Record High Butterfat Content Sparks Debate Over Prices and Dairy Market Strategy.

Not all that long ago, milk was milk. But today, milk’s components are evolving fast, particularly butterfat content.

Thanks to advances in dairy cow genetics and feed strategies, butterfat levels in U.S. milk are climbing. For producers, handlers, and processors alike, this shift is both an opportunity and a challenge.

The good: Higher butterfat means more cream, more butter, and potentially greater product yields.

The bad: Higher butterfat complicates supply and demand dynamics in a market already notorious for volatility.

The question: What’s really happening in the butterfat economy, and where does it go from here?

The rise of butterfat

Butterfat isn’t just going up: it’s booming.

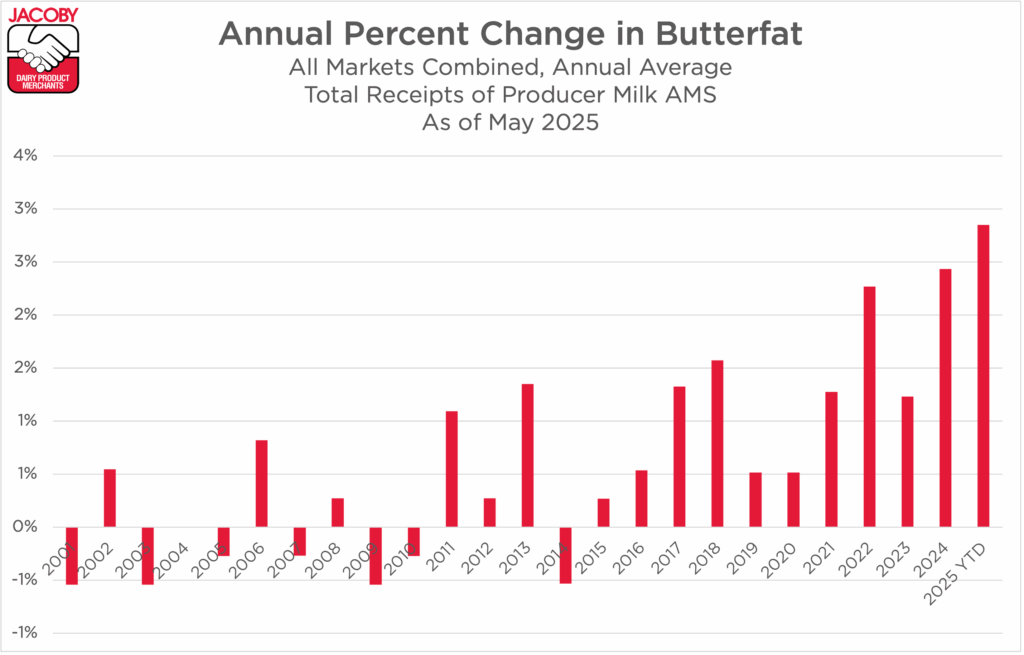

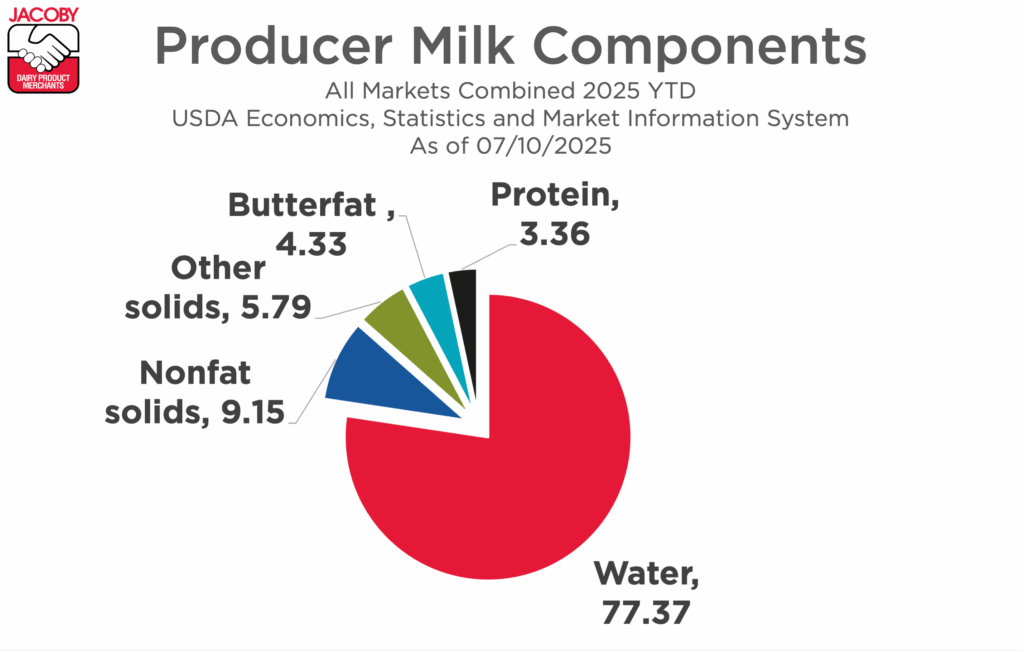

In the early 2000s, the annual butterfat percentage as a component of milk was fairly stable. Across all U.S. markets combined, butterfat was typically up or down by a percentage or so annually. But starting in 2015, the percentage of butterfat as a component of milk increased every single year.

This year, we’ve seen the increase in butterfat continue. In December 2024, U.S. data for All Markets Combined shows a new record, with butterfat making up 4.42 % of total milk components. Then that record was toppled the very next month in January 2025 at 4.43%. In fact, the five highest monthly butterfat percentages for all U.S. markets combined all occurred within the last 12 months, reflecting a rapid and significant upward trend in U.S. milkfat levels.

According to data from multiple U.S. milk sheds, average butterfat percentages have climbed (with seasonal variation) over the past decade, and the curve is steepening.

https://www.jacoby.com/wp-content/uploads/2025/07/Butterfat-recording.mov

One reason? Butterfat is easier to breed and feed for than any other component, and breeding programs have increasingly prioritized it over sheer volume.

“We’ve gone through so many technologies like selection for fitness, longevity, and fertility, and then we went through genomic technology that’s had a huge impact on the industry,” Nate Zwald, president and COO of Progenco and former CEO of ABS Global said in a recent episode of The Milk Check. “More recently, sex semen and the use of beef on dairy cows have all had substantial changes to the genetic progress curve.”

At the same time, dairy farmers are implementing targeted feeding strategies to further enhance butterfat output, such as:

- Enriching diets with high-oleic soybeans to increase milkfat yield without depressing protein

- Supplementing with live yeast to boost digestibility and milkfat output

- Balancing unsaturated fatty acids to enhance milk fat synthesis by supporting fat storage (triacylglycerol accumulation) and key gene expression

Together, these breeding and feeding advances are enabling U.S. herds to produce richer milk without sacrificing yield.

