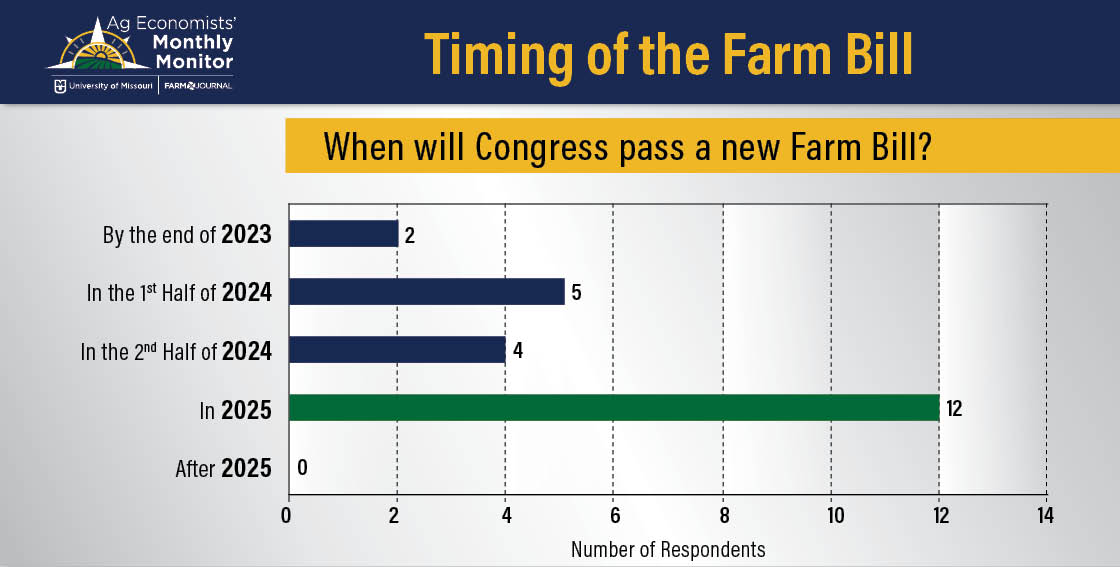

Of those surveyed, 50% think it will be 2025 before Congress passes a new farm bill. 20% think it could happen within the first half of 2024.

“Historically, when you get the alignment of a farm bill with that presidential election cycle, you tend to see people want to wait until after that cycle to see what changes – either colors over the White House or within the house of Congress itself,” Tackach says. “So, I think that’s what the economists are reacting to. This is a presidential election year next year and we’ve got some things we need to address in terms of budgets and funding of the government just in general coming up in November.”

He says economists are taking note of the political realities of what happens in an election year, but also the ag economic picture.

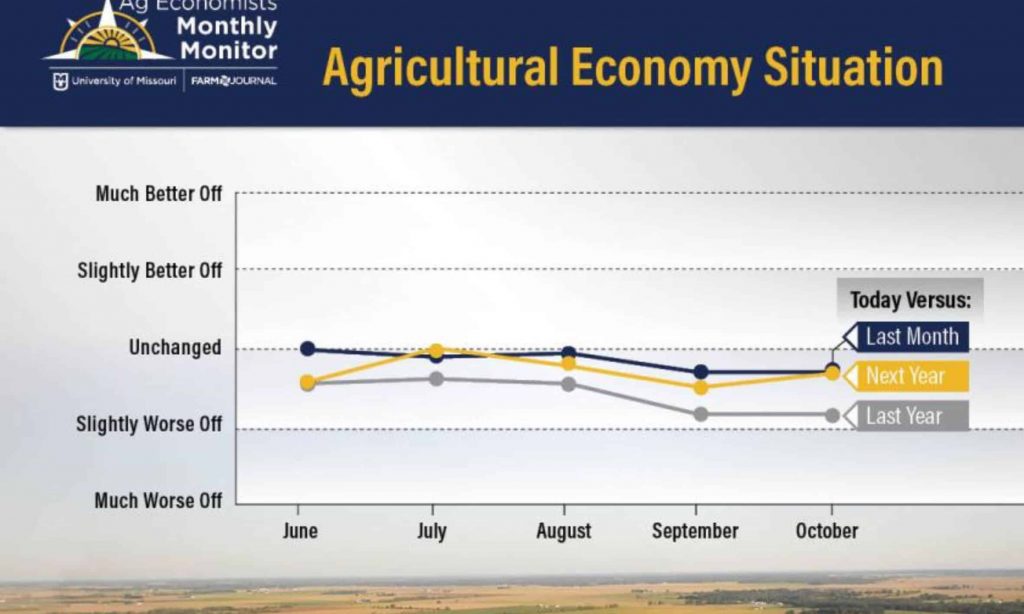

“The ag economy is generally healthy. So, a lot of these changes that you might typically see in a farm bill year, maybe some of them can wait with an extension of the existing provisions and budget allocations,” he says.

