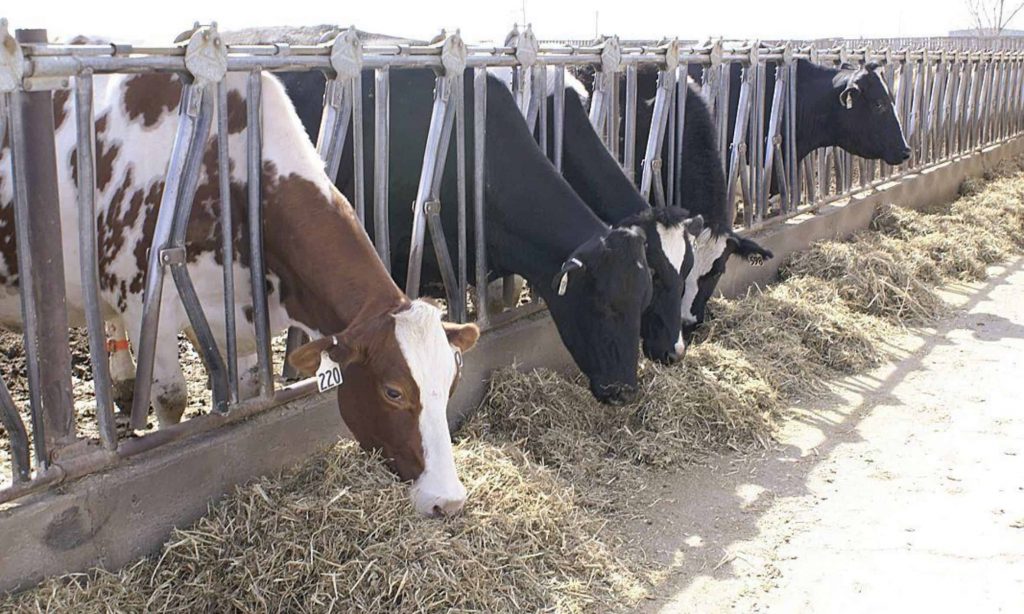

“It makes sense when you have low margins, negative margins, that producers are going to be very, very aggressive about sending those cows to slaughter,” he said during a commodity perspectives webinar this week.

That has dropped off over the last two or three months in response to better margins, he said.

Recent dairy cow slaughter has been down 7.5% year over year, according to USDA.

Replacement costs

In addition, most dairy producers have locked up most of their feedstuffs for the winter. If they were going to reduce cow numbers, they probably would have done it during the summer, he said.

“I think the other thing is when you look at … replacement values, it’s extremely expensive to go out and replace a cow for these dairies now,” he said.

In addition, the availability of replacement heifers is relatively limited, and they’re expensive. If producers plan to keep milking, they know it’s going to take them 18 to 24 months to regrow their herd, he said.

“I think we got to a point here where producers kind of realized that, and that’s what’s really led to this pullback, this slowdown in terms of dairy cow slaughter,” he said.

“So you’ve just seen guys naturally slow down their culling in order to try to stabilize those herd numbers and potentially be ready … to grow a little,” he said.

Bouncing back

Production per cow has been disappointing, with USDA reporting per-cow production unchanged or negative year over year for three out of the last four months, he said.

StoneX’s expectation is now that cow herds have stabilized, production per cow will bounce back and 2024 milk production will be up about 1% year over year, he said.

“So we’re looking at some pretty substantial recoveries in terms of our milk production toward the back end of … next year,” he said.

But it’s not going to be in line with the 15-year historical growth of a 2% annual average increase, he said.

Supply and demand

Globally, the environment right now has been weak supply and weak demand, he said.

“We’re at a really tricky balance point I think … from a dairy standpoint because that supply … is pretty tight and not really projected to grow too much for the next few months,” he said.

But StoneX expects demand to come back in 2024.

“And if it does, then we’re going to get into a situation where supply is going to be very short relative to demand, and it’s a long time to turn that supply back on,” he said.