Milk production for 2020 is forecast at 222.4 billion pounds, up about 200 million pounds from last month’s forecast, primarily due to higher-than-expected cow numbers. If realized, it would be up about 1.8% from 2019’s total of 218.4 billion pounds.

U.S. dairy exports were forecast higher based on recent trade data and stronger expected global demand for skim milk powder, whey products and other dairy products.

Projected 2020 prices for cheese and whey were raised from last month, but butter and nonfat dry milk prices were lowered. Based on these estimates, the 2020 average cheese price will now be $1.42 per pound, down almost 34 cents from 2019. At $1.41 per pound, the projected butter price is down more than 83 cents from 2019’s average. The 2020 projected nonfat dry milk price is 94 cents per pound, down more than a dime from 2019, but the outlook for whey prices is stronger than a month ago and at 38 cents per pound, would be about equal to 2019.

As a result, the USDA’s updated projections for 2020 milk prices are mixed compared to last month. The Class III milk price forecast is now $13.35 per hundredweight (cwt), up 60 cents from last month but still $3.60 less than the 2019 average. The Class IV price is projected at $11.90 per cwt, down 25 cents from last month and $4.40 less than 2019’s average. The 2020 all-milk price is now projected at $14.55 per cwt, 20 cents less than last month’s forecast and down more than $4 from 2019.

Chicago Mercantile Exchange (CME) milk futures prices have recovered since the USDA price forecasts were estimated. As of the close of trading on May 11, and using previously announced milk class prices through April, the 2020 Class III price would average $15.59 per cwt, while the Class IV price would average $13.53 per cwt.

The WASDE report also offered a first look at 2021, when milk production is forecast at 224.1 billion pounds based on stronger expected growth in milk per cow and despite a slightly smaller dairy cow herd. If realized, it would be up less than 1% from 2020’s estimate.

With improved domestic and export demand, all dairy products prices are forecast slightly higher, but not by much. Initial projections put the 2021 Class III price forecast at $14.20 per cwt, the Class IV price at $12.20 per cwt and the all-milk price at $15 per cwt.

Beef outlook clouded by economic uncertainty

The 2020 beef production forecast was reduced as the industry adjusts to the economic uncertainty related to the COVID-19 pandemic, with lower expected cattle slaughter more than offsetting heavier carcass weights. The 2020 average fed cattle price was projected at $104 per cwt, down nearly $7 from last month’s forecast and about $12.75 per cwt less than the 2019 average of $116.78 per cwt.

Beef production is forecast higher in 2021, as higher as cattle placements in 2020 are expected to shift toward the latter part of the year and be marketed and slaughtered in 2021. Heavier carcass weights are also expected to support higher production.

Feed outlook: lower prices

Impacting the cost side of the dairy income ledger:

Corn: The projected 2019-20 season-average corn price received by producers is $3.60 per bushel, about even with the 2018-19 average price. The 2020-21 season-average price was initially set at about $3.20 per bushel, the lowest since 2006-07.

The 2020-21 corn crop is projected at a record 16 billion bushels, up from last year on increased acreage and a return to normal yields, projected at about 178.5 bushels per acre. Despite beginning stocks that are down slightly from a year ago, total ending stocks of corn supplies are forecast at a record-high 18.1 billion bushels and would be the highest since 1987-88.

Soybeans: The U.S. season-average soybean price received by producers for 2019-20 was estimated at $8.50 per bushel, about equal with the 2018-19 average. The soybean meal price was unchanged at $300 per ton, $8 less than the year before.

The 2020-21 outlook for U.S. soybeans is for higher supplies, crush and exports, and lower ending stocks compared to 2019-20. The soybean crop is projected at 4.125 billion bushels, up 568 million from last year based on increased acreage and yields. Despite lower beginning stocks, soybean supplies are projected up 5% from 2019-20.

The first predictions for 2020-21 prices put soybeans at $8.20 per bushel and soybean meal at $290 per ton.

Hay inventories stronger in dairy states

Along with the WASDE report, the USDA also released a crop production report, estimating hay inventories stored on farms as of May 1 were the highest for that date in three years.

All hay stored on U.S. farms on May 1, 2020, totaled 20.4 million tons, up 37% (5.5 million tons) from a year ago. May 1, 2019, hay inventories were the second lowest since the USDA began keeping records in 1950.

The higher May 2020 hay inventories can be attributed to increased production in 2019 and slightly lower use to start the year. Production of both alfalfa and other dry hay in 2019 was up about 4% from 2019. In addition, hay “disappearance” between Dec. 1, 2019, and May 1, 2020, was estimated at 64.1 million tons, down less than 1% from the same period a year earlier.

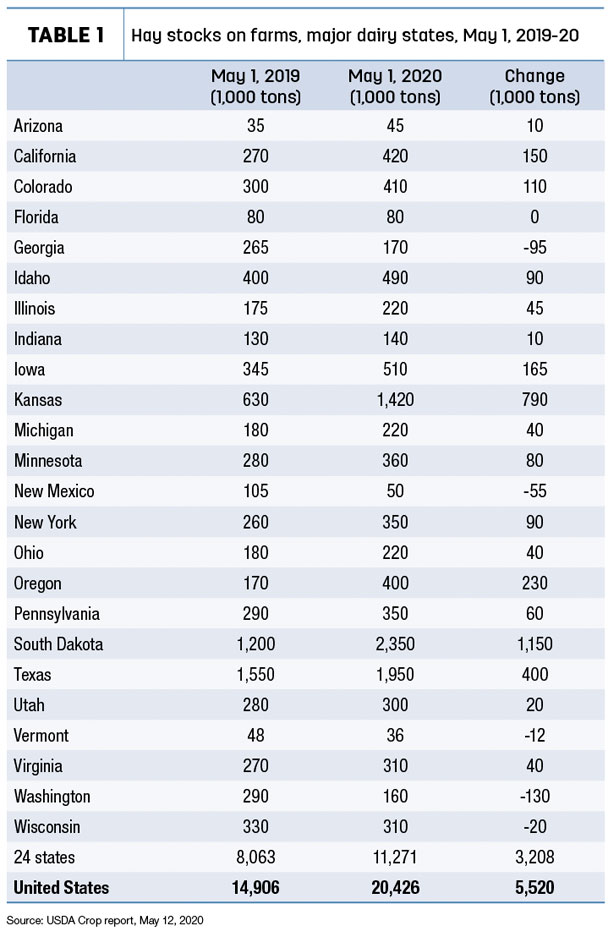

Among the 24 major dairy states, May 1 hay inventories were up 3.2 million tons compared to a year earlier (Table 1). Inventories were down in just five, led by Washington (-130,000 tons). Others were Georgia, New Mexico, Vermont and Wisconsin.

Dairy producers in 18 states started spring with higher hay inventories, led by South Dakota (+1.15 million tons), Kansas (+790,000 tons), Texas (+400,000 tons) and Oregon (+230,000 tons). Despite a continued decline in hay acreage, inventories were up 150,000 tons in California.