Economists even disagree on timing of a farm bill extension. Of those surveyed, the majority think Congress will pass an extension, while two think it will fail to do so. Of those who think Congress will move on an extension, the majority think it’ll happen before the end of this year.

Top Two Factors That Could Shape Agriculture Over the Next 12 Months

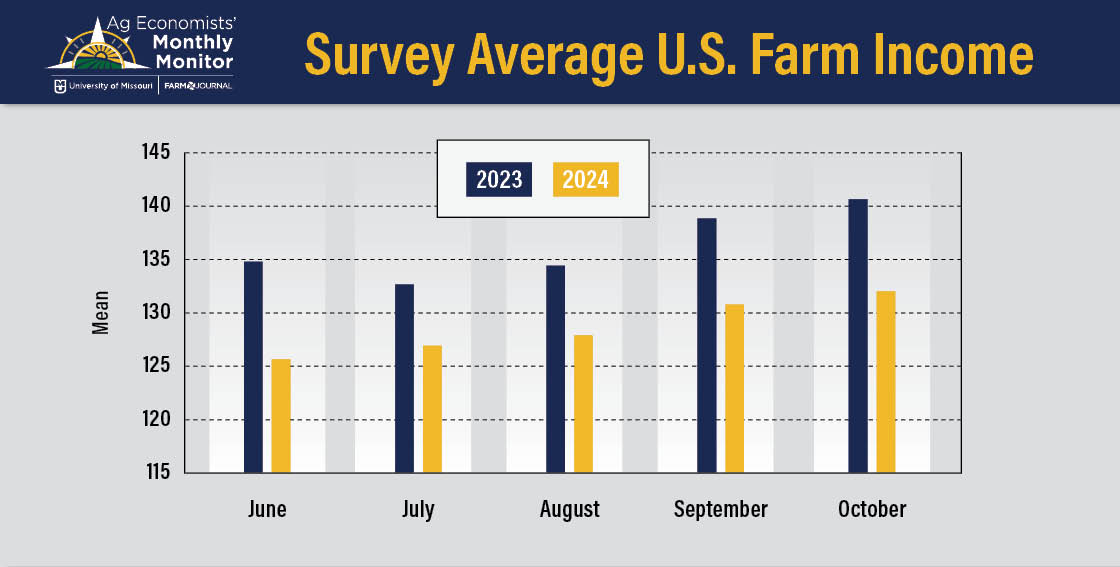

If Congress is unable to pass a new farm bill before 2025, economists worry farmers could face crop prices below break-even. When asked what they think are the two most important factors that could shape agriculture over the next 12 months, rising costs and declining crop prices were some of the top concerns.

- “Crop margins are considerably tighter than they were last year. In addition to relatively high breakeven prices, crop prices are much lower this fall,” responded one economist.

- “Today: weaker commodity prices for crops, high interest rates; 12 month: I expect lower input costs,” said another economist.

- “Today- commodity prices and working capital; 12 Months- interest rates and production,” an economist said in the October survey.

- “Impact from escalating interest rates. Disappointing export sales,” was another response.

- “The outlook for commodity prices and for input costs. In 2023, commodity prices have declined, while input costs remain high. In 2024, both may be lower than in 2023,” responded one economist.

Takach points out balance sheets are healthy today, but there are rising concerns about the cost side of them.

“Balance sheets are incredibly strong. We got a couple of years of really strong incomes and farmers and ranchers socked away a lot of that cash. I’ve rebuilt our working capital after several years of maybe tighter margins in 2018/2019. So, replenishment of that working capital was a welcome sign for ag lenders. But of course, for those farm families in ‘23, you do see those higher costs: higher cost of land, higher cost of interest, higher costs of labor. All those sorts of things start to eat into the cost of production,” he says.

Looking Ahead to the Next 6 Months

Economists were also asked what factors will impact crop and livestock prices over the next 6 months.

For crops, they said:

- South American production and weather favorability.

- Export competition from Russia and Brazil.

- Global factors including economic health, geopolitical risks, dollar strength and demand impacts on export volumes.

