After a successful 2022 dairy year, economist Marion Cassagnou at the Idele conference in Paris predicted a slowdown in US milk production, a lower milk price and more competition on export markets, this year.

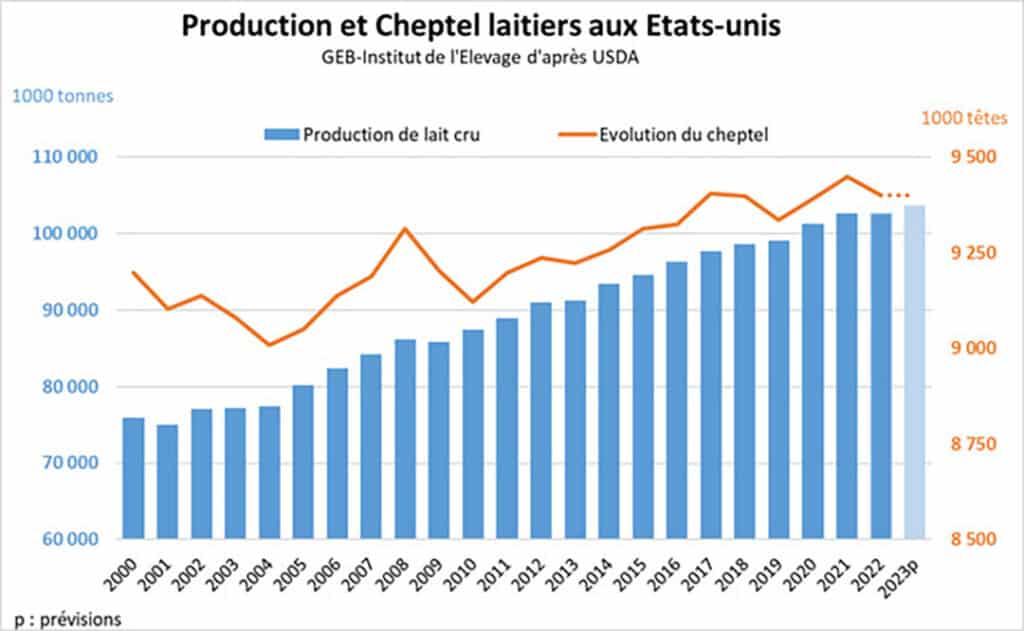

US dairy production was stable in 2022 at 102,7 mt (up 0.1% over 2021), a bit lower in the first half (-0.8%) compared the second half (+1%). “US dairy production has been steadily increasing since 2010, and it should continue to increase, but a little less than in previous years,” said Cassagnou.

The herd is stabilising at around 9.4 million head, with yields rising a little to nearly 11,000 kg of milk per cow per year.

Milk prices also increased by 37% in 2022 compared to 2021 to €536/t.

A historic trade surplus

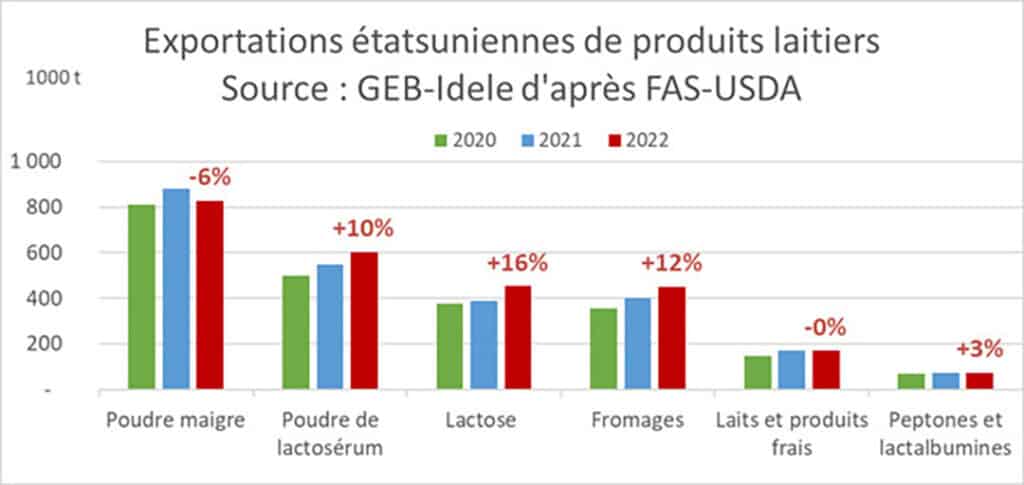

US dairy exports hit record highs in 2022, up 25% in value at US$10 billion and up 6% in volume. The increase in exports affects all major dairy products (+10% for whey powder, +16% for lactose, +12% for cheeses), and have increased primarily to Mexico (+36% in value to US$2.4 billion) and Canada (+22% in value to US$1.1 billion).