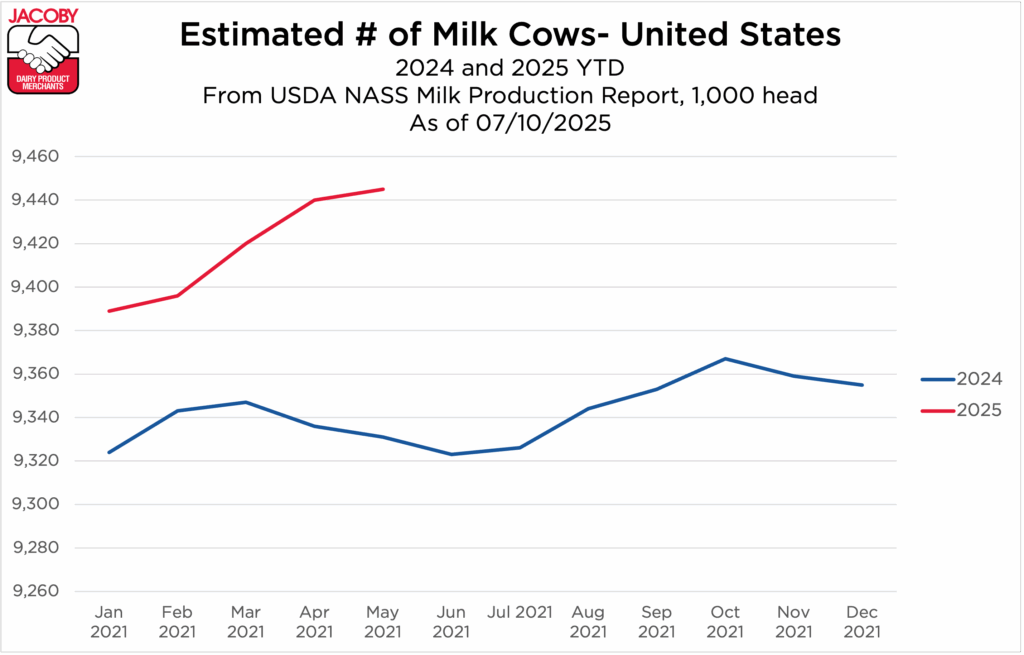

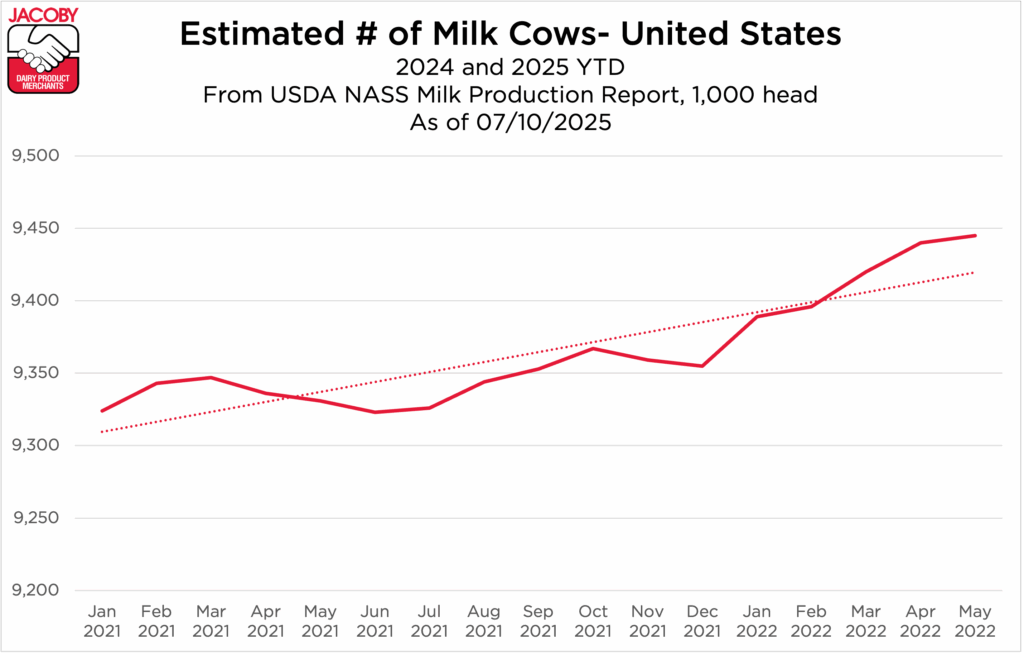

The genetic gains boosting butterfat are now being multiplied by herd growth. As stated in our June 27 Market Report, the U.S. added 122,000 cows in under a year, with expansion centered in regions where new processing plants are opening.

Can butterfat keep rising?

With butterfat on the rise, many may be wondering if the sky is the limit with butterfat percentage. But research has shown that there is a biological ceiling. The availability of short- and medium-chain fatty acids may limit increases in milk fat synthesis. While cows can push the fat curve higher, biology eventually sets the limit.

Seasonal variation also plays a role. Butterfat concentrations peak in winter and dip in summer, following a well-documented annual rhythm in milk composition across U.S. dairy herds.

But overall, in the last few years, butterfat has blossomed. All this progress has resulted in more butterfat than ever flowing into the marketplace. But while farmers have successfully boosted production, the value story hasn’t followed the same upward trajectory.

The market conundrum: More fat, lower prices?

You’d think more butterfat would mean more money. And on a per-unit basis, it does. Component pricing structures reward producers for fat, and margins per hundredweight of milk have improved for many dairies thanks to rising component concentrations.

