Avolatile economic, political, and environmental climate has affected the entire dairy supply chain in recent years. Executives of dairy companies have had to navigate inflation, supply chain challenges, labor shortages, and climate change, not to mention changing regulations and political conflict. At the same time, the dairy industry has been a site of innovation, with the entrance of new products to the market, shifting consumer awareness, and increasing competition.

Amid these challenges, dairy executives have had to prioritize where to direct their companies’ resources and attention. The choice hasn’t been easy: a number of pressing concerns have required strategic decisions and thoughtful responses.

To gain insights into the strategic priorities of dairy industry leaders in today’s world, McKinsey conducted its fifth annual survey of dairy executives as well as almost 50 interviews with industry leaders (see sidebar, “About the research”). In this article, we examine the results, exploring dairy executives’ top strategic priorities of growth, resilience, and sustainability. Despite current geopolitical and economic volatility, we heard great excitement and optimism for the future of dairy in North America.

Three priorities for executives

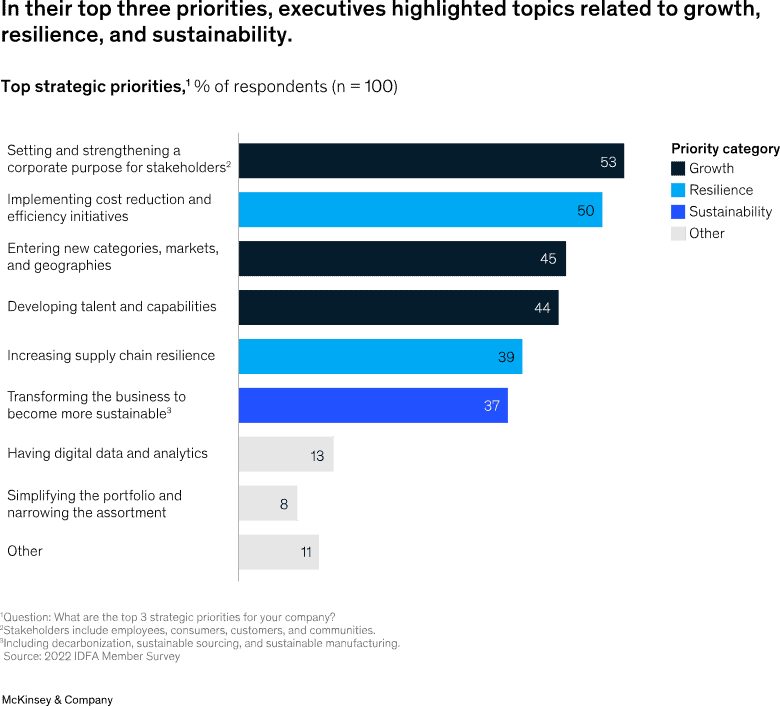

Among a range of options, a few areas stood out as key priorities for leaders in dairy: growth, resilience, and sustainability (exhibit). In terms of growth, leaders are considering expanding into new categories, markets, and geographies and thinking about the roles that company purpose and critical stakeholders play. In terms of resilience, supply chain and cost-related challenges are top of mind. Last, sustainability concerns are gaining ground.

Exhibit

Growth

Three of the four most cited strategic priorities relate to supporting company growth, highlighting executives’ focus on the topic.

Leading with purpose and collaborating more effectively

Of the executives we surveyed, 53 percent cited “setting and strengthening a corporate purpose for stakeholders” as a top three strategic priority for their company. A high level of interest in corporate purpose makes sense: purpose provides value for consumers and employees and could lead to better company performance.

Research has linked companies that have a clear purpose with greater success in company growth, global expansion, number of product launches, and transformations, compared with companies lacking a clear purpose.1

Beyond benefits at the corporate level, company purpose also benefits employee stakeholders. When employees can live their purpose at work, they are not only more productive, healthy, and resilient but also more likely to stay at the company and contribute to its success.2

In addition to perceiving the value of company purpose, dairy executives have also been prioritizing stakeholder relationships in the broadest sense. The COVID-19 pandemic has changed the way dairy stakeholders interact across the value chain, requiring executives to step up.