Imports are also up both in value (up 25% to US$5.8 billion) and in volume (up 12%). “This increase in exports compensated for lower domestic demand in 2022,” commented Cassagnou.

Dairy production and herd in the US (source: GEB, Institut de l’Elevage from USDA)

-Production de lait cru = Crude milk production

-Evolution du cheptel = Herd evolution

-1,000 têtes = 1,000 heads

Early 2023 is marked by a slowdown in the increase in milk production and a fall in the price of milk, which remains historically high. Feed costs remain stable and margins deteriorate for farmers.

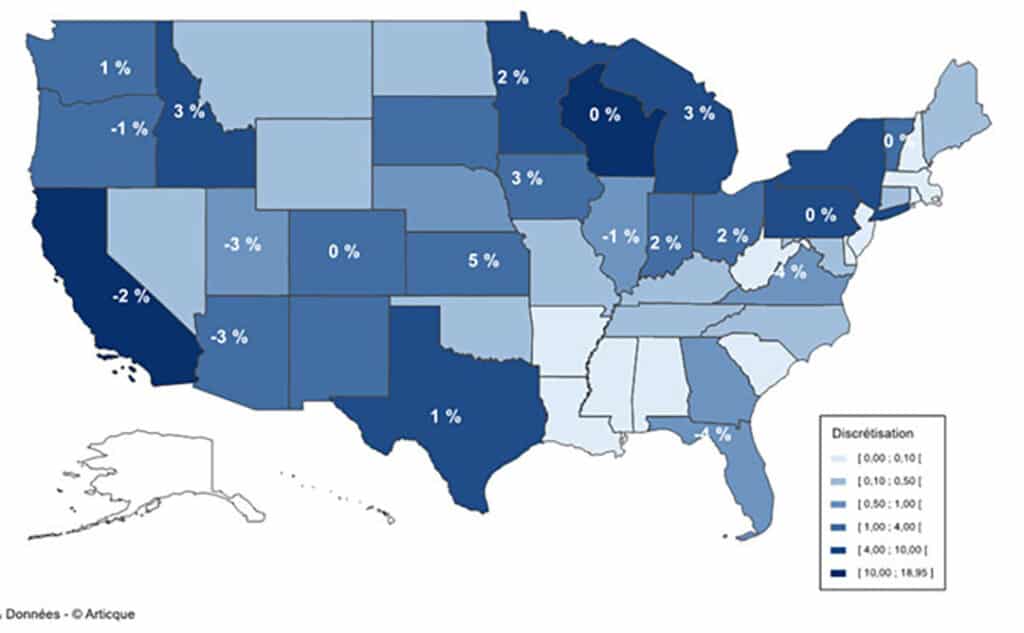

“Real uncertainties about the evolution of the herd remain with a herd still slightly increasing at the start of 2023, but an increase in the number of slaughtered cows,” comments Cassagnou, who underlines a different dairy dynamic according to the major production areas (see map).

1- California is marked by a decline that began in 2023 (drought, then floods but also loss of attractiveness and fewer dairy farms) and this region may lose its dairy leadership position.

2- The Great Lakes region is marked by supply management difficulties (the volume of milk produced is on the rise, but processing difficulties due to the lack of manpower).

3- The southern plains are marked by a strong growth dynamic, especially in livestock, with the construction of new mega-dairy farms.

US dairy products exports (source: GEB-Idele from FAS-USDA)

-poudre maigre = lean powder

-poudre de lactosérum = Whey powder

-fromages = Cheese

-lait et produits frais = Milk and fresh products

-peptones et lactalbumines = Peptones and – lactalbumins

What was the supply/demand balance at the start of 2023? “The supply starts to be more important than demand,” comments Cassagnou, who adds that US exports have been disappointing since February 2023 despite a very strong presence of Mexico for purchases, particularly of cheeses.

Forecasts for 2023

-Milk production could slow down in particular due to a decline in livestock. It is estimated at 103.7 mt by the USDA (+1% /2022).

-Lower milk price forecast: -19% at €412/t

-Stronger competition on the export market: back from New Zealand and EU 27

-Still large stocks of dairy products

Distribution of milk production in the US in 2022 (mt) and variation in % in April 2023/2022.