- Domestic demand and final size of the 2023 crop.

For livestock, they said:

- Tight cattle/beef supplies, sow herd liquidation.

- Cost of production, including feed costs and interest rates.

-

Of those surveyed, 50% think it will be 2025 before Congress passes a new farm bill. 20% think it could happen within the first half of 2024.

“Historically, when you get the alignment of a farm bill with that presidential election cycle, you tend to see people want to wait until after that cycle to see what changes – either colors over the White House or within the house of Congress itself,” Tackach says. “So, I think that’s what the economists are reacting to. This is a presidential election year next year and we’ve got some things we need to address in terms of budgets and funding of the government just in general coming up in November.”

He says economists are taking note of the political realities of what happens in an election year, but also the ag economic picture.

“The ag economy is generally healthy. So, a lot of these changes that you might typically see in a farm bill year, maybe some of them can wait with an extension of the existing provisions and budget allocations,” he says.

Economists even disagree on timing of a farm bill extension. Of those surveyed, the majority think Congress will pass an extension, while two think it will fail to do so. Of those who think Congress will move on an extension, the majority think it’ll happen before the end of this year.

Top Two Factors That Could Shape Agriculture Over the Next 12 Months

If Congress is unable to pass a new farm bill before 2025, economists worry farmers could face crop prices below break-even. When asked what they think are the two most important factors that could shape agriculture over the next 12 months, rising costs and declining crop prices were some of the top concerns.

- “Crop margins are considerably tighter than they were last year. In addition to relatively high breakeven prices, crop prices are much lower this fall,” responded one economist.

- “Today: weaker commodity prices for crops, high interest rates; 12 month: I expect lower input costs,” said another economist.

- “Today- commodity prices and working capital; 12 Months- interest rates and production,” an economist said in the October survey.

- “Impact from escalating interest rates. Disappointing export sales,” was another response.

- “The outlook for commodity prices and for input costs. In 2023, commodity prices have declined, while input costs remain high. In 2024, both may be lower than in 2023,” responded one economist.

Takach points out balance sheets are healthy today, but there are rising concerns about the cost side of them.

“Balance sheets are incredibly strong. We got a couple of years of really strong incomes and farmers and ranchers socked away a lot of that cash. I’ve rebuilt our working capital after several years of maybe tighter margins in 2018/2019. So, replenishment of that working capital was a welcome sign for ag lenders. But of course, for those farm families in ‘23, you do see those higher costs: higher cost of land, higher cost of interest, higher costs of labor. All those sorts of things start to eat into the cost of production,” he says.

Looking Ahead to the Next 6 Months

Economists were also asked what factors will impact crop and livestock prices over the next 6 months.

For crops, they said:

- South American production and weather favorability.

- Export competition from Russia and Brazil.

- Global factors including economic health, geopolitical risks, dollar strength and demand impacts on export volumes.

- Domestic demand and final size of the 2023 crop.

For livestock, they said:

- Tight cattle/beef supplies, sow herd liquidation.

- Cost of production, including feed costs and interest rates.

-

Of those surveyed, 50% think it will be 2025 before Congress passes a new farm bill. 20% think it could happen within the first half of 2024.

“Historically, when you get the alignment of a farm bill with that presidential election cycle, you tend to see people want to wait until after that cycle to see what changes – either colors over the White House or within the house of Congress itself,” Tackach says. “So, I think that’s what the economists are reacting to. This is a presidential election year next year and we’ve got some things we need to address in terms of budgets and funding of the government just in general coming up in November.”

He says economists are taking note of the political realities of what happens in an election year, but also the ag economic picture.

“The ag economy is generally healthy. So, a lot of these changes that you might typically see in a farm bill year, maybe some of them can wait with an extension of the existing provisions and budget allocations,” he says.

Economists even disagree on timing of a farm bill extension. Of those surveyed, the majority think Congress will pass an extension, while two think it will fail to do so. Of those who think Congress will move on an extension, the majority think it’ll happen before the end of this year.

Top Two Factors That Could Shape Agriculture Over the Next 12 Months

If Congress is unable to pass a new farm bill before 2025, economists worry farmers could face crop prices below break-even. When asked what they think are the two most important factors that could shape agriculture over the next 12 months, rising costs and declining crop prices were some of the top concerns.

- “Crop margins are considerably tighter than they were last year. In addition to relatively high breakeven prices, crop prices are much lower this fall,” responded one economist.

- “Today: weaker commodity prices for crops, high interest rates; 12 month: I expect lower input costs,” said another economist.

