With things relatively quiet on the dairy front in New Zealand (Westland aside), I took the opportunity to take a look and see what was happening in Ireland as they have some similarities to New Zealand, especially when compared to other northern hemisphere countries.

An increasing amount of Irish milk is being derived from pasture-based systems. Approaching 80% of the Irish dairy cows diet comes from grazed pasture. This compares to globally only 10% of total milk production is pasture based.

This reaffirms the need for New Zealand to highlight this attribute of its dairy system as it is generally considered to provide a tastier and healthier product, as well as being cheaper to produce.

An Irish report of some interest highlighted the fact that pasture with a clover content also increased milk solid yield by 39kg MS/cow compared to the grass only diet – something that many New Zealand dairy farms have moved away from.

From this point similarities start to dwindle. The average Irish dairy farm is around 70 ha with a herd size of 80-90 cows on 15,000 dairy farms.

The milk market in Ireland is also closely linked to the Global Dairy Trade auction price signals, and although the Irish Creamery Milk Suppliers’ Association’s (ICMSA’s) dairy chairperson, Ger Quain, believed the basics of supply and demand were sound, but the uncertainty surrounding international trade which is being reflected in the GDT price drops and were affecting buyers confidence.

Notable issues mentioned were the issues around Brexit which look set to continue for some time yet; the current USA – Iran tensions and their affect upon oil supply; the continuing trade war between the USA and China. The decision of the European Central Bank to lower interest rates to try and stimulate EU economies have also led to some being worried about a looming slowdown. Finally, there is a perception that markets are overreacting to possible changes to western tastes for dairy products. In 2018 Irish dairy farms experienced a 25% drop in profit, providing subsidies are excluded. And to bolster income, over 70% of dairy farm households had an off farm income source.

When it comes to Irish agriculture’s greenhouse gas emissions, they look set to increase in the short term with an increase in animal numbers. Ireland is out of step with the rest of the EU and the UK and its emissions profile is on the increase.

Like New Zealand, agriculture makes up the biggest proportion of Ireland’s emissions, however their reduction requirements are more like New Zealand’s pre 2019 with no specific targets other than being encouraged to reduce fertiliser and use “smart practices”, and these include using methane reducing feeds. As with New Zealand, some of these technologies are unproven or will have limited impact upon emissions. Some have suggested a cull of dairy cow numbers (sounds familiar) but is not considered to be politically viable.

powered by Rubicon Project

Overall in Ireland, the State is required to reduce emissions by 30% between 2021 and 2030 but the focus appears to be on encouraging electric vehicles uptake with the target of 980,000 by 2030 and an increasing amount of home energy production.

Landowners are also encouraged to increase annual forestry planting from 5,500 ha per annum to 10,000 ha. However, farmers have reduced their planting of trees in the last decade and seem reluctant to accept afforestation. Subsidies will be used to encourage farmers rather than force them down this pathway.

The new Common Agriculture Policy after 2020 (which applies to Ireland) will also reward sustainability, carbon sinks and climate protection, encouraging some farmers to diversify from livestock. A carbon tax will be introduced to most sectors (I don’t believe this will apply to agriculture) going up in steps to €80 per tonne of carbon.

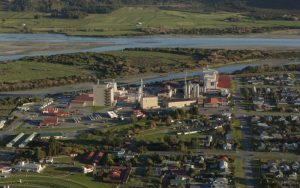

The Westland / Yili end game

Closer to home, Westland Chairman, Pete Morrison is urging all shareholders to exercise their right to vote on the Yili purchase of all Westland shares at, or before, the Scheme Meeting on 4 July. The price offered at $3.41 is more than double the current share value. Southern Pastures’ part owners of Lewis Road Creamery and the largest shareholder of Westland (although just coming on board last year) have said they will not participate in the voting as they feel being new and on the Canterbury side of the ranges they have options other traditional shareholders don’t have.

Yili is having a battle in China over its position as sole sponsor of dairy products to the 2022 Winter Olympics being held in China. Main rival Mengniu have managed to slip in as “Joint beverage global supplier” through its relationship with Coca Cola. Yili is the largest player in China’s $62 billion Chinese dairy industry with a 24% share with Mengniu not far behind with 22% and are fierce rivals. Yili has warned it may pull out as main sponsor unless the matter is sorted. Given the amount of dairy product that will be coming out of New Zealand, having Yili keeping its position won’t hurt. Although how much will filter down to the farm is questionable.