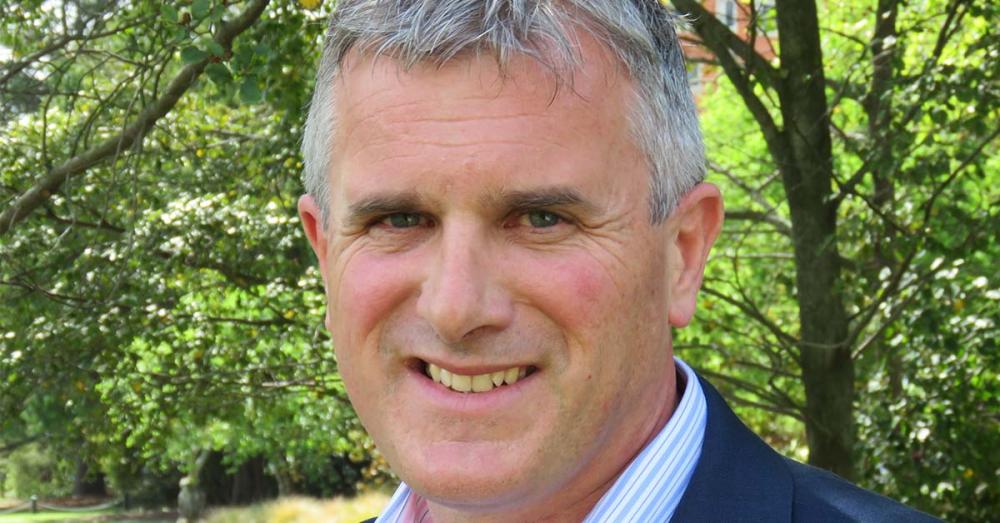

Chief executive John Penno, back in the hot seat after 30 months occupation by Leon Clement, has forecast a base milk price of $7.55/kg milksolids for the 2021 payout.

“Commodity prices have continued to outperform our expectations, predominantly due to strong Chinese demand,” Penno said.

“When combined with a relatively stable foreign exchange rate, we are pleased to increase our forecast for this season and next.”

In the 2020 financial year, Synlait also paid an average 25c incentives and premiums.

Should that recur, then its 250 farmer-suppliers would receive, on average, $7.80, which would exceed Fonterra’s current range of $7.45-$7.65.

On May 24 Synlait downgraded its FY2021 guidance to a net profit after tax loss between $20 million and $30m, compared with plus $75m in FY2020.

As a public company with two dairy industry cornerstone shareholders, Bright Dairy of Shanghai and a2 Milk Company (a2MC), Synlait directors have chosen to match or exceed Fonterra’s milk payouts instead of boosting profitability.

Fonterra has begun a capital and share standard restructure designed to make it financially easier for farmers to join and supply milk.

Fonterra is also likely to pay a dividend of 20c/share on top of its final 2021 milk price.

The final milk prices of both Fonterra and Synlait will not be known until late September, along with the annual results.

Synlait shareholders would have had no expectation of a dividend in FY2021 because it has reinvested all profits until now in the expansion of the company.

Since the height of sharemarket enthusiasm for Synlait two years ago, its share price has fallen from $10 to $3 currently.

Much of that fall has been in the past eight months following a2MC’s regular downgrades of revenue and margin forecasts that stem from covid-19 disruption to its daigou trading channel for infant formula into China.

Synlait is the biggest supplier of a2 infant base powder.

The share price for a2MC peaked at $21.50 last August.

Combined with its extraordinarily large number of 743m shares, it meant the company had the largest market capitalisation on the NZX of $16 billion.

After the trading downgrades that share price has fallen to around $5.90 and the market capitalisation has shrunk to $4.3b, smaller than Fonterra.

Like Synlait, a2MC has traditionally not paid a dividend and the investors in that huge share registry can only wait until trading conditions improve before the share price may rise again.