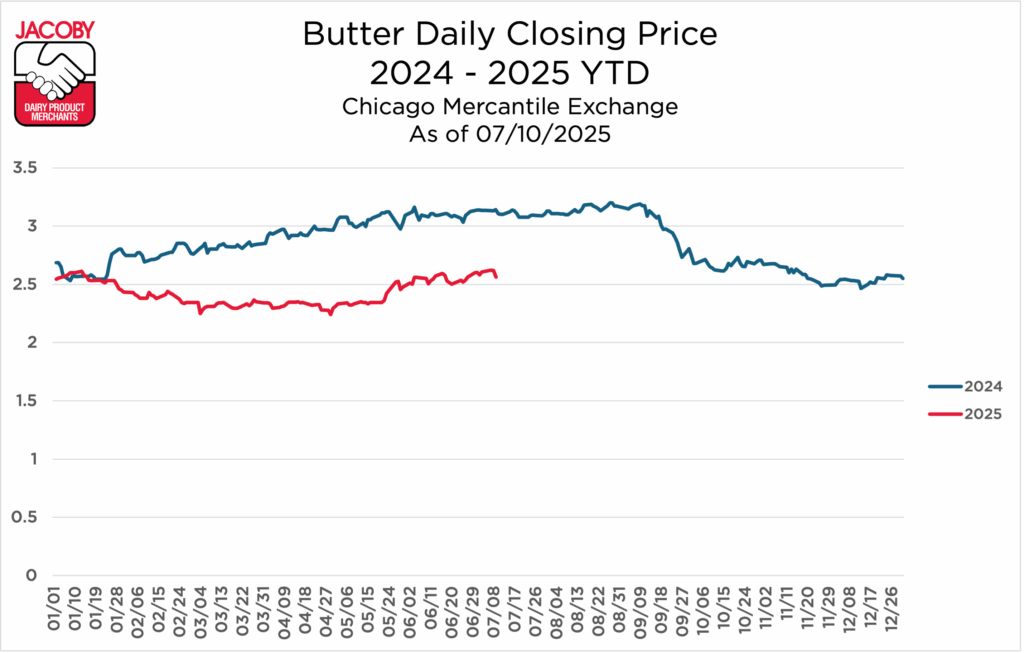

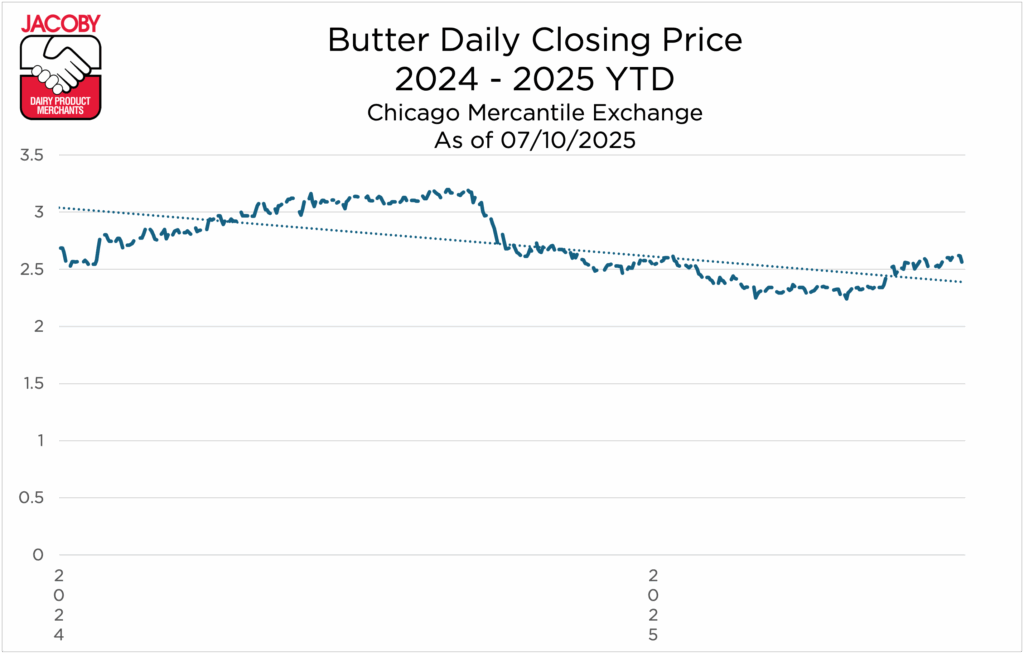

But at the macro level, the story is more complex. As butterfat supply rises faster than demand growth, prices face downward pressure. Butter prices on the Chicago Mercantile Exchange (CME) have remained under pressure despite record-high component levels and strong export interest.

