Monthly year-over-year output has now been up less than 1 percent in six of the past seventh months, with March 2019 production lower than the year before.

April 2018-19 recap at a glance

Reviewing the USDA estimates for April 2019 compared to April 2018:

U.S. milk production: 18.43 billion pounds, up 0.1 percent

U.S. cow numbers: 9.328 million, down 90,000 head

U.S. average milk per cow per month: 1,976 pounds, up 21 pounds

23-state milk production: 17.38 billion pounds, up 0.3 percent

23-state cow numbers: 8.705 million, down 55,000 head

23-state average milk per cow per month: 1,996 pounds, up 19 pounds

Source: USDA Milk Production report May 20, 2019

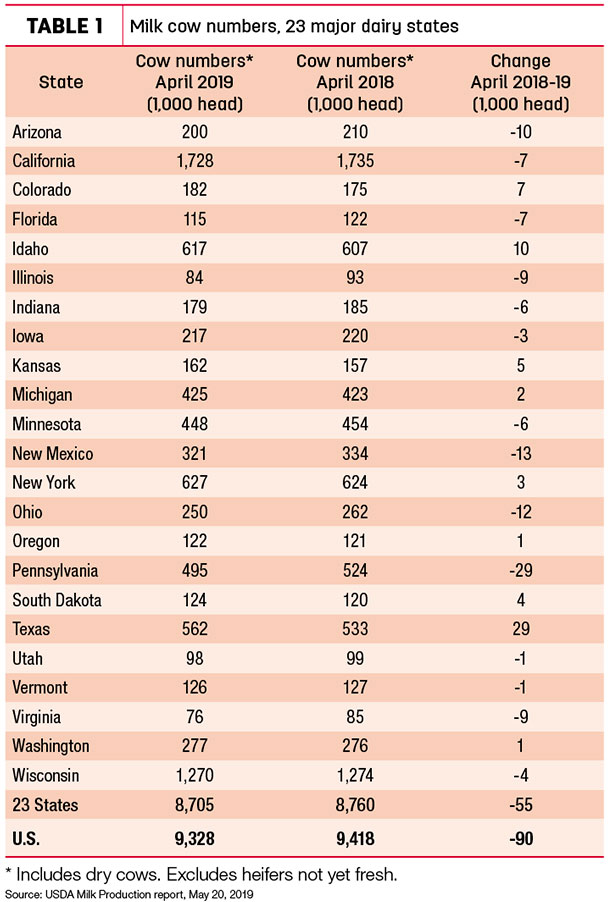

U.S. dairy cow numbers dropped to 9.328 million, the lowest total since June 2016. The number of milk cows on farms in the 23 major states was 8.705 million head, the lowest number since February 2017.

Nine states increased cow numbers compared to April 2018 (Table 1), with the largest jumps in Texas (+29,000 head), Idaho (+10,000) and Colorado (+7,000).

In contrast, Pennsylvania (-29,000) and New Mexico (-13,000) again led decliners, with Ohio, Arizona, Virginia, Illinois, Florida and California each down 7,000 to 10,000 head. Iowa, Minnesota and Wisconsin were down a combined 13,000 head.

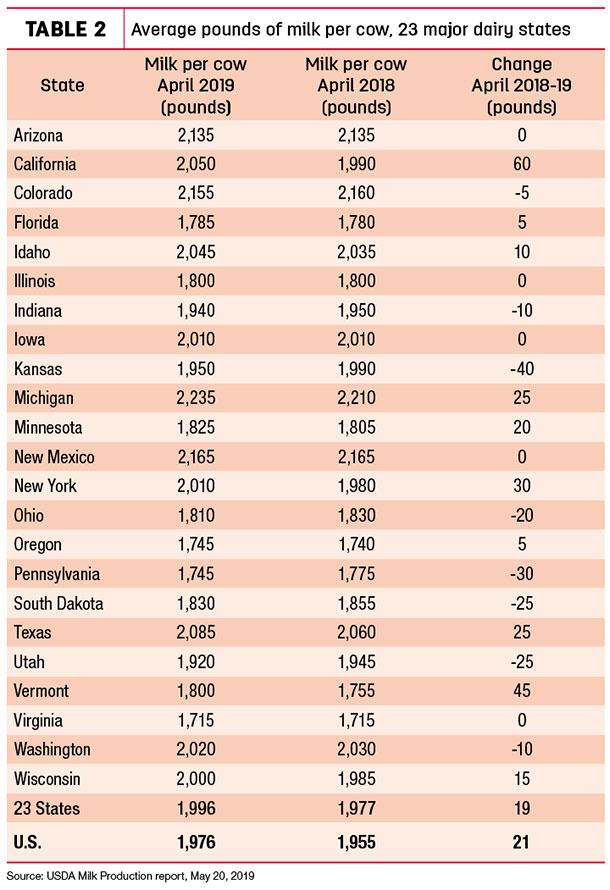

Weather issues continue to impact output per cow in several states, with cows in eight states yielding less milk in April than the same month a year earlier. (Table 2). Ohio, South Dakota, Utah, Pennsylvania and Kansas saw declines of 20 to 40 pounds per cow. In contrast, California posted the largest gain, up about 2 pounds per day. Texas, Michigan, New York and Vermont were up 25 to 45 pounds for the month.

Among all major states, California led in terms of volume of milk production increase in April 2019, up 89 million pounds (2.6 percent) compared to April 2018. Texas led all states in terms of percentage growth, up 6.7 percent.

Pennsylvania milk production was down 66 million pounds, a 7.1 percent decline. On a percentage basis, Virginia (-11 percent) and Illinois (-9.6 percent) led decliners.

Dairy cow slaughter levels high

U.S. dairy farmers continue to move dairy cull cows to slaughter at a high rate. Federally inspected milk cow slaughter was estimated at 1.135 million through April 27, 2019, about 57,900 head more than a similar date a year earlier, according to the USDA.

Price outlook impacted by exports

With culling and production trends, there’s a good possibility milk prices could strengthen later this year, according to Bob Cropp, dairy economist emeritus with the University of Wisconsin – Madison. He remains more optimistic than current Class III milk futures prices predict, forecasting the possibility of $17 per hundredweight by June and in the high $17s by September or October. Class IV prices could be in the $17s from July through the end of the year.

Where dairy exports are headed will have a major bearing how much milk prices improve, Cropp said. Canada and Mexico are lifting retaliatory tariffs on U.S. dairy products in response to President Trump’s rollback of tariffs on Canada and Mexico aluminum and steel. The lifting of Mexico’s retaliatory tariffs on U.S. cheese could provide a boost to cheese exports by last quarter of this year.

However, increased tariffs imposed by the U.S. on China’s goods and China retaliating with higher tariffs on U.S. dairy products could further reduce dairy exports to China. Unless the U.S.-China trade dispute is ended, exports to China will not improve in 2019, Cropp said.

Closer to home, continued growth in the U.S. economy, low unemployment and higher wages could help provide modest growth in domestic butter and cheese sales.