- “Today- commodity prices and working capital; 12 Months- interest rates and production,” an economist said in the October survey.

- “Impact from escalating interest rates. Disappointing export sales,” was another response.

- “The outlook for commodity prices and for input costs. In 2023, commodity prices have declined, while input costs remain high. In 2024, both may be lower than in 2023,” responded one economist.

Takach points out balance sheets are healthy today, but there are rising concerns about the cost side of them.

“Balance sheets are incredibly strong. We got a couple of years of really strong incomes and farmers and ranchers socked away a lot of that cash. I’ve rebuilt our working capital after several years of maybe tighter margins in 2018/2019. So, replenishment of that working capital was a welcome sign for ag lenders. But of course, for those farm families in ‘23, you do see those higher costs: higher cost of land, higher cost of interest, higher costs of labor. All those sorts of things start to eat into the cost of production,” he says.

Looking Ahead to the Next 6 Months

Economists were also asked what factors will impact crop and livestock prices over the next 6 months.

For crops, they said:

- South American production and weather favorability.

- Export competition from Russia and Brazil.

- Global factors including economic health, geopolitical risks, dollar strength and demand impacts on export volumes.

- Domestic demand and final size of the 2023 crop.

For livestock, they said:

- Tight cattle/beef supplies, sow herd liquidation.

- Cost of production, including feed costs and interest rates.

- Confidence in domestic consumer demand, export opportunities.Confidence in domestic consumer demand, export opportunities.Confidence in domestic consumer demand, export opportunities.Competing issues and priorities, paired with limited time on the legislative calendar and no urgency around agriculture.

- Of those surveyed, 50% think it will be 2025 before Congress passes a new farm bill. 20% think it could happen within the first half of 2024.

“Historically, when you get the alignment of a farm bill with that presidential election cycle, you tend to see people want to wait until after that cycle to see what changes – either colors over the White House or within the house of Congress itself,” Tackach says. “So, I think that’s what the economists are reacting to. This is a presidential election year next year and we’ve got some things we need to address in terms of budgets and funding of the government just in general coming up in November.”

He says economists are taking note of the political realities of what happens in an election year, but also the ag economic picture.

“The ag economy is generally healthy. So, a lot of these changes that you might typically see in a farm bill year, maybe some of them can wait with an extension of the existing provisions and budget allocations,” he says.

Economists even disagree on timing of a farm bill extension. Of those surveyed, the majority think Congress will pass an extension, while two think it will fail to do so. Of those who think Congress will move on an extension, the majority think it’ll happen before the end of this year.

Top Two Factors That Could Shape Agriculture Over the Next 12 Months

If Congress is unable to pass a new farm bill before 2025, economists worry farmers could face crop prices below break-even. When asked what they think are the two most important factors that could shape agriculture over the next 12 months, rising costs and declining crop prices were some of the top concerns.

- “Crop margins are considerably tighter than they were last year. In addition to relatively high breakeven prices, crop prices are much lower this fall,” responded one economist.

- “Today: weaker commodity prices for crops, high interest rates; 12 month: I expect lower input costs,” said another economist.

- “Today- commodity prices and working capital; 12 Months- interest rates and production,” an economist said in the October survey.

- “Impact from escalating interest rates. Disappointing export sales,” was another response.

- “The outlook for commodity prices and for input costs. In 2023, commodity prices have declined, while input costs remain high. In 2024, both may be lower than in 2023,” responded one economist.

Takach points out balance sheets are healthy today, but there are rising concerns about the cost side of them.

“Balance sheets are incredibly strong. We got a couple of years of really strong incomes and farmers and ranchers socked away a lot of that cash. I’ve rebuilt our working capital after several years of maybe tighter margins in 2018/2019. So, replenishment of that working capital was a welcome sign for ag lenders. But of course, for those farm families in ‘23, you do see those higher costs: higher cost of land, higher cost of interest, higher costs of labor. All those sorts of things start to eat into the cost of production,” he says.

Looking Ahead to the Next 6 Months

Economists were also asked what factors will impact crop and livestock prices over the next 6 months.

For crops, they said:

- South American production and weather favorability.

- Export competition from Russia and Brazil.

- Global factors including economic health, geopolitical risks, dollar strength and demand impacts on export volumes.

- Domestic demand and final size of the 2023 crop.

For livestock, they said:

- Tight cattle/beef supplies, sow herd liquidation.

- Cost of production, including feed costs and interest rates.

- Confidence in domestic consumer demand, export opportunities.