- Retail demand shows signs of weakening. Recent USDA data shows butter prices have softened even amid strong international demand. Even after the spring flush, milk volumes remain heavier than anticipated, evidence that the U.S. butterfat surplus is more structural than seasonal.

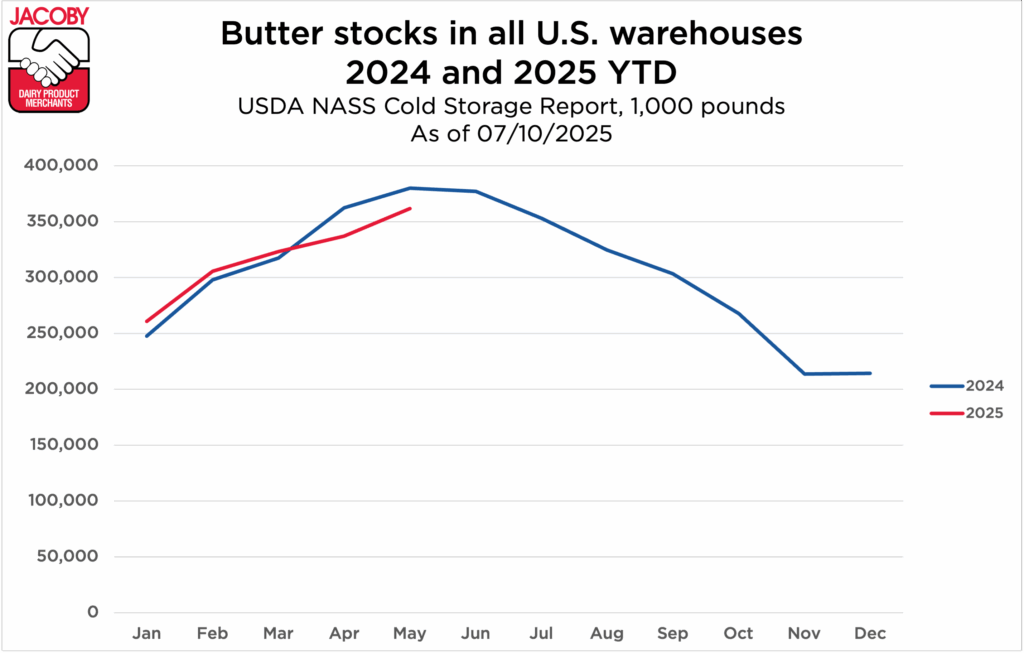

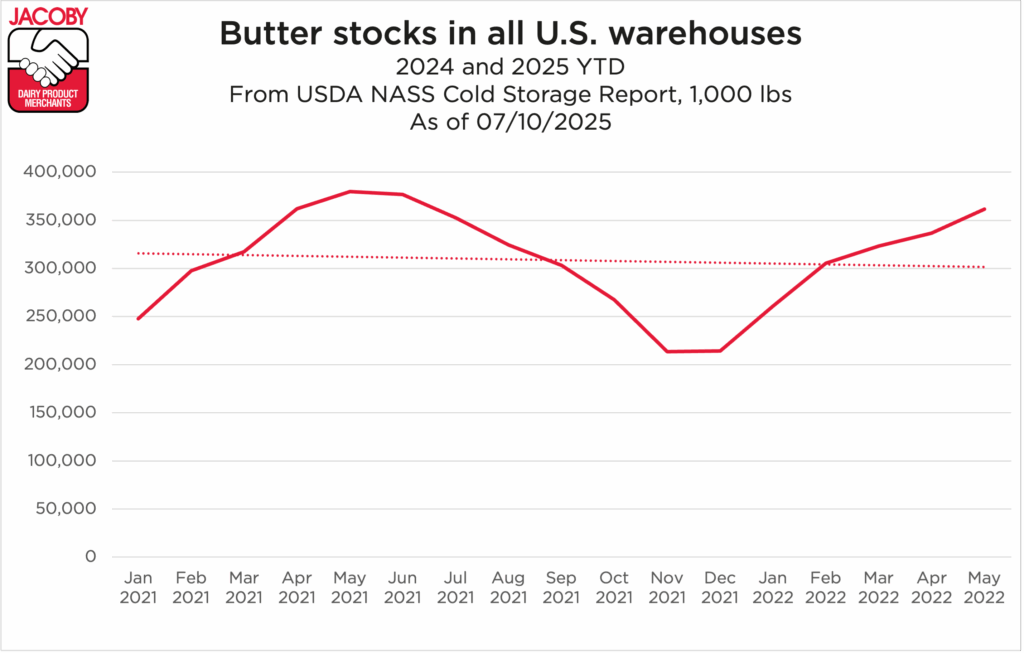

- Inventories are elevated. Butter stocks remain elevated, indicating that the U.S. is churning more butterfat than the market can currently absorb.

- Bulk butter surpluses vary by region. Bulk butter overages range widely, with some processors reporting surpluses due to cream constraints or churn limitations. We’ve hit the summer heat in most areas of the country, so the seasonal decline in milk supply may be upon us.

In essence, the U.S. is producing more butterfat than it can absorb at premium prices, even as global buyers continue to express interest. Producers are milking more cows, more efficiently, with more butterfat, and the market is feeling the weight of that volume.

Structural Shifts: Cream Concentration and Churn Bottlenecks

A surge in butterfat has reshaped how milk is utilized. In 2025, Class IV products (butter and powder) accounted for over 25% of total milk utilization in some federal order areas, up significantly from historical norms.

In California, for example, more than 55% of milk is being directed toward Class IV, where processing infrastructure is already under strain. And while cheese makers (Class III) also benefit from higher components, they’re more limited in how much fat they can absorb into cheese yield.

That’s pushing cream into butter churns and saturating the market, a trend that marketers and co-op leaders must navigate carefully when aligning milk flows with processor needs.

Nutritional shifts: GLP-1 users may change component demand

In addition to structural shifts on the supply side, consumer demand is undergoing a major recalibration, especially among health-focused demographics.

We explore this in greater depth in our recent article on the rise of GLP-1 weight loss drugs and their ripple effects across food and beverage preferences. These medications are changing how people eat, with a noticeable pivot toward high-quality, high-bioavailability proteins. As a result, while milkfat-rich products may see softer demand among calorie-conscious consumers, protein-centric dairy, particularly whey, could benefit from a demand surge.