Some executives are taking new actions to care for their employees, from making sure employees’ voices are heard to providing employee housing and transportation. Also, almost 70 percent of respondents are now collaborating in some way with other stakeholders, from farmers and suppliers to research institutions. Companies that do not typically work together are also collaborating.

For example, dairy exporters, a trade association, ports, and shipping lines came together in 2022 to discuss shipping challenges facing the industry, breaking down historical barriers to address pressing supply chain issues.

With an ‘all in it together’ mentality, industry stakeholders broke down historical barriers to reach a solution to our supply chain challenges. This would never have happened before the pandemic.

Dairy executive

Finding new ways for dairy to grow

Of the executives we surveyed, 45 percent cited “entering new categories, markets, and geographies” as a top three strategic priority for their company. Despite current challenges, including declining fluid-milk consumption, 45 percent of executives are prioritizing new growth opportunities, and most executives we spoke to expressed optimism about the future of dairy.

Executives are most excited about opportunities for the US dairy industry, given possible supply constraints in the European Union and Oceania and expectations that dairy consumption in Asia–Pacific will grow about 7 percent annually over the next five years.3 Amid these conditions, US dairy is well positioned to increase supply and help satisfy demand for dairy abroad.

This strategic focus on growth has been felt in dairy markets at home and around the world. From 2021 to 2022, the market for US dairy grew 3 percent overall (based on retail value), with yogurt and sour-milk products growing by 6 percent and drinking-milk products growing by 1 percent.

Globally, growth was 4 percent overall, 2 percent for yogurt and sour-milk products, and 5 percent for drinking-milk products.4 Accordingly, executives are investing in expanding capacity to meet this market demand: more than 20 industry stakeholders recently announced capital investments in the United States and Europe.

Despite the slowdown in the economy, dairy consumption has not gone down. We still have consumer loyalty. We are a staple; and on top of that, there are a lot of different, exciting forms of dairy products coming down the pipeline.

Dairy executive

Elevating the industry in a tough labor market

Of the executives we surveyed, 44 percent cited “talent and capability development” as a top three strategic priority for their company. Companies have found hiring and retaining talent difficult, with about 70 percent of executives in our 2022 survey noting concerns with labor.

This trend is not new: in our 2021 survey, a similar percentage of executives noted that labor shortages were a top three concern during the prior 12 months.5

Executives shared that these challenges are pushing them to rethink the workplace, consider what is most important to employees, and invest in people. Companies have been expanding the benefits they offer, including flexible scheduling, shorter workdays, additional pay and vacation, and even company-provided apartments and transportation.

It will be critical for companies to work with employees to improve hiring and retention and reduce the employer–employee mismatch in what they consider to be important. Clear alignment between employee needs and employer offerings may help the dairy industry tackle these labor challenges.6

We have great customers and a great product but not enough people to make it.

Dairy executive

Resilience

In addition to growth, a complex geopolitical climate and a volatile economic situation have made dairy executives prioritize resilience-building measures.

Adapting to unprecedented inflation

Half of the executives we surveyed cited “cost reduction and efficiency initiatives” as a top three strategic priority for their company. Input costs for dairy processors have risen remarkably over the past year. In September 2022, all milk prices were 33 percent higher than the year prior, compared with just a 2 percent increase from 2020 to 2021.7

This is in part due to dramatic increases in energy costs as well as costlier labor, with total compensation costs for civilian workers rising 5 percent from September 2021 to September 2022.8 Given the increasing cost of inputs, dairy processors are trying to balance three actions: reducing costs, increasing their prices, and, ultimately, squeezing their margins. About 75 percent of interviewed executives are concerned about the effects of inflation and have already taken actions to address supply-side challenges and a consumer side that has been hit hard by inflation.

It’s been hard to keep up with inflation; almost every quarter we need to revisit it because things are just moving so quickly. It remains an ongoing challenge.

Dairy executive

Prioritizing supply chain resilience

Of the executives we surveyed, 39 percent cited “increasing supply chain resilience” as a top three strategic priority for their company. It is no surprise that supply chain concerns are top of mind for executives, a result that was consistent across both our survey and our supplementary interviews: about 65 percent of interviewees noted the supply chain as a challenge for their company.

Supply chain problems have ranged from difficulty accessing materials to problems with shipping—resulting in delayed capital expenditure projects—inability to get certain ingredients, and overall inconsistency and unpredictability, among other consequences. In light of these challenges, executives have prioritized building supply chains that are more resilient.

