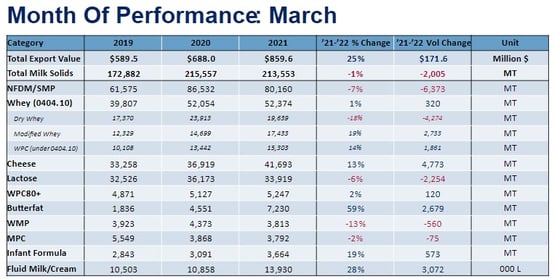

U.S. dairy exports in March nearly matched the record high of 2021, as total exports on a milk solids equivalent (MSE) basis decreased by less than 1%, a drop of only 2,005 metric tons (MT) MSE.

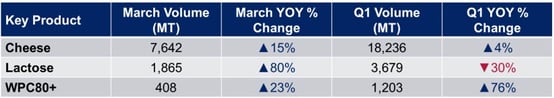

The strong performance of cheese (+13%, +4,773 MT), particularly cheddar (+86%, +3,596 MT), is a positive signal to the market, highlighting global consumers’ growing consumption of U.S.-made cheese.

Arguably, a recovery in low-protein whey exports (+1%, +320 MT) after three straight underwhelming months is the most bullish March indicator for future performance. But given the importance of China to the whey market, the country’s recent lockdowns and corresponding fallout regarding supply chains are likely to cause whey exports to fluctuate significantly in the short term.

More broadly, several short-term factors – constrained milk supplies, strong domestic demand early in the year limiting export availability, logistics frustration, and high prices slowing some global demand growth among lower-income consumers – have and continue to act as short-term headwinds to U.S. dairy export volume meeting or exceeding 2021 records.

Export value, on the other hand, continued to soar in March and looks poised to build off the success of 2021 as a result of the tight global market and increased U.S. shipments of higher-value products like cheese, butter and protein concentrates. Export value in March jumped 25% (+$172 million) to $860 million, the highest month on record by a considerable margin.

Below is how U.S. dairy exports fared to the major markets and our key takeaways.

MEXICO

-May-04-2022-08-04-15-26-PM.jpg?width=554&name=Chart2%20(2)-May-04-2022-08-04-15-26-PM.jpg)

- Key trend: High input costs are reportedly slowing Mexico’s domestic milk production growth, necessitating imports to meet domestic demand.

- Moving forward: Given the tight milk supplies within Mexico, the fact that NFDM volumes still trail pre-pandemic levels on an annualized basis, and logistics headaches are expected to continue, we anticipate greater nonfat volumes moving south of the border this year. Provided the economy holds and inflation is kept to a reasonable level, cheese exports to the country should continue to perform well.

SOUTHEAST ASIA

- Key trend: U.S. exports of high protein whey to the region have slowed down sharply, likely a result of limited availability and high prices burning off some demand. Long-term growth is still very positive, particularly with more supply capacity expected in 2023 and beyond.

- Moving forward: With Southeast Asian markets opening up after two years of relatively tight COVID restrictions, buyers are expected to become increasingly active in anticipation of demand growth. With the recent troubles in China, the U.S. should expect increased competition from New Zealand, as product previously earmarked for China is re-routed to SEA.

CHINA+HK

- Key trend: Government lockdowns continue to snarl global supply chains and limit imports into a market we believed was already well-stocked on ingredients coming into the new year.

- Moving forward: In the short term, we anticipate China’s COVID lockdown measures will challenge exports across the dairy complex. Crucially, if Chinese consumers under quarantine are not consuming fresh milk, not only will that lessen the need for imports, it will also likely result in additional domestic milk production being dried into whole milk powder, further exacerbating the import demand slowdown. The length and severity of the lockdown measures will remain the primary inflection points as to whether this is a short-term blip or will create ripple effects in global dairy markets through the end of the year.

JAPAN

- Key trend(s): After a slow year in 2021, U.S. cheese exports to Japan got off to an incredibly strong start as buyers looked to the U.S. for supply security and, at times, favorable prices.

- Moving forward: We expect U.S. cheese exports to remain favorable given the lack of supply out of Europe and New Zealand through the first half. Much of the abnormally strong import demand growth appears to be restocking rather than a surge in new demand. Exports of high value proteins, on the other hand, are growing at an exponential rate as consumers move strongly towards health and wellness – a trend we anticipate will persist in the long-run (even if export growth moderates later in the year).

KOREA

- Key trend: Some of the world’s tighter COVID measures—including restrictions on operating hours for restaurants and bars that started in early January—limited economic growth as well as cheese consumption in South Korea in the first quarter. However those measures did little to dampen demand for products utilizing milk and whey proteins.

- Moving forward: South Korea dropped most of its COVID restrictions in mid-to-late April, and signs of reinvigorated consumption are already beginning to show. U.S. suppliers went through a four-month period (May-August 2021) where their main dairy product export to the country—cheese—fell by 30% (a decline of nearly 10,000 MT). Fewer COVID restrictions and favorable cheese comparisons bode well for U.S. prospects this summer.

MIDDLE EAST-NORTH AFRICA (MENA)

- Key trend: High commodity prices are restraining dairy import demand in the price-sensitive MENA region. U.S. shortfalls are magnified by Egypt and Algeria’s spike in buying U.S. milk powder in the first quarter of 2021, as well as some increased availability of SMP for export out of smaller suppliers, including Turkey and India.

- Moving forward: A prolonged period of elevated oil prices—which it certainly appears will be the case—could help soften the blow of historically high dairy commodity prices for some of the more oil-dependent countries in the region. In addition, milk powder, butterfat and cheese prices have come off recent peaks and—should they continue to moderate—could also help stir demand. MENA inventories are likely in need of a burst of buying activity.