Producers and processors may want to consider aligning component strategies not just with processor specs, but with consumer dietary shifts shaped by these emerging pharmaceutical trends.

Implications for dairy strategy

The rise in butterfat is not temporary. It’s a structural shift driven by long-term investments in genetics and feeding. That means processors and marketers must adapt, not resist.

Following are three strategic considerations:

For producers: Rethink component targets

Producers may want to consider shifting toward maximizing protein. Protein still commands strong prices, especially for processors targeting whey and nutritional ingredients for an increasingly nutrition-conscious consumer. For processors focused on protein recovery, such as those producing nutritional powders, a shift too far toward fat can reduce marketability in some product streams.

For handlers: Align nilk utilization with market value

The current federal milk marketing system isn’t designed to flex quickly with market shifts. While groups like the National Milk Producers Federation (NMPF) have petitioned the USDA to update outdated pricing assumptions, there’s also a need for greater operational agility. Those who work closely with multi-class processors or have the flexibility to adjust utilization quickly will be best positioned to manage component surpluses and capture value.

For processors: Expand value-added butter markets

From grass-fed to cultured, premium butter is gaining traction. Processors who can innovate in this space may unlock higher margins and help absorb surplus fat more profitably, both domestically and in export markets.

Final thought: A richer milk, a tighter margin

Butterfat is valuable, but as with any agricultural product, too much of a good thing can squeeze margins. Success depends on strategic alignment between cow, creamery, and customer, from genetics and feed on the farm to product mix and pricing.

Success – and survival – goes to those who can turn rich milk into richer margins.