It feels like we have been playing ‘whack-a-mole.’ From ingredients to supplies to distribution, there has been a new challenge each week.

Dairy executive

Sustainability

In addition to growth and resilience, executives highlighted sustainability as their third most important strategic priority, which aligns with the dairy industry’s commitment to net-zero emissions by 2050.

Committing to environmental sustainability

Of the executives we surveyed, 37 percent cited “transforming the business to become more environmentally sustainable” as a top three strategic priority for their company. The sizable minority of executives who rated sustainability transformations as a top priority exist in a broader pool of support for environmental, social, and governance (ESG) values.

Out of our survey sample, 75 percent of executives have a sustainability strategy or an ESG strategy (or both). Seventy-two percent have a board or leadership that actively oversees their sustainability programs, and 67 percent have allocated funds to these programs. These are important steps in promoting follow-through and impact. They also show progress: only 57 percent of companies in last year’s dairy executive survey said they were investing resources to align their business with their sustainability goals.

We don’t have time to see where the customer is going to be; we need to jump in together and solve it.

Dairy executive

Executives have reported that a number of stakeholder groups have also being driving recent improvements in sustainability efforts. Customers are one of the biggest drivers of sustainable practices among dairy processors: 70 percent of processors with sustainability or ESG strategies cited customer requirements as a top three motivator. These companies have also highlighted working closely with customers to meet their requirements.

Our sustainability and ESG strategy largely integrates the goals of customers.

Dairy executive

Investor pressures and regulatory requirements are less important than customer demand, but they still drive sustainability for processors, with 28 percent and 23 percent of companies citing these as top three motivators, respectively. Both investor pressures and regulatory requirements have the potential to change the competitive landscape when it comes to sustainability.

For example, if new regulation makes certain environmental changes mandatory for all companies, leaders in sustainability may need to find novel approaches to stand out from the crowd. This can simultaneously lead to collaborative sustainability improvements across the dairy industry and new opportunities for companies to compete on ESG, ultimately ensuring lasting environmental change.

Even if regulations don’t apply to us directly, they may impact our financial partners. Banking and insurance partners are asking about our sustainability programs: these questions can quickly shift to requirements.

Dairy executive

Looking ahead

Dairy processors stand to benefit from strategic priorities now and in the long term. Committing to growth, resilience, and sustainability priorities can help protect dairy processors as they face today’s challenges—including inflation, supply chains disruptions, labor shortages, and climate change—while positioning them to take advantage of future tailwinds related to growth, innovation, and new market opportunities.

I love this industry, and I love this product; milk is full of nutrients, and we’re just starting to scratch the surface…. Dairy has a lot more to do and grow.

Dairy executive

Despite the many challenges facing the industry, executives are excited about the future. Based on the insights gained from our interviews and our survey of dairy industry leaders, we have identified several actions companies can take to support the dairy industry’s growth:

-Pursue avenues for growth. This includes exploring new geographies to grow reach and developing products that align with consumers’ preferences for healthy eating.

-Strengthen corporate purpose. A sense of commitment can help build values-based connections with consumers and motivate in a challenging labor market.

-Invest meaningfully in sustainability. Careful investment can reduce dairy’s environmental footprint and mitigate against the negative impacts of climate change.

-Anticipate future pressures. This entails getting ahead of regulatory and consumer pressures and differentiating on ESG and sustainability.

-Consider industry-wide collaborations. Doing so can build sustainability practices and supply chains that are overall more robust.

These actions can help individual companies stand out while making the industry more robust, resilient, and sustainable.

The dairy industry has an opportunity to leverage the industry’s existing momentum to shift toward collective action. Together, industry stakeholders can address economic, social, and environmental challenges and proactively engage consumers and customers with a unified story that highlights the unique nutritional and environmental benefits of dairy.

ABOUT THE AUTHOR(S)

Christina Adams is a partner in McKinsey’s New York office; Ludovic Meilhac is a partner in the Stamford office; and Kate Toews is an associate partner in the Chicago office, where Roberto Uchoa is a senior partner.

The authors wish to thank Melanie Lieberman, Emmy Moore, Adele Wunsch, and Elizabeth Yablon for their contributions to this article.